Reset Form

Print Form

MISSOURI DEPARTMENT OF REVENUE

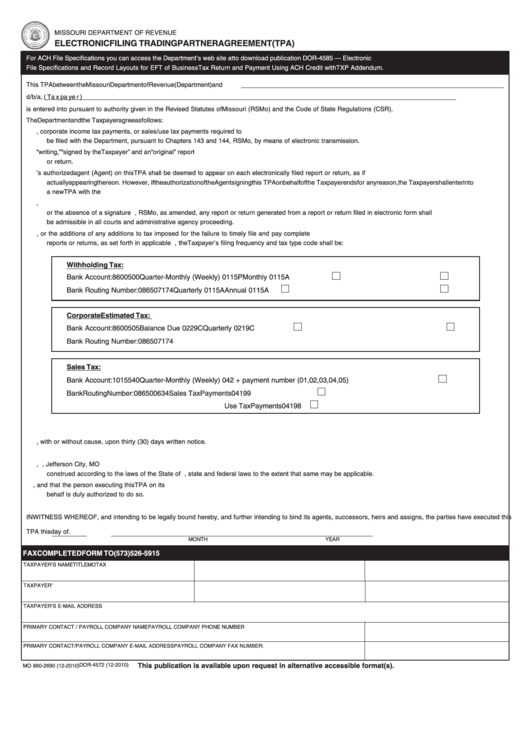

ELECTRONIC FILING TRADING PARTNER AGREEMENT (TPA)

For ACH File Specifications you can access the Department’s web site at to download publication DOR-4585 — Electronic

File Specifications and Record Layouts for EFT of Business Tax Return and Payment Using ACH Credit with TXP Addendum.

This TPA between the Missouri Department of Revenue (Department) and

d/b/a

, ( Ta x p a y e r )

is entered into pursuant to authority given in the Revised Statutes of Missouri (RSMo) and the Code of State Regulations (CSR).

The Department and the Taxpayer agree as follows:

1. The Department authorizes the Taxpayer to file Missouri withholding payments and returns, corporate income tax payments, or sales/use tax payments required to

be filed with the Department, pursuant to Chapters 143 and 144, RSMo, by means of electronic transmission.

2. Each tax report or return filed in electronic form pursuant to this TPA shall for all purposes be considered a “writing,” “signed by the Taxpayer” and an “original” report

or return.

3. The signature of the Taxpayer or the Taxpayer’s authorized agent (Agent) on this TPA shall be deemed to appear on each electronically filed report or return, as if

actually appearing thereon. However, if the authorization of the Agent signing this TPA on behalf of the Taxpayer ends for any reason, the Taxpayer shall enter into

a new TPA with the Department. Any failure to comply with this provision shall result in the Taxpayer being deemed to have filed an incomplete report or return.

4. The Taxpayer shall not contest the validity or enforceability of any report or return filed in electronic form on the basis of the absence of a paper writing or original,

or the absence of a signature thereon. Pursuant to 32.080, RSMo, as amended, any report or return generated from a report or return filed in electronic form shall

be admissible in all courts and administrative agency proceeding.

5. This TPA shall not alter the filing due dates of any report or return, or the additions of any additions to tax imposed for the failure to timely file and pay complete

reports or returns, as set forth in applicable statutes. For purposes of this Agreement, the Taxpayer’s filing frequency and tax type code shall be:

Withholding Tax:

Bank Account: 8600500

Quarter-Monthly (Weekly) 0115P

Monthly 0115A

Bank Routing Number: 086507174

Quarterly 0115A

Annual 0115A

Corporate Estimated Tax:

Bank Account: 8600505

Balance Due 0229C

Quarterly 0219C

Bank Routing Number: 086507174

Sales Tax:

Bank Account: 1015540

Quarter-Monthly (Weekly) 042 + payment number (01,02,03,04,05)

Bank Routing Number: 086500634

Sales Tax Payments 04199

Use Tax Payments 04198

6. This TPA may be amended only by written amendment executed by the Department and the Taxpayer prior to the effective date thereof.

7. This TPA may be terminated by either party, with or without cause, upon thirty (30) days written notice.

8. This TPA represents the entire understanding of the parties in relation to the electronic filing of reports or returns.

9. The place of performance of this TPA shall be deemed to be the Missouri Department of Revenue, P.O. Box 629, Jefferson City, MO 65105-0629. This TPA shall be

construed according to the laws of the State of Missouri. The Taxpayer shall comply with all local, state and federal laws to the extent that same may be applicable.

10. Each party represents and warrants that it has all necessary power and authority to enter into and perform this TPA, and that the person executing this TPA on its

behalf is duly authorized to do so.

IN WITNESS WHEREOF, and intending to be legally bound hereby, and further intending to bind its agents, successors, heirs and assigns, the parties have executed this

TPA this

day of

.

MONTH

YEAR

FAX COMPLETED FORM TO (573) 526-5915

TAXPAYER’S NAME

TITLE

MO TAX I.D. NUMBER

TAXPAYER’S SIGNATURE

FEDERAL I.D. NUMBER

TAXPAYER’S E-MAIL ADDRESS

PRIMARY CONTACT / PAYROLL COMPANY NAME

PAYROLL COMPANY PHONE NUMBER

PRIMARY CONTACT/PAYROLL COMPANY E-MAIL ADDRESS

PAYROLL COMPANY FAX NUMBER:

This publication is available upon request in alternative accessible format(s).

DOR-4572 (12-2010)

MO 860-2690 (12-2010)

1

1