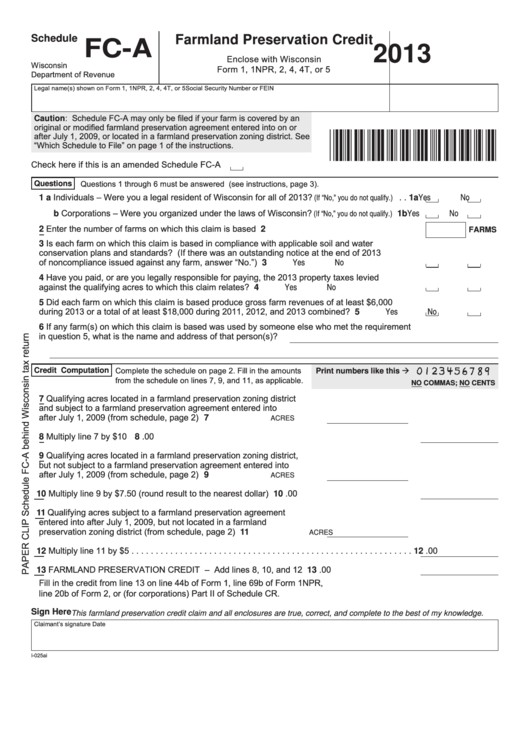

Schedule

Farmland Preservation Credit

FC-A

2013

Enclose with Wisconsin

Wisconsin

Form 1, 1NPR, 2, 4, 4T, or 5

Department of Revenue

Legal name(s) shown on Form 1, 1NPR, 2, 4, 4T, or 5

Social Security Number or FEIN

Caution: Schedule FC‑A may only be filed if your farm is covered by an

original or modified farmland preservation agreement entered into on or

after July 1, 2009, or located in a farmland preservation zoning district. See

“Which Schedule to File” on page 1 of the instructions.

Check here if this is an amended Schedule FC‑A

Questions 1 through 6 must be answered (see instructions, page 3).

Questions

Yes

No

1 a Individuals – Were you a legal resident of Wisconsin for all of 2013?

(If “No,” you do not qualify.)

. . 1a

Yes

No

b Corporations – Were you organized under the laws of Wisconsin?

(If “No,” you do not qualify.)

. . . . 1b

2 Enter the number of farms on which this claim is based . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

FARMS

3 Is each farm on which this claim is based in compliance with applicable soil and water

conservation plans and standards? (If there was an outstanding notice at the end of 2013

Yes

No

of noncompliance issued against any farm, answer “No.”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Have you paid, or are you legally responsible for paying, the 2013 property taxes levied

Yes

No

against the qualifying acres to which this claim relates? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Did each farm on which this claim is based produce gross farm revenues of at least $6,000

Yes

No

during 2013 or a total of at least $18,000 during 2011, 2012, and 2013 combined? . . . . . . . . . 5

6 If any farm(s) on which this claim is based was used by someone else who met the requirement

in question 5, what is the name and address of that person(s)?

Complete the schedule on page 2. Fill in the amounts

Print numbers like this

Credit Computation

from the schedule on lines 7, 9, and 11, as applicable.

NO COMMAS; NO CENTS

7 Qualifying acres located in a farmland preservation zoning district

and subject to a farmland preservation agreement entered into

after July 1, 2009 (from schedule, page 2) . . . . . . . . . . . . . . . . . . . . . 7

ACRES

8 Multiply line 7 by $10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

9 Qualifying acres located in a farmland preservation zoning district,

but not subject to a farmland preservation agreement entered into

after July 1, 2009 (from schedule, page 2) . . . . . . . . . . . . . . . . . . . . . 9

ACRES

10 Multiply line 9 by $7.50 (round result to the nearest dollar) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11 Qualifying acres subject to a farmland preservation agreement

entered into after July 1, 2009, but not located in a farmland

preservation zoning district (from schedule, page 2) . . . . . . . . . . . . . 11

ACRES

12 Multiply line 11 by $5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 FARMLAND PRESERVATION CREDIT – Add lines 8, 10, and 12 . . . . . . . . . . . . . . . . . . . . . . 13

.00

Fill in the credit from line 13 on line 44b of Form 1, line 69b of Form 1NPR,

line 20b of Form 2, or (for corporations) Part II of Schedule CR.

Sign Here

This farmland preservation credit claim and all enclosures are true, correct, and complete to the best of my knowledge.

Claimant’s signature

Date

I‑025ai

1

1 2

2 3

3 4

4