Form St-809 - New York State And Local Sales And Use Tax Return For Part-Quarterly (Monthly) Filers - 2015

ADVERTISEMENT

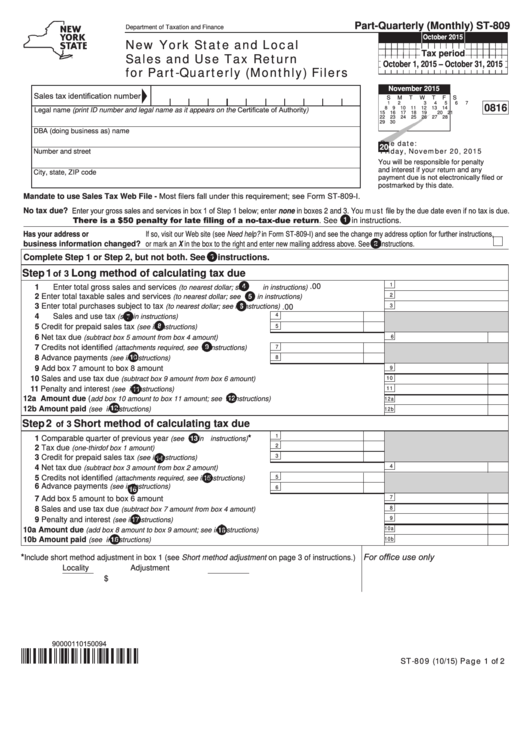

Part-Quarterly (Monthly) ST-809

Department of Taxation and Finance

October 2015

New York State and Local

Sales and Use Tax Return

Tax period

October 1, 2015 – October 31, 2015

for Part-Quarterly (Monthly) Filers

November 2015

Sales tax identification number

S M

T W

T

F

S

1

2

3

4

5

6

7

0816

Legal name (print ID number and legal name as it appears on the Certificate of Authority)

8

9

10

11

12

13

14

15 16

17

18

19 2220 21

22 23

24

25

26

27

28

29 30

DBA (doing business as) name

Due date:

20

Friday, November 20, 2015

Number and street

You will be responsible for penalty

and interest if your return and any

City, state, ZIP code

payment due is not electronically filed or

postmarked by this date.

Mandate to use Sales Tax Web File - Most filers fall under this requirement; see Form ST-809-I.

No tax due? Enter your gross sales and services in box 1 of Step 1 below; enter none in boxes 2 and 3. You must file by the due date even if no tax is due.

There is a $50 penalty for late filing of a no-tax-due return. See

in instructions.

If so, visit our Web site (see Need help? in Form ST-809-I) and see the change my address option for further instructions,

Has your address or

business information changed? or mark an X in the box to the right and enter new mailing address above. See

in instructions. ................................

Complete Step 1 or Step 2, but not both. See

in instructions.

Step 1

Long method of calculating tax due

of 3

1

.00

1 Enter total gross sales and services

.....................................

(to nearest dollar; see

in instructions)

2

2 Enter total taxable sales and services

..................................

.00

(to nearest dollar; see

in instructions)

3

3 Enter total purchases subject to tax

.......................................

(to nearest dollar; see

in instructions)

.00

4

4 Sales and use tax

.......................................

(see

in instructions)

5

5 Credit for prepaid sales tax

.........................

(see

in instructions)

6

6 Net tax due

..........................................................................

(subtract box 5 amount from box 4 amount)

7 Credits not identified

7

(attachments required, see

in instructions)

8

8 Advance payments

....................................

(see

in instructions)

9

9 Add box 7 amount to box 8 amount ..................................................................................................

10

10 Sales and use tax due

........................................................

(subtract box 9 amount from box 6 amount)

11

11 Penalty and interest

.......................................................................................

(see

in instructions)

12a

12a Amount due (

............................................

add box 10 amount to box 11 amount; see

in instructions)

12b

12b Amount paid

..................................................................................................

(see

in instructions)

Step 2

Short method of calculating tax due

of 3

1

* .......

1 Comparable quarter of previous year

(see

in instructions)

2

2 Tax due

..................................................

(one-third of box 1 amount)

3

3 Credit for prepaid sales tax

.........................

(see

in instructions)

4

4 Net tax due

..........................................................................

(subtract box 3 amount from box 2 amount)

5 Credits not identified

5

(attachments required, see

in instructions)

6

6 Advance payments

.....................................

(see

in instructions)

7

7 Add box 5 amount to box 6 amount ...................................................................................................

8

8 Sales and use tax due

........................................................

(subtract box 7 amount from box 4 amount)

9

9 Penalty and interest

........................................................................................

(see

in instructions)

10a

10a Amount due

................................................

(add box 8 amount to box 9 amount; see

in instructions)

10b

10b Amount paid

..................................................................................................

(see

in instructions)

For office use only

*

Include short method adjustment in box 1 (see Short method adjustment on page 3 of instructions.)

Locality

Adjustment

$

90000110150094

ST-809 (10/15) Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2