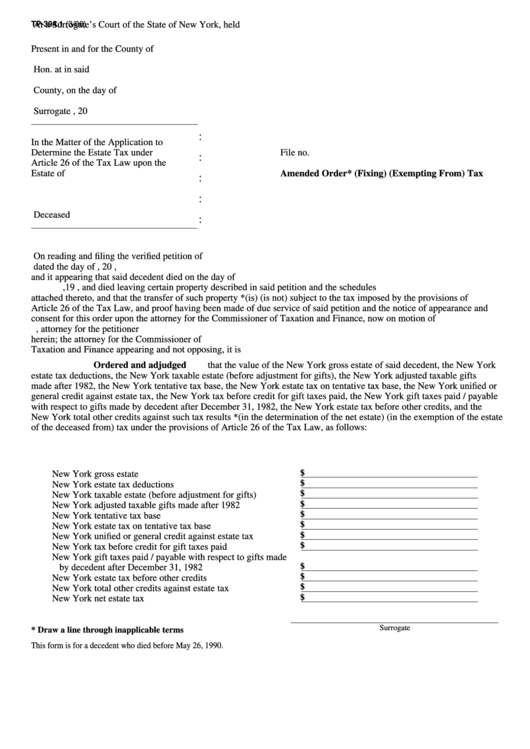

Form Tp-394.1 - Amended Order* (Fixing) (Exempting From) Tax

ADVERTISEMENT

TP-394.1 (3/06)

At a Surrogate’s Court of the State of New York, held

Present

in and for the County of

Hon.

at

in said

County, on the

day of

Surrogate

, 20

:

In the Matter of the Application to

Determine the Estate Tax under

File no.

:

Article 26 of the Tax Law upon the

Estate of

Amended Order* (Fixing) (Exempting From) Tax

:

:

Deceased

:

On reading and filing the verified petition of

dated the

day of

, 20

,

and it appearing that said decedent died on the

day of

,19

, and died leaving certain property described in said petition and the schedules

attached thereto, and that the transfer of such property *(is) (is not) subject to the tax imposed by the provisions of

Article 26 of the Tax Law, and proof having been made of due service of said petition and the notice of appearance and

consent for this order upon the attorney for the Commissioner of Taxation and Finance, now on motion of

, attorney for the petitioner

herein;

the attorney for the Commissioner of

Taxation and Finance appearing and not opposing, it is

Ordered and adjudged

that the value of the New York gross estate of said decedent, the New York

estate tax deductions, the New York taxable estate (before adjustment for gifts), the New York adjusted taxable gifts

made after 1982, the New York tentative tax base, the New York estate tax on tentative tax base, the New York unified or

general credit against estate tax, the New York tax before credit for gift taxes paid, the New York gift taxes paid / payable

with respect to gifts made by decedent after December 31, 1982, the New York estate tax before other credits, and the

New York total other credits against such tax results *(in the determination of the net estate) (in the exemption of the estate

of the deceased from) tax under the provisions of Article 26 of the Tax Law, as follows:

$

New York gross estate

$

New York estate tax deductions

$

New York taxable estate (before adjustment for gifts)

$

New York adjusted taxable gifts made after 1982

$

New York tentative tax base

$

New York estate tax on tentative tax base

$

New York unified or general credit against estate tax

$

New York tax before credit for gift taxes paid

New York gift taxes paid / payable with respect to gifts made

$

by decedent after December 31, 1982

$

New York estate tax before other credits

$

New York total other credits against estate tax

$

New York net estate tax

Surrogate

* Draw a line through inapplicable terms

This form is for a decedent who died before May 26, 1990.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1