Instructions For Idaho Form Pte-12 - Idaho Schedule For Pass-Through Owners

ADVERTISEMENT

EIN00054

09-26-13

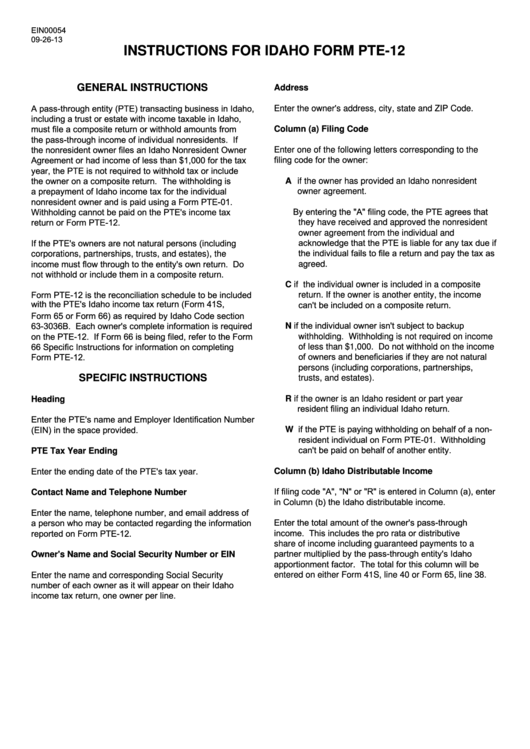

INSTRUCTIONS FOR IDAHO FORM PTE-12

GENERAL INSTRUCTIONS

Address

A pass-through entity (PTE) transacting business in Idaho,

Enter the owner's address, city, state and ZIP Code.

including a trust or estate with income taxable in Idaho,

must file a composite return or withhold amounts from

Column (a) Filing Code

the pass-through income of individual nonresidents. If

the nonresident owner files an Idaho Nonresident Owner

Enter one of the following letters corresponding to the

filing code for the owner:

Agreement or had income of less than $1,000 for the tax

year, the PTE is not required to withhold tax or include

the owner on a composite return. The withholding is

A if the owner has provided an Idaho nonresident

a prepayment of Idaho income tax for the individual

owner agreement.

nonresident owner and is paid using a Form PTE-01.

By entering the "A" filing code, the PTE agrees that

Withholding cannot be paid on the PTE's income tax

return or Form PTE-12.

they have received and approved the nonresident

owner agreement from the individual and

acknowledge that the PTE is liable for any tax due if

If the PTE's owners are not natural persons (including

the individual fails to file a return and pay the tax as

corporations, partnerships, trusts, and estates), the

income must flow through to the entity's own return. Do

agreed.

not withhold or include them in a composite return.

C if the individual owner is included in a composite

Form PTE-12 is the reconciliation schedule to be included

return. If the owner is another entity, the income

can't be included on a composite return.

with the PTE's Idaho income tax return (Form 41S,

Form 65 or Form 66) as required by Idaho Code section

N if the individual owner isn't subject to backup

63-3036B. Each owner's complete information is required

on the PTE-12. If Form 66 is being filed, refer to the Form

withholding. Withholding is not required on income

66 Specific Instructions for information on completing

of less than $1,000. Do not withhold on the income

of owners and beneficiaries if they are not natural

Form PTE-12.

persons (including corporations, partnerships,

SPECIFIC INSTRUCTIONS

trusts, and estates).

R if the owner is an Idaho resident or part year

Heading

resident filing an individual Idaho return.

Enter the PTE's name and Employer Identification Number

W if the PTE is paying withholding on behalf of a non-

(EIN) in the space provided.

resident individual on Form PTE-01. Withholding

can't be paid on behalf of another entity.

PTE Tax Year Ending

Enter the ending date of the PTE's tax year.

Column (b) Idaho Distributable Income

If filing code "A", "N" or "R" is entered in Column (a), enter

Contact Name and Telephone Number

in Column (b) the Idaho distributable income.

Enter the name, telephone number, and email address of

Enter the total amount of the owner's pass-through

a person who may be contacted regarding the information

income. This includes the pro rata or distributive

reported on Form PTE-12.

share of income including guaranteed payments to a

partner multiplied by the pass-through entity's Idaho

Owner's Name and Social Security Number or EIN

apportionment factor. The total for this column will be

Enter the name and corresponding Social Security

entered on either Form 41S, line 40 or Form 65, line 38.

number of each owner as it will appear on their Idaho

income tax return, one owner per line.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2