Instructions For Form Mi-1040cr - Homestead Property Tax Credit - 2013

ADVERTISEMENT

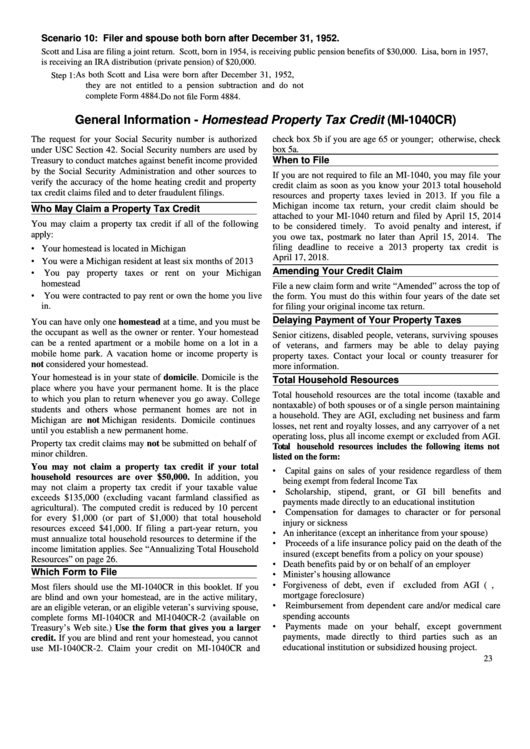

Scenario 10: Filer and spouse both born after December 31, 1952.

Scott and Lisa are filing a joint return. Scott, born in 1954, is receiving public pension benefits of $30,000. Lisa, born in 1957,

is receiving an IRA distribution (private pension) of $20,000.

As both Scott and Lisa were born after December 31, 1952,

Step 1:

they are not entitled to a pension subtraction and do not

complete Form 4884. ................................................................

Do not file Form 4884.

General Information - Homestead Property Tax Credit (MI-1040CR)

check box 5b if you are age 65 or younger; otherwise, check

The request for your Social Security number is authorized

box 5a.

under USC Section 42. Social Security numbers are used by

When to File

Treasury to conduct matches against benefit income provided

by the Social Security Administration and other sources to

If you are not required to file an MI-1040, you may file your

verify the accuracy of the home heating credit and property

credit claim as soon as you know your 2013 total household

tax credit claims filed and to deter fraudulent filings.

resources and property taxes levied in 2013. If you file a

Michigan income tax return, your credit claim should be

Who May Claim a Property Tax Credit

attached to your MI-1040 return and filed by April 15, 2014

You may claim a property tax credit if all of the following

to be considered timely. To avoid penalty and interest, if

apply:

you owe tax, postmark no later than April 15, 2014. The

• Your homestead is located in Michigan

filing deadline to receive a 2013 property tax credit is

April 17, 2018.

• You were a Michigan resident at least six months of 2013

• You pay property taxes or rent on your Michigan

Amending Your Credit Claim

homestead

File a new claim form and write “Amended” across the top of

• You were contracted to pay rent or own the home you live

the form. You must do this within four years of the date set

in.

for filing your original income tax return.

Delaying Payment of Your Property Taxes

You can have only one homestead at a time, and you must be

the occupant as well as the owner or renter. Your homestead

Senior citizens, disabled people, veterans, surviving spouses

can be a rented apartment or a mobile home on a lot in a

of veterans, and farmers may be able to delay paying

mobile home park. A vacation home or income property is

property taxes. Contact your local or county treasurer for

not considered your homestead.

more information.

Your homestead is in your state of domicile. Domicile is the

Total Household Resources

place where you have your permanent home. It is the place

Total household resources are the total income (taxable and

to which you plan to return whenever you go away. College

nontaxable) of both spouses or of a single person maintaining

students and others whose permanent homes are not in

a household. They are AGI, excluding net business and farm

Michigan are not Michigan residents. Domicile continues

losses, net rent and royalty losses, and any carryover of a net

until you establish a new permanent home.

operating loss, plus all income exempt or excluded from AGI.

Property tax credit claims may not be submitted on behalf of

Total household resources includes the following items not

minor children.

listed on the form:

You may not claim a property tax credit if your total

• Capital gains on sales of your residence regardless of them

household resources are over $50,000. In addition, you

being exempt from federal Income Tax

may not claim a property tax credit if your taxable value

• Scholarship, stipend, grant, or GI bill benefits and

exceeds $135,000 (excluding vacant farmland classified as

payments made directly to an educational institution

agricultural). The computed credit is reduced by 10 percent

• Compensation for damages to character or for personal

for every $1,000 (or part of $1,000) that total household

injury or sickness

resources exceed $41,000. If filing a part-year return, you

• An inheritance (except an inheritance from your spouse)

must annualize total household resources to determine if the

• Proceeds of a life insurance policy paid on the death of the

income limitation applies. See “Annualizing Total Household

insured (except benefits from a policy on your spouse)

Resources” on page 26.

• Death benefits paid by or on behalf of an employer

• Minister’s housing allowance

Which Form to File

• Forgiveness of debt, even if excluded from AGI (e.g.,

Most filers should use the MI-1040CR in this booklet. If you

mortgage foreclosure)

are blind and own your homestead, are in the active military,

• Reimbursement from dependent care and/or medical care

are an eligible veteran, or an eligible veteran’s surviving spouse,

spending accounts

complete forms MI-1040CR and MI-1040CR-2 (available on

• Payments made on your behalf, except government

Treasury’s Web site.) Use the form that gives you a larger

payments, made directly to third parties such as an

credit. If you are blind and rent your homestead, you cannot

educational institution or subsidized housing project.

use MI-1040CR-2. Claim your credit on MI-1040CR and

23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8