Form Tp-650 - Application For Registration Under Articles 12-A And 13-A

ADVERTISEMENT

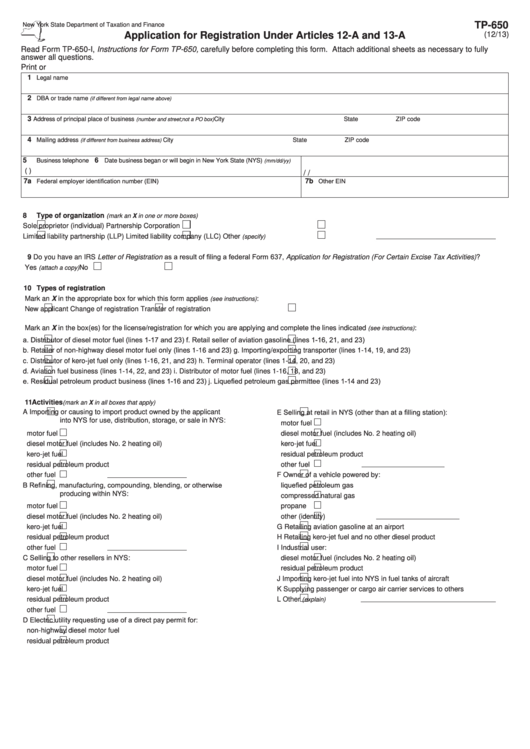

TP-650

New York State Department of Taxation and Finance

Application for Registration Under Articles 12-A and 13-A

(12/13)

Read Form TP‑650‑I, Instructions for Form TP‑650, carefully before completing this form. Attach additional sheets as necessary to fully

answer all questions.

Print or type. All applicants must complete lines 1 through 14.

1

Legal name

2

DBA or trade name

(if different from legal name above)

3

Address of principal place of business

City

State

ZIP code

(number and street; not a PO box)

4

Mailing address

City

State

ZIP code

(if different from business address)

5

6

Business telephone

Date business began or will begin in New York State (NYS)

(mm/dd/yy)

(

)

/

/

Federal employer identification number (EIN)

Other EIN

7a

7b

8 Type of organization

(mark an X in one or more boxes)

Sole proprietor (individual)

Partnership

Corporation

Limited liability partnership (LLP)

Limited liability company (LLC)

Other

(specify)

9 Do you have an IRS Letter of Registration as a result of filing a federal Form 637, Application for Registration (For Certain Excise Tax Activities)?

Yes

No

(attach a copy)

10 Types of registration

Mark an X in the appropriate box for which this form applies

:

(see instructions)

New applicant

Change of registration

Transfer of registration

Mark an X in the box(es) for the license/registration for which you are applying and complete the lines indicated

:

(see instructions)

a.

Distributor of diesel motor fuel (lines 1-17 and 23)

f.

Retail seller of aviation gasoline (lines 1-16, 21, and 23)

b.

Retailer of non‑highway diesel motor fuel only (lines 1‑16 and 23)

g.

Importing/exporting transporter (lines 1‑14, 19, and 23)

c.

Distributor of kero‑jet fuel only (lines 1‑16, 21, and 23)

h.

Terminal operator (lines 1‑14, 20, and 23)

d.

Aviation fuel business (lines 1‑14, 22, and 23)

i.

Distributor of motor fuel (lines 1‑16, 18, and 23)

e.

Residual petroleum product business (lines 1-16 and 23)

j.

Liquefied petroleum gas permittee (lines 1-14 and 23)

11 Activities

(mark an X in all boxes that apply)

E

Selling at retail in NYS (other than at a filling station):

A

Importing or causing to import product owned by the applicant

into NYS for use, distribution, storage, or sale in NYS:

motor fuel

motor fuel

diesel motor fuel (includes No. 2 heating oil)

diesel motor fuel (includes No. 2 heating oil)

kero‑jet fuel

kero‑jet fuel

residual petroleum product

residual petroleum product

other fuel

other fuel

F

Owner of a vehicle powered by:

B

Refining, manufacturing, compounding, blending, or otherwise

liquefied petroleum gas

producing within NYS:

compressed natural gas

motor fuel

propane

diesel motor fuel (includes No. 2 heating oil)

other (identify)

kero‑jet fuel

G

Retailing aviation gasoline at an airport

residual petroleum product

H

Retailing kero‑jet fuel and no other diesel product

other fuel

I

Industrial user:

C

Selling to other resellers in NYS:

diesel motor fuel (includes No. 2 heating oil)

motor fuel

residual petroleum product

diesel motor fuel (includes No. 2 heating oil)

J

Importing kero‑jet fuel into NYS in fuel tanks of aircraft

kero‑jet fuel

K

Supplying passenger or cargo air carrier services to others

residual petroleum product

L

Other

(explain)

other fuel

D

Electric utility requesting use of a direct pay permit for:

non‑highway diesel motor fuel

residual petroleum product

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4