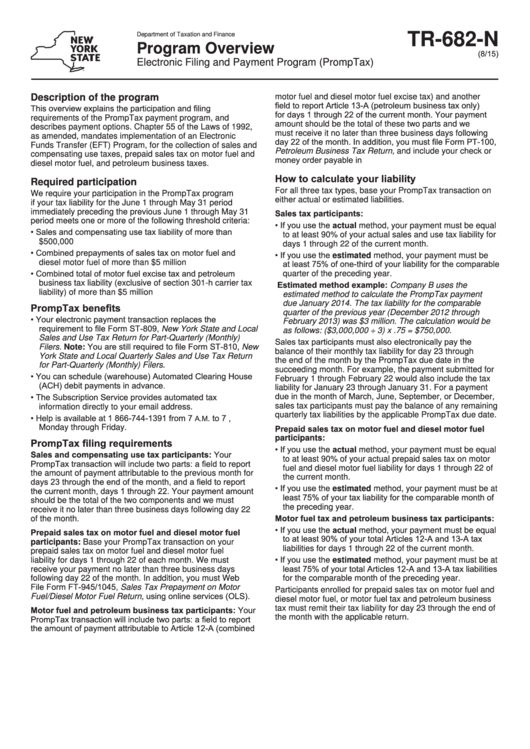

Form Tr-682-N - Program Overview Electronic Filing And Payment Program (Promptax)

ADVERTISEMENT

TR-682-N

Department of Taxation and Finance

Program Overview

(8/15)

Electronic Filing and Payment Program (PrompTax)

Description of the program

motor fuel and diesel motor fuel excise tax) and another

field to report Article 13-A (petroleum business tax only)

This overview explains the participation and filing

for days 1 through 22 of the current month. Your payment

requirements of the PrompTax payment program, and

amount should be the total of these two parts and we

describes payment options. Chapter 55 of the Laws of 1992,

must receive it no later than three business days following

as amended, mandates implementation of an Electronic

day 22 of the month. In addition, you must file Form PT-100,

Funds Transfer (EFT) Program, for the collection of sales and

Petroleum Business Tax Return, and include your check or

compensating use taxes, prepaid sales tax on motor fuel and

money order payable in U.S. funds for the balance.

diesel motor fuel, and petroleum business taxes.

How to calculate your liability

Required participation

For all three tax types, base your PrompTax transaction on

We require your participation in the PrompTax program

either actual or estimated liabilities.

if your tax liability for the June 1 through May 31 period

immediately preceding the previous June 1 through May 31

Sales tax participants:

period meets one or more of the following threshold criteria:

• If you use the actual method, your payment must be equal

• Sales and compensating use tax liability of more than

to at least 90% of your actual sales and use tax liability for

$500,000

days 1 through 22 of the current month.

• Combined prepayments of sales tax on motor fuel and

• If you use the estimated method, your payment must be

diesel motor fuel of more than $5 million

at least 75% of one-third of your liability for the comparable

• Combined total of motor fuel excise tax and petroleum

quarter of the preceding year.

Estimated method example: Company B uses the

business tax liability (exclusive of section 301-h carrier tax

liability) of more than $5 million

estimated method to calculate the PrompTax payment

due January 2014. The tax liability for the comparable

PrompTax benefits

quarter of the previous year (December 2012 through

• Your electronic payment transaction replaces the

February 2013) was $3 million. The calculation would be

requirement to file Form ST-809, New York State and Local

as follows: ($3,000,000 ÷ 3) x .75 = $750,000.

Sales and Use Tax Return for Part-Quarterly (Monthly)

Sales tax participants must also electronically pay the

Filers. Note: You are still required to file Form ST-810, New

balance of their monthly tax liability for day 23 through

York State and Local Quarterly Sales and Use Tax Return

the end of the month by the PrompTax due date in the

for Part-Quarterly (Monthly) Filers.

succeeding month. For example, the payment submitted for

• You can schedule (warehouse) Automated Clearing House

February 1 through February 22 would also include the tax

(ACH) debit payments in advance.

liability for January 23 through January 31. For a payment

due in the month of March, June, September, or December,

• The Subscription Service provides automated tax

sales tax participants must pay the balance of any remaining

information directly to your email address.

quarterly tax liabilities by the applicable PrompTax due date.

• Help is available at 1 866-744-1391 from 7

. to 7

A.M

,

P.M.

Prepaid sales tax on motor fuel and diesel motor fuel

Monday through Friday.

participants:

PrompTax filing requirements

• If you use the actual method, your payment must be equal

Sales and compensating use tax participants: Your

to at least 90% of your actual prepaid sales tax on motor

PrompTax transaction will include two parts: a field to report

fuel and diesel motor fuel liability for days 1 through 22 of

the amount of payment attributable to the previous month for

the current month.

days 23 through the end of the month, and a field to report

• If you use the estimated method, your payment must be at

the current month, days 1 through 22. Your payment amount

least 75% of your tax liability for the comparable month of

should be the total of the two components and we must

the preceding year.

receive it no later than three business days following day 22

Motor fuel tax and petroleum business tax participants:

of the month.

• If you use the actual method, your payment must be equal

Prepaid sales tax on motor fuel and diesel motor fuel

to at least 90% of your total Articles 12-A and 13-A tax

participants: Base your PrompTax transaction on your

liabilities for days 1 through 22 of the current month.

prepaid sales tax on motor fuel and diesel motor fuel

• If you use the estimated method, your payment must be at

liability for days 1 through 22 of each month. We must

least 75% of your total Articles 12-A and 13-A tax liabilities

receive your payment no later than three business days

following day 22 of the month. In addition, you must Web

for the comparable month of the preceding year.

File Form FT-945/1045, Sales Tax Prepayment on Motor

Participants enrolled for prepaid sales tax on motor fuel and

Fuel/Diesel Motor Fuel Return, using online services (OLS).

diesel motor fuel, or motor fuel tax and petroleum business

Motor fuel and petroleum business tax participants: Your

tax must remit their tax liability for day 23 through the end of

the month with the applicable return.

PrompTax transaction will include two parts: a field to report

the amount of payment attributable to Article 12-A (combined

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3