Form 75 - Idaho Fuels Use Report

Download a blank fillable Form 75 - Idaho Fuels Use Report in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 75 - Idaho Fuels Use Report with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

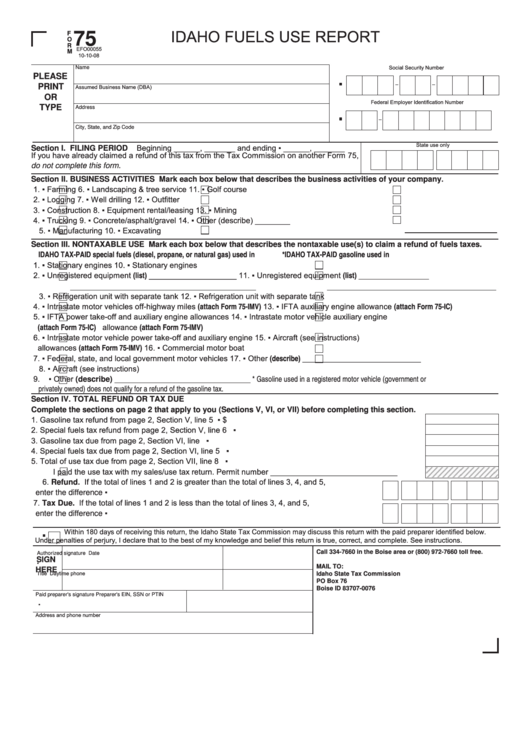

IDAHO FUELS USE REPORT

F

75

O

R

EFO00055

M

10-10-08

Social Security Number

Name

PLEASE

PRINT

Assumed Business Name (DBA)

OR

Federal Employer Identification Number

TyPE

Address

City, State, and Zip Code

State use only

Beginning ______, _______ and ending ▪ ______, _______

Section I.

FILING PERIOD

If you have already claimed a refund of this tax from the Tax Commission on another Form 75,

do not complete this form.

Section II.

BUSINESS ACTIVITIES

Mark each box below that describes the business activities of your company.

1. ▪

Farming

6.

▪

Landscaping & tree service

11. ▪

Golf course

2. ▪

Logging

7.

▪

Well drilling

12. ▪

Outfitter

3. ▪

Construction

8.

▪

Equipment rental/leasing

13. ▪

Mining

4. ▪

Trucking

9.

▪

Concrete/asphalt/gravel

14. ▪

Other (describe) ________

5. ▪

Manufacturing

10. ▪

Excavating

Section III.

NONTAXABLE USE

Mark each box below that describes the nontaxable use(s) to claim a refund of fuels taxes.

Idaho TaX-PaId special fuels (diesel, propane, or natural gas) used in

*Idaho TaX-PaId gasoline used in

1. ▪

Stationary engines

10. ▪

Stationary engines

Unregistered equipment (list) ____________________

Unregistered equipment (list) ________________

2. ▪

11. ▪

3. ▪

Refrigeration unit with separate tank

12. ▪

Refrigeration unit with separate tank

Intrastate motor vehicles off-highway miles (attach Form 75-IMV)

IFTA auxiliary engine allowance (attach Form 75-IC)

4. ▪

13. ▪

5. ▪

IFTA power take-off and auxiliary engine allowances

14. ▪

Intrastate motor vehicle auxiliary engine

(attach Form 75-IC)

allowance (attach Form 75-IMV)

6. ▪

Intrastate motor vehicle power take-off and auxiliary engine

15. ▪

Aircraft (see instructions)

allowances (attach Form 75-IMV)

16. ▪

Commercial motor boat

Other (describe) ___________________________

7. ▪

Federal, state, and local government motor vehicles

17. ▪

8. ▪

Aircraft (see instructions)

* Gasoline used in a registered motor vehicle (government or

9. ▪

Other (describe) _______________________________

privately owned) does not qualify for a refund of the gasoline tax.

Section IV.

TOTAL REFUND OR TAX DUE

Complete the sections on page 2 that apply to you (Sections V, VI, or VII) before completing this section.

1. Gasoline tax refund from page 2, Section V, line 5 ....................................................................................... ▪ $

2. Special fuels tax refund from page 2, Section V, line 6 ................................................................................ ▪

3. Gasoline tax due from page 2, Section VI, line 4.......................................................................................... ▪

4. Special fuels tax due from page 2, Section VI, line 5 ................................................................................... ▪

5. Total of use tax due from page 2, Section VII, line 8 .................................................................................... ▪

I paid the use tax with my sales/use tax return. Permit number _____________________________

6. Refund. If the total of lines 1 and 2 is greater than the total of lines 3, 4, and 5,

enter the difference .................................................................................................................. ▪

7. Tax Due. If the total of lines 1 and 2 is less than the total of lines 3, 4, and 5,

enter the difference .................................................................................................................. ▪

.

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct, and complete. See instructions.

Call 334-7660 in the Boise area or (800) 972-7660 toll free.

Authorized signature

Date

SIGN

▪

MAIL TO:

HERE

Title

Daytime phone

Idaho State Tax Commission

PO Box 76

Boise ID 83707-0076

Paid preparer's signature

Preparer's EIN, SSN or PTIN

▪

Address and phone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5