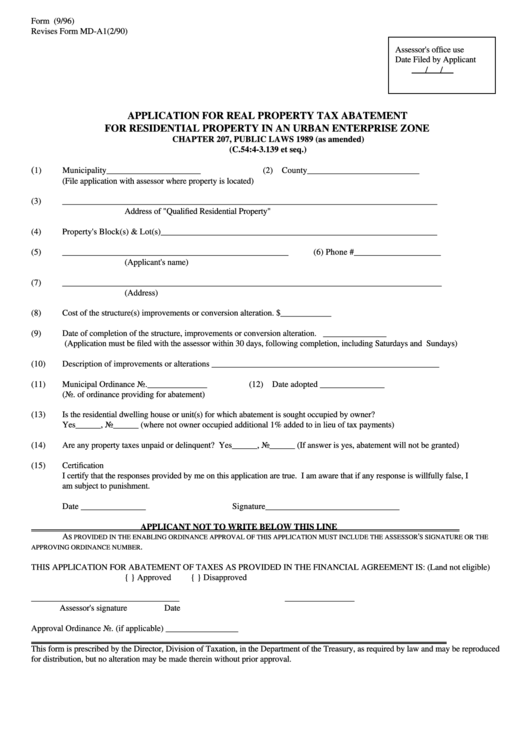

Form U.E.Z. (9/96)

Revises Form MD-A1(2/90)

Assessor's office use

Date Filed by Applicant

/

/

APPLICATION FOR REAL PROPERTY TAX ABATEMENT

FOR RESIDENTIAL PROPERTY IN AN URBAN ENTERPRISE ZONE

CHAPTER 207, PUBLIC LAWS 1989 (as amended)

(C.54:4-3.139 et seq.)

(

1)

Municipality______________________

(2) County__________________________

(File application with assessor where property is located)

(3)

______________________________________________________________________________________

Address of "Qualified Residential Property"

(4)

Property's Block(s) & Lot(s)________________________________________________________________

(5)

____________________________________________________

(6) Phone #____________________

(Applicant's name)

(7)

_______________________________________________________________________________________

(Address)

(8)

Cost of the structure(s) improvements or conversion alteration. $____________

(9)

Date of completion of the structure, improvements or conversion alteration. _______________

(Application must be filed with the assessor within 30 days, following completion, including Saturdays and Sundays)

(10)

Description of improvements or alterations _____________________________________________________

(11)

Municipal Ordinance No.______________

(12) Date adopted _______________

(No. of ordinance providing for abatement)

(13)

Is the residential dwelling house or unit(s) for which abatement is sought occupied by owner?

Yes______, No______ (where not owner occupied additional 1% added to in lieu of tax payments)

(14)

Are any property taxes unpaid or delinquent? Yes______, No______ (If answer is yes, abatement will not be granted)

(15)

Certification

I certify that the responses provided by me on this application are true. I am aware that if any response is willfully false, I

am subject to punishment.

Date _______________

Signature_______________________________

APPLICANT NOT TO WRITE BELOW THIS LINE

A

'

S PROVIDED IN THE ENABLING ORDINANCE APPROVAL OF THIS APPLICATION MUST INCLUDE THE ASSESSOR

S SIGNATURE OR THE

.

APPROVING ORDINANCE NUMBER

THIS APPLICATION FOR ABATEMENT OF TAXES AS PROVIDED IN THE FINANCIAL AGREEMENT IS: (Land not eligible)

{ } Approved

{ } Disapproved

__________________________________

________________

Assessor's signature

Date

Approval Ordinance No. (if applicable) _________________

This form is prescribed by the Director, Division of Taxation, in the Department of the Treasury, as required by law and may be reproduced

for distribution, but no alteration may be made therein without prior approval.

1

1 2

2