130005K11283

A

D

R

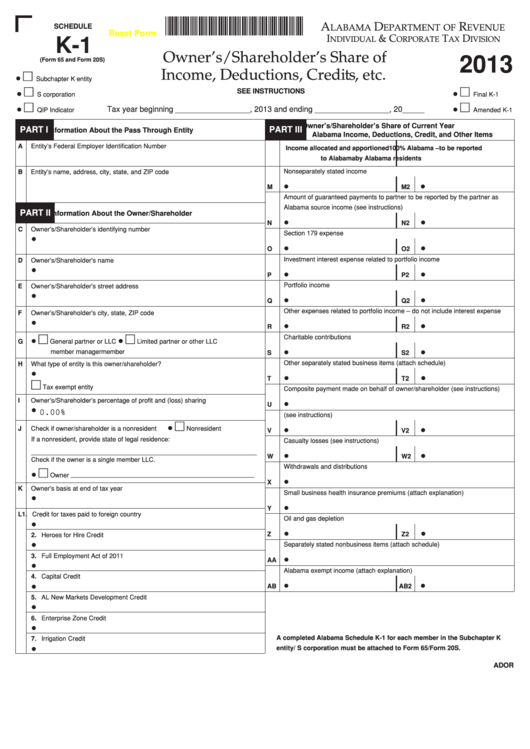

SCHEDULE

LABAMA

EPARTMENT OF

EVENUE

Reset Form

K-1

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

Owner’s/Shareholder’s Share of

2013

(Form 65 and Form 20S)

Income, Deductions, Credits, etc.

•

Subchapter K entity

SEE INSTRUCTIONS

•

•

S corporation

Final K-1

•

•

Tax year beginning _________________, 2013 and ending _________________, 20_____

QIP Indicator

Amended K-1

Owner’s/Shareholder’s Share of Current Year

PART I

Information About the Pass Through Entity

PART III

Alabama Income, Deductions, Credit, and Other Items

A

Entity’s Federal Employer Identification Number

Income allocated and apportioned

100% Alabama – to be reported

to Alabama

by Alabama residents

Nonseparately stated income

B

Entity’s name, address, city, state, and ZIP code

•

•

M

M2

Amount of guaranteed payments to partner to be reported by the partner as

Alabama source income (see instructions)

PART II

Information About the Owner/Shareholder

•

•

N

N2

C

Owner’s/Shareholder’s identifying number

Section 179 expense

•

•

•

O

O2

Investment interest expense related to portfolio income

D

Owner’s/Shareholder’s name

•

•

•

P

P2

Portfolio income

E

Owner’s/Shareholder’s street address

•

•

•

Q

Q2

Other expenses related to portfolio income – do not include interest expense

F

Owner’s/Shareholder’s city, state, ZIP code

•

•

•

R

R2

Charitable contributions

G •

•

General partner or LLC

Limited partner or other LLC

•

•

member manager

member

S

S2

Other separately stated business items (attach schedule)

H

What type of entity is this owner/shareholder?

•

•

•

T

T2

Tax exempt entity

Composite payment made on behalf of owner/shareholder (see instructions)

I

Owner’s/Shareholder’s percentage of profit and (loss) sharing

•

U

•

0.00%

U.S. income taxes paid (see instructions)

•

J

Check if owner/shareholder is a nonresident

Nonresident

•

•

V

V2

If a nonresident, provide state of legal residence:

Casualty losses (see instructions)

•

•

W

W2

Check if the owner is a single member LLC.

Withdrawals and distributions

•

Owner ____________________________________________________

•

X

K

Owner’s basis at end of tax year

Small business health insurance premiums (attach explanation)

•

•

Y

L

1. Credit for taxes paid to foreign country

Oil and gas depletion

•

•

•

Z

Z2

2 Heroes for Hire Credit

•

Separately stated nonbusiness items (attach schedule)

3 Full Employment Act of 2011

AA •

•

Alabama exempt income (attach explanation)

4 Capital Credit

AB •

•

•

AB2

5 AL New Markets Development Credit

•

6 Enterprise Zone Credit

•

A completed Alabama Schedule K-1 for each member in the Subchapter K

7 Irrigation Credit

•

entity/ S corporation must be attached to Form 65/Form 20S.

ADOR

1

1