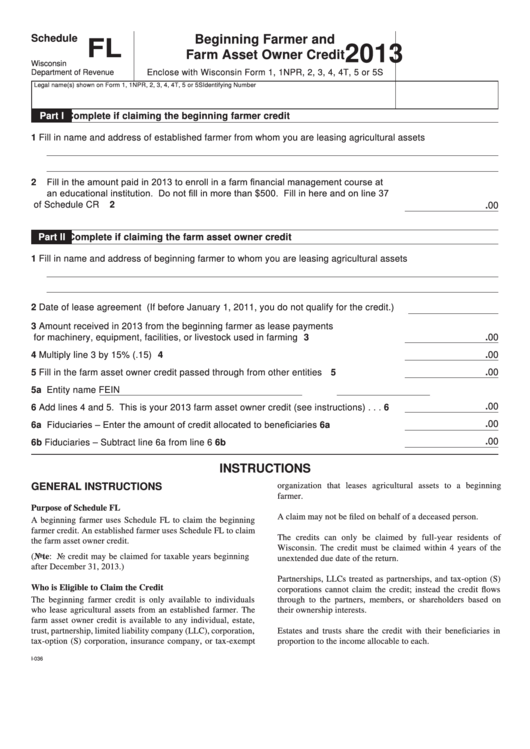

Schedule

Beginning Farmer and

FL

2013

Farm Asset Owner Credit

Wisconsin

Department of Revenue

Enclose with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Legal name(s) shown on Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Identifying Number

Part I

Complete if claiming the beginning farmer credit

1

Fill in name and address of established farmer from whom you are leasing agricultural assets

2 Fill in the amount paid in 2013 to enroll in a farm financial management course at

an educational institution. Do not fill in more than $500. Fill in here and on line 37

of Schedule CR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

Part II

Complete if claiming the farm asset owner credit

1

Fill in name and address of beginning farmer to whom you are leasing agricultural assets

2

Date of lease agreement (If before January 1, 2011, you do not qualify for the credit.)

3

Amount received in 2013 from the beginning farmer as lease payments

for machinery, equipment, facilities, or livestock used in farming . . . . . . . . . . . . . . . 3

.00

4

Multiply line 3 by 15% (.15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5

Fill in the farm asset owner credit passed through from other entities . . . . . . . . . . . 5

.00

5a Entity name

FEIN

.00

6

Add lines 4 and 5. This is your 2013 farm asset owner credit (see instructions) . . . 6

6a Fiduciaries – Enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . 6a

.00

.00

6b Fiduciaries – Subtract line 6a from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

INSTRUCTIONS

GENERAL INSTRUCTIONS

organization that leases agricultural assets to a beginning

farmer.

Purpose of Schedule FL

A claim may not be filed on behalf of a deceased person.

A beginning farmer uses Schedule FL to claim the beginning

farmer credit. An established farmer uses Schedule FL to claim

The credits can only be claimed by full-year residents of

the farm asset owner credit.

Wisconsin. The credit must be claimed within 4 years of the

(Note: No credit may be claimed for taxable years beginning

unextended due date of the return.

after December 31, 2013.)

Partnerships, LLCs treated as partnerships, and tax-option (S)

Who is Eligible to Claim the Credit

corporations cannot claim the credit; instead the credit flows

The beginning farmer credit is only available to individuals

through to the partners, members, or shareholders based on

who lease agricultural assets from an established farmer. The

their ownership interests.

farm asset owner credit is available to any individual, estate,

trust, partnership, limited liability company (LLC), corporation,

Estates and trusts share the credit with their beneficiaries in

tax-option (S) corporation, insurance company, or tax-exempt

proportion to the income allocable to each.

I-036

1

1 2

2