Form St-104g - Sales Tax Exemption Claim For Cash Purchases By Government Agencies

ADVERTISEMENT

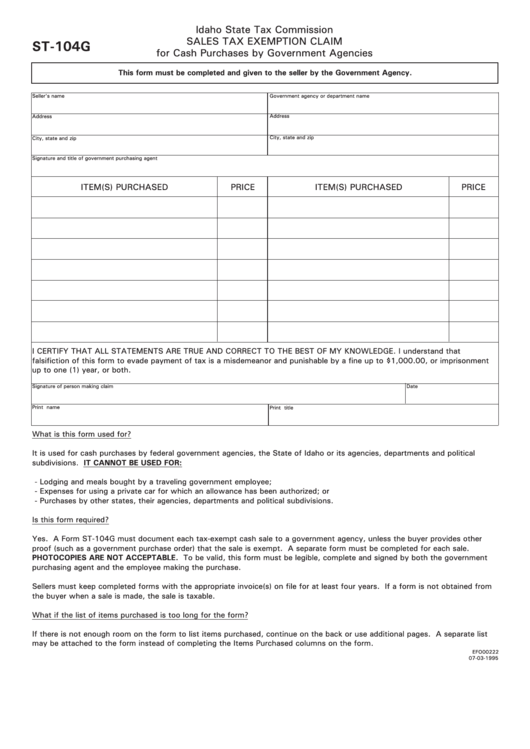

Idaho State Tax Commission

SALES TAX EXEMPTION CLAIM

ST-104G

for Cash Purchases by Government Agencies

This form must be completed and given to the seller by the Government Agency.

Seller's name

Government agency or department name

Address

Address

City, state and zip

City, state and zip

Signature and title of government purchasing agent

PRICE

ITEM(S) PURCHASED

PRICE

ITEM(S) PURCHASED

I CERTIFY THAT ALL STATEMENTS ARE TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE. I understand that

falsifiction of this form to evade payment of tax is a misdemeanor and punishable by a fine up to $1,000.00, or imprisonment

up to one (1) year, or both.

Signature of person making claim

Date

Print name

Print title

What is this form used for?

It is used for cash purchases by federal government agencies, the State of Idaho or its agencies, departments and political

subdivisions. IT CANNOT BE USED FOR:

- Lodging and meals bought by a traveling government employee;

- Expenses for using a private car for which an allowance has been authorized; or

- Purchases by other states, their agencies, departments and political subdivisions.

Is this form required?

Yes. A Form ST-104G must document each tax-exempt cash sale to a government agency, unless the buyer provides other

proof (such as a government purchase order) that the sale is exempt. A separate form must be completed for each sale.

PHOTOCOPIES ARE NOT ACCEPTABLE. To be valid, this form must be legible, complete and signed by both the government

purchasing agent and the employee making the purchase.

Sellers must keep completed forms with the appropriate invoice(s) on file for at least four years. If a form is not obtained from

the buyer when a sale is made, the sale is taxable.

What if the list of items purchased is too long for the form?

If there is not enough room on the form to list items purchased, continue on the back or use additional pages. A separate list

may be attached to the form instead of completing the Items Purchased columns on the form.

EFO00222

07-03-1995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1