Form St-810.6 - Quarterly Schedule P For Part-Quarterly (Monthly) Filers - Sales And Use Tax Promptax Payments - 2015

ADVERTISEMENT

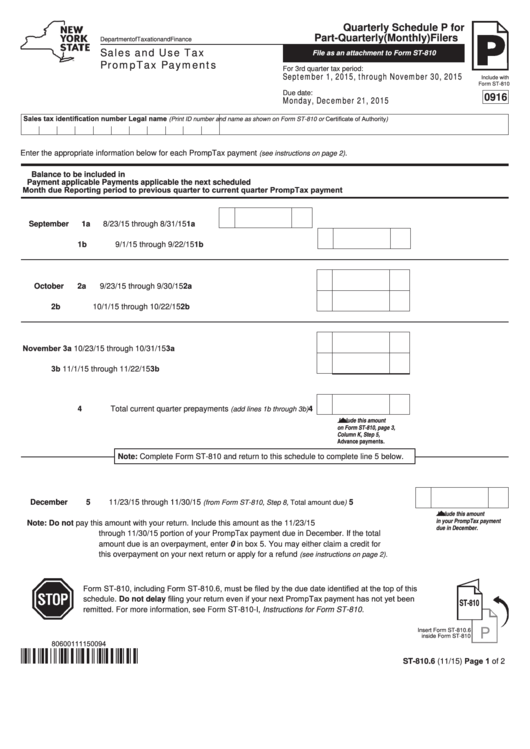

Quarterly Schedule P for

Part-Quarterly (Monthly) Filers

Department of Taxation and Finance

Sales and Use Tax

File as an attachment to Form ST-810

PrompTax Payments

For 3rd quarter tax period:

September 1, 2015, through November 30, 2015

Include with

Form ST-810

Due date:

0916

Monday, December 21, 2015

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-810 or Certificate of Authority)

Enter the appropriate information below for each PrompTax payment

.

(see instructions on page 2)

Balance to be included in

Payment applicable

Payments applicable

the next scheduled

Month due

Reporting period

to previous quarter

to current quarter

PrompTax payment

September

1a 8/23/15 through 8/31/15 ............... 1a

1b 9/1/15 through 9/22/15 .............................................................. 1b

October

2a 9/23/15 through 9/30/15 ............................................................ 2a

2b 10/1/15 through 10/22/15 .......................................................... 2b

November

3a 10/23/15 through 10/31/15 ........................................................ 3a

3b 11/1/15 through 11/22/15 ........................................................... 3b

4 Total current quarter prepayments

........

4

(add lines 1b through 3b)

Include this amount

on Form ST-810, page 3,

Column K, Step 5,

Advance payments.

Note: Complete Form ST-810 and return to this schedule to complete line 5 below.

December

5 11/23/15 through 11/30/15

....................................

5

(from Form ST-810, Step 8, Total amount due)

Include this amount

in your PrompTax payment

Note: Do not pay this amount with your return. Include this amount as the 11/23/15

due in December.

through 11/30/15 portion of your PrompTax payment due in December. If the total

amount due is an overpayment, enter 0 in box 5. You may either claim a credit for

this overpayment on your next return or apply for a refund

(see instructions on page 2).

Form ST-810, including Form ST-810.6, must be filed by the due date identified at the top of this

schedule. Do not delay filing your return even if your next PrompTax payment has not yet been

ST-810

remitted. For more information, see Form ST-810-I, Instructions for Form ST-810.

P

Insert Form ST-810.6

inside Form ST-810

80600111150094

ST-810.6 (11/15) Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2