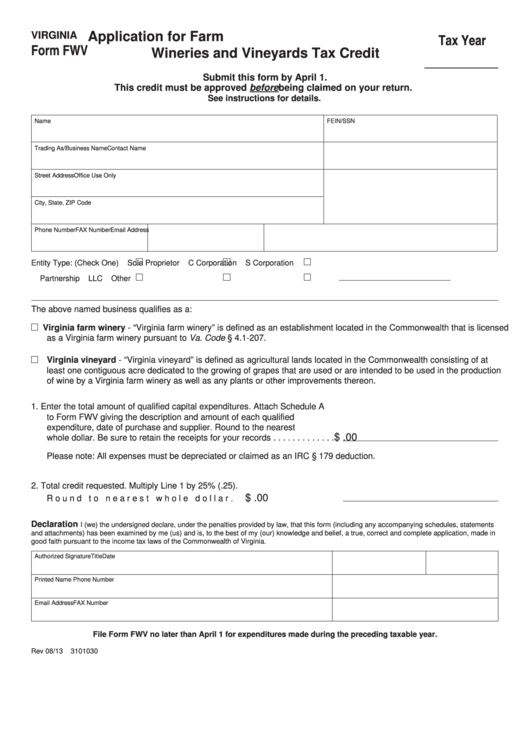

VIRGINIA

Application for Farm

Tax Year

Form FWV

Wineries and Vineyards Tax Credit

___________

Submit this form by April 1.

This credit must be approved before being claimed on your return.

See instructions for details.

Name

FEIN/SSN

Trading As/Business Name

Contact Name

Street Address

Office Use Only

City, State, ZIP Code

Phone Number

FAX Number

Email Address

Entity Type: (Check One)

Sole Proprietor

C Corporation

S Corporation

Partnership

LLC

Other

The above named business qualifies as a:

Virginia farm winery - “Virginia farm winery” is defined as an establishment located in the Commonwealth that is licensed

as a Virginia farm winery pursuant to Va. Code § 4.1-207.

Virginia vineyard - “Virginia vineyard” is defined as agricultural lands located in the Commonwealth consisting of at

least one contiguous acre dedicated to the growing of grapes that are used or are intended to be used in the production

of wine by a Virginia farm winery as well as any plants or other improvements thereon.

1. Enter the total amount of qualified capital expenditures. Attach Schedule A

to Form FWV giving the description and amount of each qualified

expenditure, date of purchase and supplier. Round to the nearest

$

.00

whole dollar. Be sure to retain the receipts for your records . . . . . . . . . . . . .

Please note: All expenses must be depreciated or claimed as an IRC § 179 deduction.

2. Total credit requested. Multiply Line 1 by 25% (.25).

$

.00

Round to nearest whole dollar. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Declaration

I (we) the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements

and attachments) has been examined by me (us) and is, to the best of my (our) knowledge and belief, a true, correct and complete application, made in

good faith pursuant to the income tax laws of the Commonwealth of Virginia.

Authorized Signature

Title

Date

Printed Name

Phone Number

Email Address

FAX Number

File Form FWV no later than April 1 for expenditures made during the preceding taxable year.

Rev 08/13

3101030

1

1 2

2 3

3 4

4