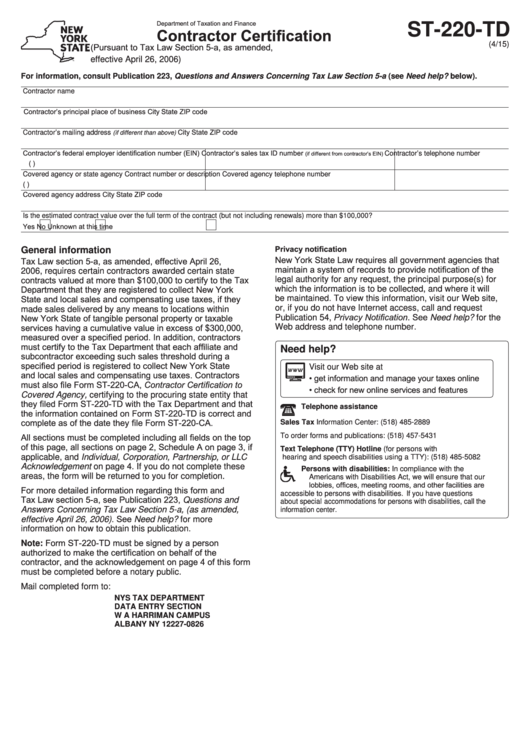

Department of Taxation and Finance

ST-220-TD

Contractor Certification

(4/15)

(Pursuant to Tax Law Section 5-a, as amended,

effective April 26, 2006)

For information, consult Publication 223, Questions and Answers Concerning Tax Law Section 5-a (see Need help? below).

Contractor name

Contractor’s principal place of business

City

State

ZIP code

City

State

ZIP code

Contractor’s mailing address

(if different than above)

Contractor’s federal employer identification number (EIN)

Contractor’s sales tax ID number

(if different from contractor’s EIN)

Contractor’s telephone number

(

)

Covered agency or state agency

Contract number or description

Covered agency telephone number

(

)

Covered agency address

City

State

ZIP code

Is the estimated contract value over the full term of the contract (but not including renewals) more than $100,000?

Yes

No

Unknown at this time

Privacy notification

General information

New York State Law requires all government agencies that

Tax Law section 5-a, as amended, effective April 26,

maintain a system of records to provide notification of the

2006, requires certain contractors awarded certain state

contracts valued at more than $100,000 to certify to the Tax

legal authority for any request, the principal purpose(s) for

Department that they are registered to collect New York

which the information is to be collected, and where it will

State and local sales and compensating use taxes, if they

be maintained. To view this information, visit our Web site,

or, if you do not have Internet access, call and request

made sales delivered by any means to locations within

Publication 54, Privacy Notification. See Need help? for the

New York State of tangible personal property or taxable

services having a cumulative value in excess of $300,000,

Web address and telephone number.

measured over a specified period. In addition, contractors

must certify to the Tax Department that each affiliate and

Need help?

subcontractor exceeding such sales threshold during a

specified period is registered to collect New York State

Visit our Web site at

and local sales and compensating use taxes. Contractors

• get information and manage your taxes online

must also file Form ST-220-CA, Contractor Certification to

• check for new online services and features

Covered Agency, certifying to the procuring state entity that

they filed Form ST-220-TD with the Tax Department and that

Telephone assistance

the information contained on Form ST-220-TD is correct and

complete as of the date they file Form ST-220-CA.

Sales Tax Information Center:

(518) 485-2889

All sections must be completed including all fields on the top

To order forms and publications:

(518) 457-5431

of this page, all sections on page 2, Schedule A on page 3, if

Text Telephone (TTY) Hotline (for persons with

applicable, and Individual, Corporation, Partnership, or LLC

hearing and speech disabilities using a TTY):

(518) 485-5082

Acknowledgement on page 4. If you do not complete these

Persons with disabilities: In compliance with the

areas, the form will be returned to you for completion.

Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are

For more detailed information regarding this form and

accessible to persons with disabilities. If you have questions

Tax Law section 5-a, see Publication 223, Questions and

about special accommodations for persons with disabilities, call the

Answers Concerning Tax Law Section 5-a, (as amended,

information center.

effective April 26, 2006). See Need help? for more

information on how to obtain this publication.

Note: Form ST-220-TD must be signed by a person

authorized to make the certification on behalf of the

contractor, and the acknowledgement on page 4 of this form

must be completed before a notary public.

Mail completed form to:

NYS TAX DEPARTMENT

DATA ENTRY SECTION

W A HARRIMAN CAMPUS

ALBANY NY 12227-0826

1

1 2

2 3

3 4

4