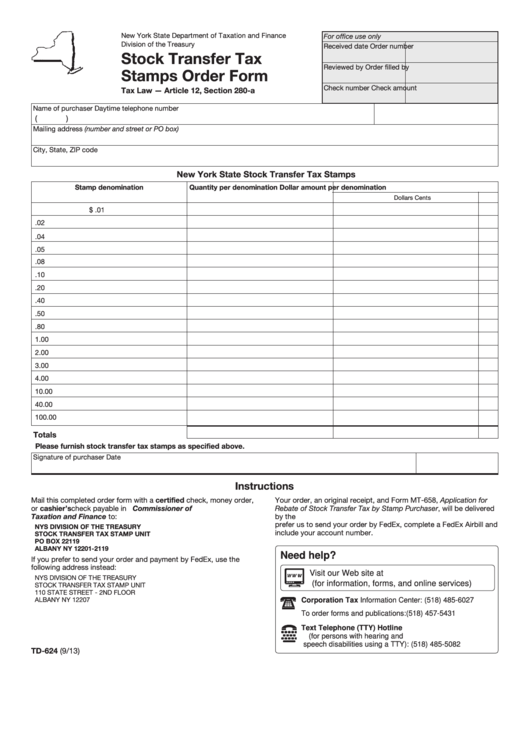

Form Td-624 - Stock Transfer Tax Stamps Order Form

ADVERTISEMENT

New York State Department of Taxation and Finance

For office use only

Division of the Treasury

Received date

Order number

Stock Transfer Tax

Reviewed by

Order filled by

Stamps Order Form

Check number

Check amount

Tax Law — Article 12, Section 280-a

Name of purchaser

Daytime telephone number

(

)

Mailing address (number and street or PO box)

City, State, ZIP code

New York State Stock Transfer Tax Stamps

Stamp denomination

Quantity per denomination

Dollar amount per denomination

Dollars

Cents

$

.01

.02

.04

.05

.08

.10

.20

.40

.50

.80

1.00

2.00

3.00

4.00

10.00

40.00

100.00

Totals

Please furnish stock transfer tax stamps as specified above.

Signature of purchaser

Date

Instructions

Mail this completed order form with a certified check, money order,

Your order, an original receipt, and Form MT-658, Application for

or cashier’s check payable in U.S. funds to Commissioner of

Rebate of Stock Transfer Tax by Stamp Purchaser, will be delivered

Taxation and Finance to:

by the U.S. Postal Service to the address indicated above. If you

prefer us to send your order by FedEx, complete a FedEx Airbill and

NYS DIVISION OF THE TREASURY

include your account number.

STOCK TRANSFER TAX STAMP UNIT

PO BOX 22119

ALBANY NY 12201-2119

Need help?

If you prefer to send your order and payment by FedEx, use the

following address instead:

Visit our Web site at

NYS DIVISION OF THE TREASURY

(for information, forms, and online services)

STOCK TRANSFER TAX STAMP UNIT

110 STATE STREET - 2ND FLOOR

ALBANY NY 12207

Corporation Tax Information Center:

(518) 485-6027

To order forms and publications:

(518) 457-5431

Text Telephone (TTY) Hotline

(for persons with hearing and

speech disabilities using a TTY):

(518) 485-5082

TD-624 (9/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1