Print

Clear

l

*128000710002*

2012

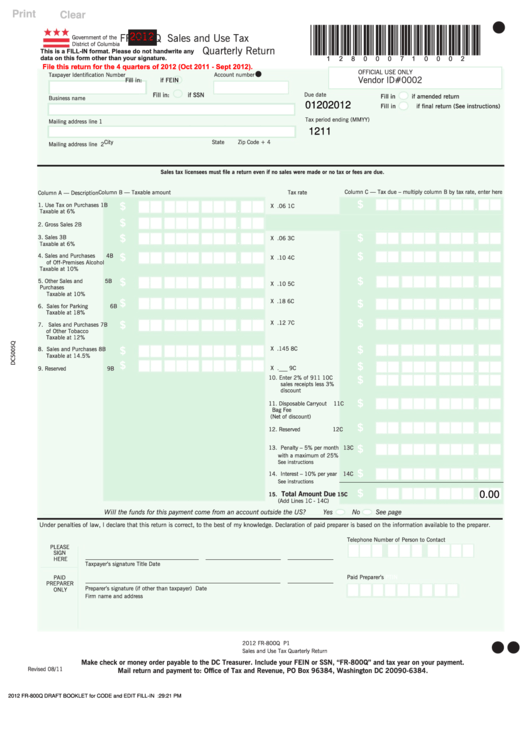

FR-800Q Sales and Use Tax

Government of the

District of Columbia

Quarterly Return

This is a FILL-IN format. Please do not handwrite any

data on this form other than your signature.

File this return for the 4 quarters of 2012 (Oct 2011 - Sept 2012).

l

OFFICIAL USE ONLY

Taxpayer Identification Number

Account number

Vendor ID#0002

Fill in:

if FEIN

Fill in:

if SSN

Due date

Fill in

if amended return

Business name

01202012

Fill in

if final return (See instructions)

Tax period ending (MMYY)

Mailing address line 1

1211

City

State

Zip Code + 4

Mailing address line 2

Sales tax licensees must file a return even if no sales were made or no tax or fees are due.

Column C — Tax due – multiply column B by tax rate, enter here

Column B — Taxable amount

Tax rate

Column A — Description

$

$

.

1. Use Tax on Purchases

1B

.

X .06

1C

Taxable at 6%

$

.

2. Gross Sales

2B

$

$

.

3. Sales

3B

.

X .06

3C

Taxable at 6%

$

$

.

4. Sales and Purchases

4B

.

X .10

4C

of Off-Premises Alcohol

Taxable at 10%

$

$

.

5. Other Sales and

5B

.

X .10

5C

Purchases

Taxable at 10%

$

$

.

.

X .18

6C

6. Sales for Parking

6B

Taxable at 18%

$

$

X .12

7C

.

.

7. Sales and Purchases

7B

of Other Tobacco

Taxable at 12%

$

$

X .145

8C

.

8. Sales and Purchases

8B

.

Taxable at 14.5%

$

$

.

.

X .___

9C

9. Reserved

9B

$

10. Enter 2% of 911

10C

.

sales receipts less 3%

discount

$

.

11. Disposable Carryout

11C

Bag Fee

(Net of discount)

$

.

12. Reserved

12C

$

.

13. P enalty – 5% per month 13C

with a maximum of 25%

See instructions

$

.

14. I nterest – 10% per year 14C

See instructions

$

.

Total Amount Due

0.00

15.

15C

(Add Lines 1C - 14C)

Will the funds for this payment come from an account outside the US?

Yes

No

See page

Under penalties of law, I declare that this return is correct, to the best of my knowledge. Declaration of paid preparer is based on the information available to the preparer.

Telephone Number of Person to Contact

PLEASE

SIGN

HERE

Taxpayer’s signature

Title

Date

PAID

Paid Preparer’s

PTIN

PREPARER

Preparer’s signature (if other than taxpayer)

Date

ONLY

Firm name and address

l

l

2012 FR-800Q P1

Sales and Use Tax Quarterly Return

Make check or money order payable to the DC Treasurer. Include your FEIN or SSN, “FR-800Q” and tax year on your payment.

Revised 08/11

Mail return and payment to: Office of Tax and Revenue, PO Box 96384, Washington DC 20090-6384.

2012 FR-800Q DRAFT BOOKLET for CODE and EDIT FILL-IN 08052011.indd 7

8/5/2011 1:29:21 PM

1

1