Reset Form

Print Form

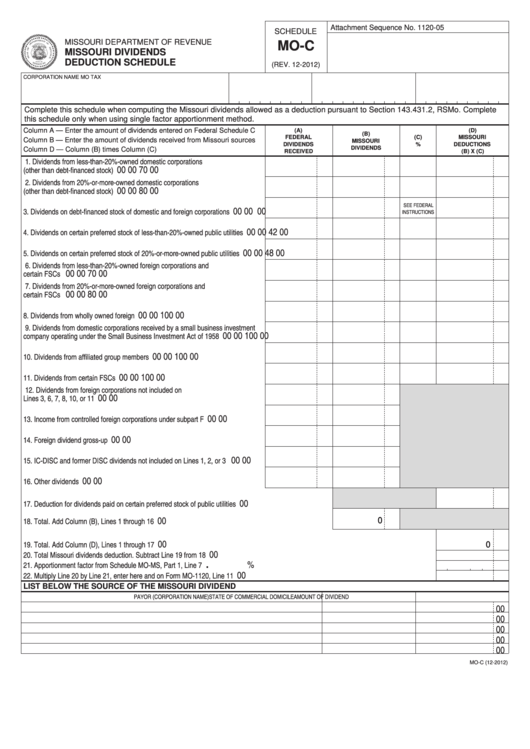

Attachment Sequence No. 1120-05

SCHEDULE

MISSOURI DEPARTMENT OF REVENUE

MO-C

MISSOURI DIVIDENDS

DEDUCTION SCHEDULE

(REV. 12-2012)

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

FEDERAL I.D. NUMBER

Complete this schedule when computing the Missouri dividends allowed as a deduction pursuant to Section 143.431.2, RSMo. Complete

this schedule only when using single factor apportionment method.

Column A — Enter the amount of dividends entered on Federal Schedule C

(A)

(D)

(B)

FEDERAL

(C)

MISSOURI

Column B — Enter the amount of dividends received from Missouri sources

MISSOURI

DIVIDENDS

%

DEDUCTIONS

DIVIDENDS

Column D — Column (B) times Column (C)

RECEIVED

(B) X (C)

1. Dividends from less‑than‑20%‑owned domestic corporations

00

00

70

00

(other than debt‑financed stock) ...........................................................................

2. Dividends from 20%‑or‑more‑owned domestic corporations

00

00

80

00

(other than debt‑financed stock) ...........................................................................

SEE FEDERAL

00

00

00

3. Dividends on debt‑financed stock of domestic and foreign corporations ..............

INSTRUCTIONS

00

00

42

00

4. Dividends on certain preferred stock of less‑than‑20%‑owned public utilities ......

00

00

48

00

5. Dividends on certain preferred stock of 20%‑or‑more‑owned public utilities ........

6. Dividends from less‑than‑20%‑owned foreign corporations and

00

00

70

00

certain FSCs ........................................................................................................

7. Dividends from 20%‑or‑more‑owned foreign corporations and

00

00

80

00

certain FSCs .......................................................................................................

00

00

100

00

8. Dividends from wholly owned foreign subsidiaries..................................................

9. Dividends from domestic corporations received by a small business investment

00

00

100

00

company operating under the Small Business Investment Act of 1958 ................

00

00

100

00

10. Dividends from affiliated group members .............................................................

00

00

100

00

11. Dividends from certain FSCs ................................................................................

12. Dividends from foreign corporations not included on

00

00

Lines 3, 6, 7, 8, 10, or 11 ......................................................................................

00

00

13. Income from controlled foreign corporations under subpart F ..............................

00

00

14. Foreign dividend gross‑up ....................................................................................

00

00

15. IC‑DISC and former DISC dividends not included on Lines 1, 2, or 3 .................

00

00

16. Other dividends .....................................................................................................

00

17. Deduction for dividends paid on certain preferred stock of public utilities ..................................................

0

00

18. Total. Add Column (B), Lines 1 through 16 .................................................................................................

0

00

19. Total. Add Column (D), Lines 1 through 17 ..........................................................................................................................................................

00

20. Total Missouri dividends deduction. Subtract Line 19 from 18 .............................................................................................................................

.

%

21. Apportionment factor from Schedule MO‑MS, Part 1, Line 7 ................................................................................................................................

00

22. Multiply Line 20 by Line 21, enter here and on Form MO‑1120, Line 11 ..............................................................................................................

LIST BELOW THE SOURCE OF THE MISSOURI DIVIDEND

PAYOR (CORPORATION NAME)

STATE OF COMMERCIAL DOMICILE

AMOUNT OF DIVIDEND

00

00

00

00

00

MO-C (12-2012)

1

1