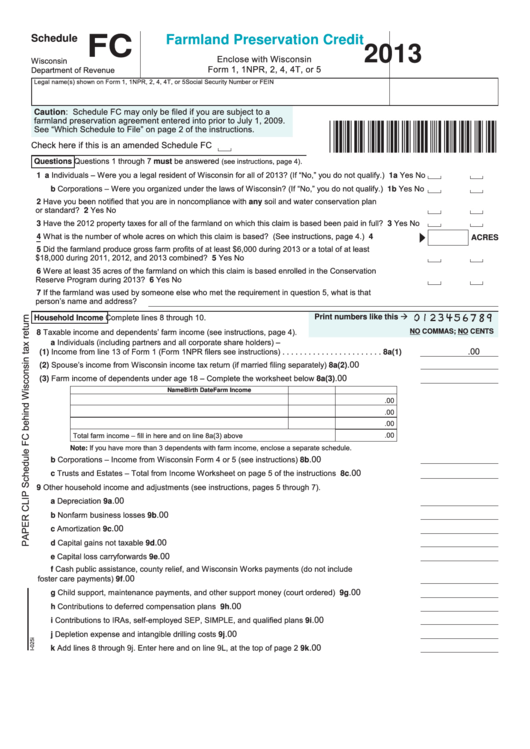

Schedule

FC

Farmland Preservation Credit

2013

Enclose with Wisconsin

Wisconsin

Form 1, 1NPR, 2, 4, 4T, or 5

Department of Revenue

Legal name(s) shown on Form 1, 1NPR, 2, 4, 4T, or 5

Social Security Number or FEIN

Caution: Schedule FC may only be filed if you are subject to a

farmland preservation agreement entered into prior to July 1, 2009.

See “Which Schedule to File” on page 2 of the instructions.

Check here if this is an amended Schedule FC

Questions 1 through 7 must be answered

.

(see instructions, page 4)

Questions

1 a Individuals – Were you a legal resident of Wisconsin for all of 2013? (If “No,” you do not qualify.) . . . . 1a

Yes

No

b Corporations – Were you organized under the laws of Wisconsin? (If “No,” you do not qualify.) . . . . . . 1b

Yes

No

2 Have you been notified that you are in noncompliance with any soil and water conservation plan

or standard? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

3 Have the 2012 property taxes for all of the farmland on which this claim is based been paid in full? . . . . . 3

Yes

No

4 What is the number of whole acres on which this claim is based? (See instructions, page 4.) . . . . . . . . . 4

ACRES

5 Did the farmland produce gross farm profits of at least $6,000 during 2013 or a total of at least

$18,000 during 2011, 2012, and 2013 combined? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Yes

No

6 Were at least 35 acres of the farmland on which this claim is based enrolled in the Conservation

Reserve Program during 2013? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Yes

No

7 If the farmland was used by someone else who met the requirement in question 5, what is that

person’s name and address?

Complete lines 8 through 10.

Print numbers like this

Household Income

8 Taxable income and dependents’ farm income (see instructions, page 4).

NO COMMAS; NO CENTS

a Individuals (including partners and all corporate share holders) –

.00

(1) Income from line 13 of Form 1 (Form 1NPR filers see instructions) . . . . . . . . . . . . . . . . . . . . . . . 8a(1)

.00

(2) Spouse’s income from Wisconsin income tax return (if married filing separately) . . . . . . . . . . . . 8a(2)

.00

(3) Farm income of dependents under age 18 – Complete the worksheet below . . . . . . . . . . . . . . . 8a(3)

Name

Birth Date

Farm Income

.00

.00

.00

.00

Total farm income – fill in here and on line 8a(3) above . . . . . . . . . . . . . . . . . . . . . . . .

Note: If you have more than 3 dependents with farm income, enclose a separate schedule.

.00

b Corporations – Income from Wisconsin Form 4 or 5 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 8b

.00

c Trusts and Estates – Total from Income Worksheet on page 5 of the instructions . . . . . . . . . . . . . . . . 8c

9 Other household income and adjustments (see instructions, pages 5 through 7).

.00

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a

.00

b Nonfarm business losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9b

.00

c Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9c

.00

d Capital gains not taxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

.00

e Capital loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9e

f Cash public assistance, county relief, and Wisconsin Works payments (do not include

.00

foster care payments) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9f

.00

g Child support, maintenance payments, and other support money (court ordered) . . . . . . . . . . . . . . . . 9g

.00

h Contributions to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9h

.00

i Contributions to IRAs, self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . . . 9i

.00

j Depletion expense and intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9j

.00

k Add lines 8 through 9j. Enter here and on line 9L, at the top of page 2 . . . . . . . . . . . . . . . . . . . . . . . . . 9k

1

1 2

2