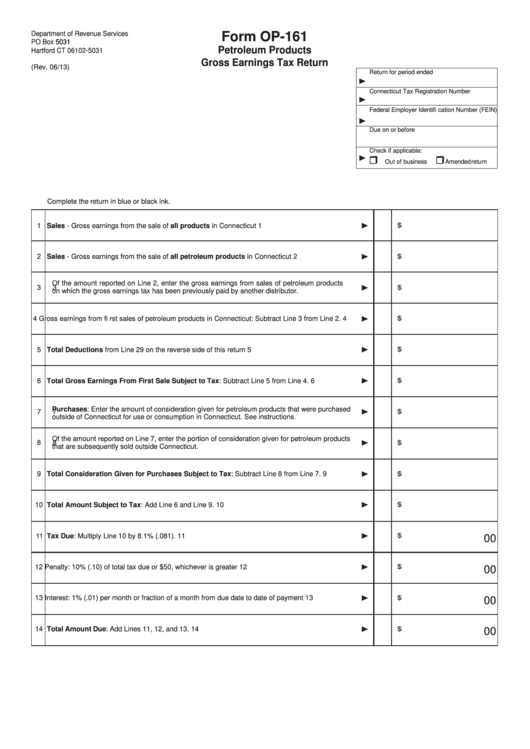

Department of Revenue Services

Form OP-161

PO Box

5031

Petroleum Products

Hartford CT 06102-5031

Gross Earnings Tax Return

(Rev. 06/13)

Return for period ended

Connecticut Tax Registration Number

Federal Employer Identifi cation Number (FEIN)

Due on or before

Check if applicable:

O ut of business

Amended return

Complete the return in blue or black ink.

1

Sales - Gross earnings from the sale of all products in Connecticut

1

$

2

Sales - Gross earnings from the sale of all petroleum products in Connecticut

2

$

Of the amount reported on Line 2, enter the gross earnings from sales of petroleum products

3

3

$

on which the gross earnings tax has been previously paid by another distributor.

4

Gross earnings from fi rst sales of petroleum products in Connecticut: Subtract Line 3 from Line 2.

4

$

5

Total Deductions from Line 29 on the reverse side of this return

5

$

6

Total Gross Earnings From First Sale Subject to Tax: Subtract Line 5 from Line 4.

6

$

Purchases: Enter the amount of consideration given for petroleum products that were purchased

7

7

$

outside of Connecticut for use or consumption in Connecticut. See instructions.

Of the amount reported on Line 7, enter the portion of consideration given for petroleum products

8

8

$

that are subsequently sold outside Connecticut.

9

Total Consideration Given for Purchases Subject to Tax: Subtract Line 8 from Line 7.

9

$

10

Total Amount Subject to Tax: Add Line 6 and Line 9.

10

$

11

Tax Due: Multiply Line 10 by 8.1% (.081).

11

$

00

12

Penalty: 10% (.10) of total tax due or $50, whichever is greater

12

$

00

13

Interest: 1% (.01) per month or fraction of a month from due date to date of payment

13

$

00

14

Total Amount Due: Add Lines 11, 12, and 13.

14

$

00

1

1 2

2 3

3 4

4