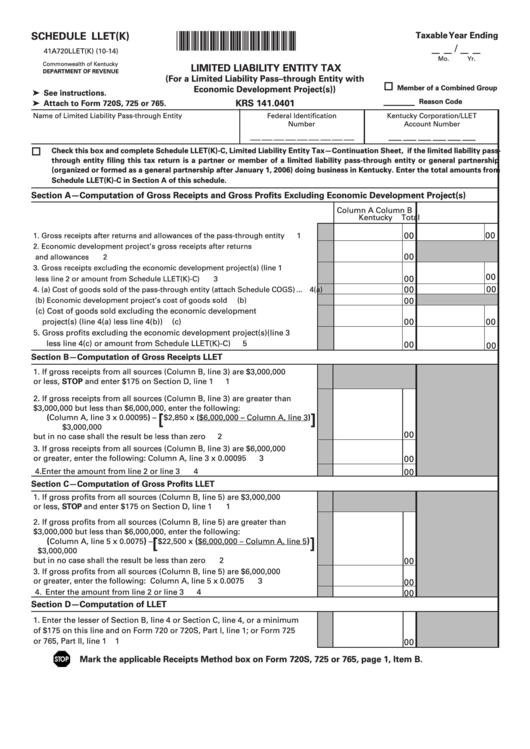

SCHEDULE LLET(K)

Taxable Year Ending

*1400030288*

_ _

_ _

/

41A720LLET(K) (10-14)

Mo.

Yr.

Commonwealth of Kentucky

LIMITED LIABILITY ENTITY TAX

DEPARTMENT OF REVENUE

(For a Limited Liability Pass–through Entity with

Member of a Combined Group

Economic Development Project(s))

➤ See instructions.

____

Reason Code

KRS 141.0401

➤ Attach to Form 720S, 725 or 765.

Name of Limited Liability Pass-through Entity

Federal Identification

Kentucky Corporation/LLET

Number

Account Number

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Check this box and complete Schedule LLET(K)-C, Limited Liability Entity Tax—Continuation Sheet, if the limited liability pass-

through entity filing this tax return is a partner or member of a limited liability pass-through entity or general partnership

(organized or formed as a general partnership after January 1, 2006) doing business in Kentucky. Enter the total amounts from

Schedule LLET(K)-C in Section A of this schedule.

Section A—Computation of Gross Receipts and Gross Profits Excluding Economic Development Project(s)

Column A

Column B

Kentucky

Total

00

00

1. Gross receipts after returns and allowances of the pass-through entity ...........

1

2. Economic development project’s gross receipts after returns

00

and allowances .......................................................................................................

2

3. Gross receipts excluding the economic development project(s) (line 1

00

00

less line 2 or amount from Schedule LLET(K)-C) .................................................

3

00

00

4. (a) Cost of goods sold of the pass-through entity (attach Schedule COGS) ... 4(a)

(b) Economic development project’s cost of goods sold ..................................

(b)

00

(c) Cost of goods sold excluding the economic development

00

00

project(s) (line 4(a) less line 4(b)) ...................................................................

(c)

5. Gross profits excluding the economic development project(s)(line 3

less line 4(c) or amount from Schedule LLET(K)-C) ......................................

5

00

00

Section B—Computation of Gross Receipts LLET

1. If gross receipts from all sources (Column B, line 3) are $3,000,000

or less, STOP and enter $175 on Section D, line 1 ........................................

1

2. If gross receipts from all sources (Column B, line 3) are greater than

$3,000,000 but less than $6,000,000, enter the following:

[

]

(Column A, line 3 x 0.00095) –

$2,850 x ($6,000,000 – Column A, line 3)

$3,000,000

00

but in no case shall the result be less than zero ...........................................

2

3. If gross receipts from all sources (Column B, line 3) are $6,000,000

or greater, enter the following: Column A, line 3 x 0.00095 .......................

3

00

4. Enter the amount from line 2 or line 3 ..........................................................

4

00

Section C—Computation of Gross Profits LLET

1. If gross profits from all sources (Column B, line 5) are $3,000,000

or less, STOP and enter $175 on Section D, line 1 .......................................

1

2. If gross profits from all sources (Column B, line 5) are greater than

$3,000,000 but less than $6,000,000, enter the following:

[

]

(

)

(

)

Column A, line 5 x 0.0075

–

$22,500 x

$6,000,000 – Column A, line 5

$3,000,000

but in no case shall the result be less than zero ..........................................

2

00

3. If gross profits from all sources (Column B, line 5) are $6,000,000

or greater, enter the following: Column A, line 5 x 0.0075 ........................

3

00

4. Enter the amount from line 2 or line 3 ..........................................................

4

00

Section D—Computation of LLET

1. Enter the lesser of Section B, line 4 or Section C, line 4, or a minimum

of $175 on this line and on Form 720 or 720S, Part I, line 1; or Form 725

or 765, Part II, line 1 ..........................................................................................

1

00

Mark the applicable Receipts Method box on Form 720S, 725 or 765, page 1, Item B.

1

1 2

2