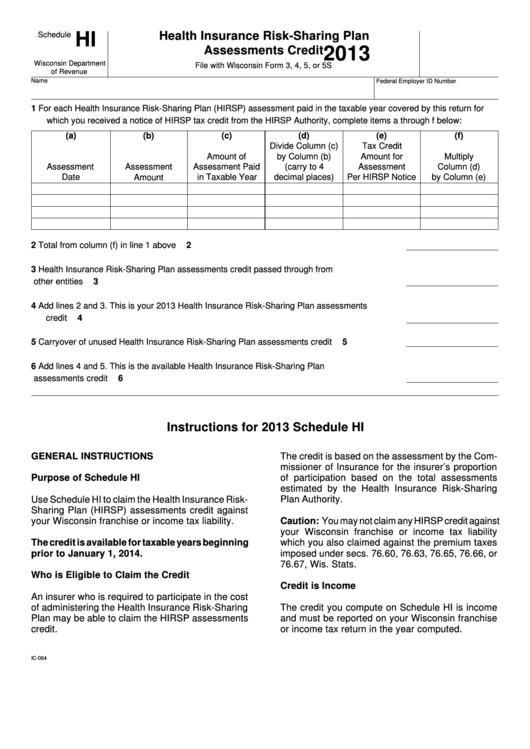

Health Insurance Risk-Sharing Plan

HI

Schedule

Assessments Credit

2013

Wisconsin Department

File with Wisconsin Form 3, 4, 5, or 5S

of Revenue

Name

Federal Employer ID Number

1

For each Health Insurance Risk-Sharing Plan (HIRSP) assessment paid in the taxable year covered by this return for

which you received a notice of HIRSP tax credit from the HIRSP Authority, complete items a through f below:

(a)

(b)

(c)

(d)

(e)

(f)

Divide Column (c)

Tax Credit

Amount of

by Column (b)

Amount for

Multiply

Assessment

Assessment

Assessment Paid

(carry to 4

Assessment

Column (d)

Date

Amount

in Taxable Year

decimal places)

Per HIRSP Notice

by Column (e)

2

Total from column (f) in line 1 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Health Insurance Risk-Sharing Plan assessments credit passed through from

other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Add lines 2 and 3. This is your 2013 Health Insurance Risk-Sharing Plan assessments

credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Carryover of unused Health Insurance Risk-Sharing Plan assessments credit. . . . . . . . . .

5

6

Add lines 4 and 5. This is the available Health Insurance Risk-Sharing Plan

assessments credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Instructions for 2013 Schedule HI

GENERAL INSTRUCTIONS

The credit is based on the assessment by the Com-

missioner of Insurance for the insurer’s proportion

Purpose of Schedule HI

of participation based on the total assessments

estimated by the Health Insurance Risk-Sharing

Use Schedule HI to claim the Health Insurance Risk-

Plan Authority.

Sharing Plan (HIRSP) assessments credit against

your Wisconsin franchise or income tax liability.

Caution: You may not claim any HIRSP credit against

your Wisconsin franchise or income tax liability

The credit is available for taxable years beginning

which you also claimed against the premium taxes

prior to January 1, 2014.

imposed under secs. 76.60, 76.63, 76.65, 76.66, or

76.67, Wis. Stats.

Who is Eligible to Claim the Credit

Credit is Income

An insurer who is required to participate in the cost

of administering the Health Insurance Risk-Sharing

The credit you compute on Schedule HI is income

Plan may be able to claim the HIRSP assessments

and must be reported on your Wisconsin franchise

credit.

or income tax return in the year computed.

IC-064

1

1 2

2