Form St-810.1 - Quarterly Schedule W For Part-Quarterly (Monthly) Filers - Report Of Purchases Eligible For Credit By A Qualified Empire Zone Enterprise (Qeze) - 2015

ADVERTISEMENT

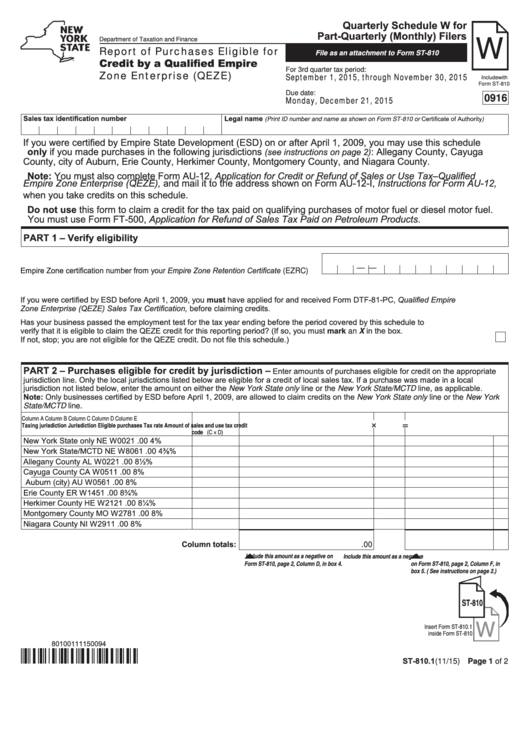

Quarterly Schedule W for

W

Part-Quarterly (Monthly) Filers

Department of Taxation and Finance

Report of Purchases Eligible for

File as an attachment to Form ST-810

Credit by a Qualified Empire

For 3rd quarter tax period:

Zone Enterprise (QEZE)

September 1, 2015, through November 30, 2015

Include with

Form ST-810

Due date:

0916

Monday, December 21, 2015

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-810 or Certificate of Authority)

If you were certified by Empire State Development (ESD) on or after April 1, 2009, you may use this schedule

only if you made purchases in the following jurisdictions

: Allegany County, Cayuga

(see instructions on page 2)

County, city of Auburn, Erie County, Herkimer County, Montgomery County, and Niagara County.

Note: You must also complete Form AU-12, Application for Credit or Refund of Sales or Use Tax–Qualified

Empire Zone Enterprise (QEZE), and mail it to the address shown on Form AU-12-I, Instructions for Form AU-12,

when you take credits on this schedule.

Do not use this form to claim a credit for the tax paid on qualifying purchases of motor fuel or diesel motor fuel.

You must use Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products.

PART 1 – Verify eligibility

Empire Zone certification number from your Empire Zone Retention Certificate (EZRC) ....

—

—

If you were certified by ESD before April 1, 2009, you must have applied for and received Form DTF-81-PC, Qualified Empire

Zone Enterprise (QEZE) Sales Tax Certification, before claiming credits.

Has your business passed the employment test for the tax year ending before the period covered by this schedule to

verify that it is eligible to claim the QEZE credit for this reporting period? (If so, you must mark an X in the box.

If not, stop; you are not eligible for the QEZE credit. Do not file this schedule.) ..............................................................................................

PART 2 – Purchases eligible for credit by jurisdiction –

Enter amounts of purchases eligible for credit on the appropriate

jurisdiction line. Only the local jurisdictions listed below are eligible for a credit of local sales tax. If a purchase was made in a local

jurisdiction not listed below, enter the amount on either the New York State only line or the New York State/MCTD line, as applicable.

Note: Only businesses certified by ESD before April 1, 2009, are allowed to claim credits on the New York State only line or the New York

State/MCTD line.

Column A

Column B

Column C

Column D

Column E

×

Taxing jurisdiction

Jurisdiction

Eligible purchases

Tax rate

=

Amount of sales and use tax credit

code

(C × D)

New York State only

NE W0021

.00

4%

New York State/MCTD

NE W8061

.00

4⅜%

Allegany County

AL W0221

.00

8½%

Cayuga County

CA W0511

.00

8%

Auburn (city)

AU W0561

.00

8%

Erie County

ER W1451

.00

8¾%

Herkimer County

HE W2121

.00

8¼%

Montgomery County

MO W2781

.00

8%

Niagara County

NI W2911

.00

8%

Column totals:

.00

Include this amount as a negative on

Include this amount as a negative

Form ST-810, page 2, Column D, in box 4.

on Form ST-810, page 2, Column F, in

box 5. ( See instructions on page 2.)

ST-810

W

Insert Form ST-810.1

inside Form ST-810

80100111150094

ST-810.1 (11/15) Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2