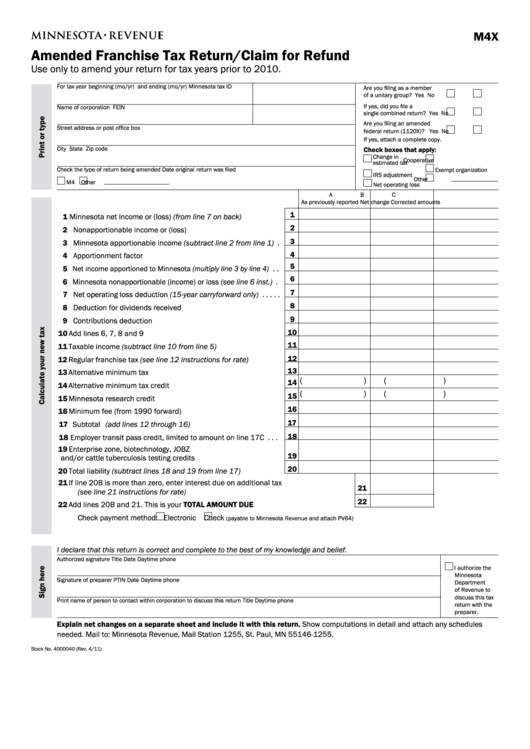

M4X

Amended Franchise Tax Return/Claim for Refund

Use only to amend your return for tax years prior to 2010 .

For tax year beginning (mo/yr)

and ending (mo/yr)

Minnesota tax ID

Are you filing as a member

of a unitary group?

Yes

No

If yes, did you file a

Name of corporation

FEIN

single combined return?

Yes

No

Are you filing an amended

Street address or post office box

federal return (1120X)?

Yes

No

If yes, attach a complete copy .

City

State

Zip code

Check boxes that apply:

Change in

Cooperative

estimated tax

Check the type of return being amended

Date original return was filed

Exempt organization

IRS adjustment

Other

M4

Other

Net operating loss

A

B

C

As previously reported

Net change

Corrected amounts

1

1 Minnesota net income or (loss) (from line 7 on back) . . . . . . . . .

2

2 Nonapportionable income or (loss) . . . . . . . . . . . . . . . . . . . . . . .

3

3 Minnesota apportionable income (subtract line 2 from line 1) .

4

4 Apportionment factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Net income apportioned to Minnesota (multiply line 3 by line 4) . .

6

6 Minnesota nonapportionable (income) or loss (see line 6 inst .) .

7

7 Net operating loss deduction (15-year carryforward only) . . . . .

8

8 Deduction for dividends received . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Contributions deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Add lines 6, 7, 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Taxable income (subtract line 10 from line 5) . . . . . . . . . . . . . . .

12

12 Regular franchise tax (see line 12 instructions for rate) . . . . . . .

13

13 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

(

)

14

14 Alternative minimum tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

(

)

15

15 Minnesota research credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16 Minimum fee (from 1990 forward) . . . . . . . . . . . . . . . . . . . . . . . .

17

17 Subtotal (add lines 12 through 16) . . . . . . . . . . . . . . . . . . . . . . .

18

18 Employer transit pass credit, limited to amount on line 17C . . .

19 Enterprise zone, biotechnology, JOBZ

19

and/or cattle tuberculosis testing credits . . . . . . . . . . . . . . . . . .

20

20 Total liability (subtract lines 18 and 19 from line 17) . . . . . . . . .

21 If line 20B is more than zero, enter interest due on additional tax

21

(see line 21 instructions for rate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22 Add lines 20B and 21 . This is your TOTAL AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . .

Check payment method:

Electronic

Check

(payable to Minnesota Revenue and attach PV64)

I declare that this return is correct and complete to the best of my knowledge and belief .

Authorized signature

Title

Date

Daytime phone

I authorize the

Minnesota

Signature of preparer

PTIN

Date

Daytime phone

Department

of Revenue to

discuss this tax

Print name of person to contact within corporation to discuss this return

Title

Daytime phone

return with the

preparer .

Explain net changes on a separate sheet and include it with this return. Show computations in detail and attach any schedules

needed . Mail to: Minnesota Revenue, Mail Station 1255, St . Paul, MN 55146-1255 .

Stock No . 4000040 (Rev . 4/11)

1

1 2

2 3

3 4

4