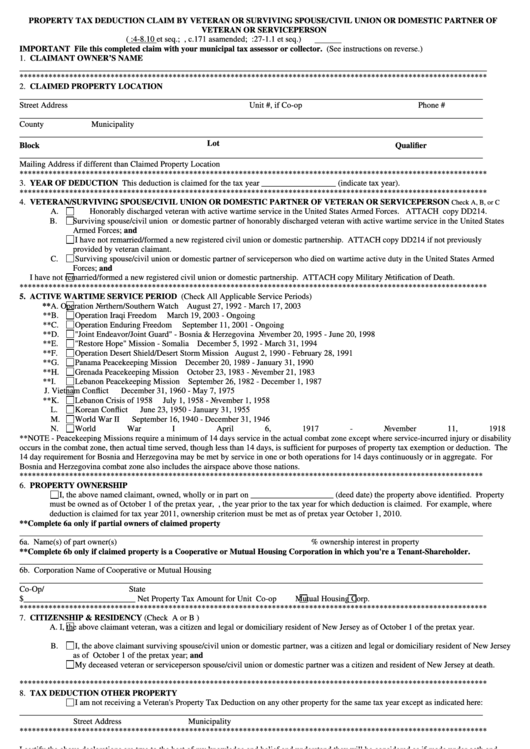

PROPERTY TAX DEDUCTION CLAIM BY VETERAN OR SURVIVING SPOUSE/CIVIL UNION OR DOMESTIC PARTNER OF

VETERAN OR SERVICEPERSON

(N.J.S.A. 54:4-8.10 et seq.; P.L.1963, c.171 as amended; N.J.A.C. 18:27-1.1 et seq.)

IMPORTANT File this completed claim with your municipal tax assessor or collector. (See instructions on reverse.)

1. CLAIMANT OWNER’S NAME

_________________________________________________________________________________________________________________

*****************************************************************************************************************

2. CLAIMED PROPERTY LOCATION

________________________________________________________________________________________________________________

Street Address

Unit #, if Co-op

Phone #

________________________________________________________________________________________________________________

County

Municipality

________________________________________________________________________________________________________________

Lot

Block

Qualifier

________________________________________________________________________________________________________________

Mailing Address if different than Claimed Property Location

*****************************************************************************************************************

3. YEAR OF DEDUCTION This deduction is claimed for the tax year __________________ (indicate tax year).

*****************************************************************************************************************

4. VETERAN/SURVIVING SPOUSE/CIVIL UNION OR DOMESTIC PARTNER OF VETERAN OR SERVICEPERSON

Check A, B, or C

A.

Honorably discharged veteran with active wartime service in the United States Armed Forces. ATTACH copy DD214.

B.

Surviving spouse/civil union or domestic partner of honorably discharged veteran with active wartime service in the United States

Armed Forces; and

I have not remarried/formed a new registered civil union or domestic partnership. ATTACH copy DD214 if not previously

provided by veteran claimant.

C.

Surviving spouse/civil union or domestic partner of serviceperson who died on wartime active duty in the United States Armed

Forces; and

I have not remarried/formed a new registered civil union or domestic partnership. ATTACH copy Military Notification of Death.

*****************************************************************************************************************

5. ACTIVE WARTIME SERVICE PERIOD (Check All Applicable Service Periods)

**A.

Operation Northern/Southern Watch

August 27, 1992 - March 17, 2003

**B.

Operation Iraqi Freedom

March 19, 2003 - Ongoing

**C.

Operation Enduring Freedom

September 11, 2001 - Ongoing

**D.

"Joint Endeavor/Joint Guard" - Bosnia & Herzegovina

November 20, 1995 - June 20, 1998

**E.

"Restore Hope" Mission - Somalia

December 5, 1992 - March 31, 1994

**F.

Operation Desert Shield/Desert Storm Mission

August 2, 1990 - February 28, 1991

**G.

Panama Peacekeeping Mission

December 20, 1989 - January 31, 1990

**H.

Grenada Peacekeeping Mission

October 23, 1983 - November 21, 1983

**I.

Lebanon Peacekeeping Mission

September 26, 1982 - December 1, 1987

J.

Vietnam Conflict

December 31, 1960 - May 7, 1975

**K.

Lebanon Crisis of 1958

July 1, 1958 - November 1, 1958

L.

Korean Conflict

June 23, 1950 - January 31, 1955

M.

World War II

September 16, 1940 - December 31, 1946

N.

World War I

April 6, 1917 - November 11, 1918

**NOTE - Peacekeeping Missions require a minimum of 14 days service in the actual combat zone except where service-incurred injury or disability

occurs in the combat zone, then actual time served, though less than 14 days, is sufficient for purposes of property tax exemption or deduction. The

14 day requirement for Bosnia and Herzegovina may be met by service in one or both operations for 14 days continuously or in aggregate. For

Bosnia and Herzegovina combat zone also includes the airspace above those nations.

****************************************************************************************************************

6. PROPERTY OWNERSHIP

I, the above named claimant, owned, wholly or in part on ____________________ (deed date) the property above identified. Property

must be owned as of October 1 of the pretax year, i.e., the year prior to the tax year for which deduction is claimed. For example, where

deduction is claimed for tax year 2011, ownership criterion must be met as of pretax year October 1, 2010.

**Complete 6a only if partial owners of claimed property

________________________________________________________________________________________________________________

6a. Name(s) of part owner(s)

% ownership interest in property

**Complete 6b only if claimed property is a Cooperative or Mutual Housing Corporation in which you're a Tenant-Shareholder.

________________________________________________________________________________________________________________

6b. Corporation Name of Cooperative or Mutual Housing

________________________________________________________________________________________________________________

Co-Op/M.H. Corp. Street Address

Municipality

State

$___________________________ Net Property Tax Amount for Unit

Co-op

Mutual Housing Corp.

*****************************************************************************************************************

7. CITIZENSHIP & RESIDENCY (Check A or B )

A.

I, the above claimant veteran, was a citizen and legal or domiciliary resident of New Jersey as of October 1 of the pretax year.

B.

I, the above claimant surviving spouse/civil union or domestic partner, was a citizen and legal or domiciliary resident of New Jersey

as of October 1 of the pretax year; and

My deceased veteran or serviceperson spouse/civil union or domestic partner was a citizen and resident of New Jersey at death.

*****************************************************************************************************************

8. TAX DEDUCTION OTHER PROPERTY

I am not receiving a Veteran's Property Tax Deduction on any other property for the same tax year except as indicated here:

________________________________________________________________________________________________________________

Street Address

Municipality

*****************************************************************************************************************

I certify the above declarations are true to the best of my knowledge and belief and understand they will be considered as if made under oath and

subject to penalties for perjury if falsified.

________________________________________________________________________________________________________________

Signature of Claimant

Date

*****************************************************************************************************************

OFFICIAL USE ONLY - Block__________Lot__________Approved in amount of $_______________________________________

Veteran

Surviving Spouse/Civil Union or Domestic Partner of

Veteran or

Serviceperson

Assessor/Collector____________________________________________________Date_____________________________________

Form V.S.S. rev. April 2012

1

1 2

2