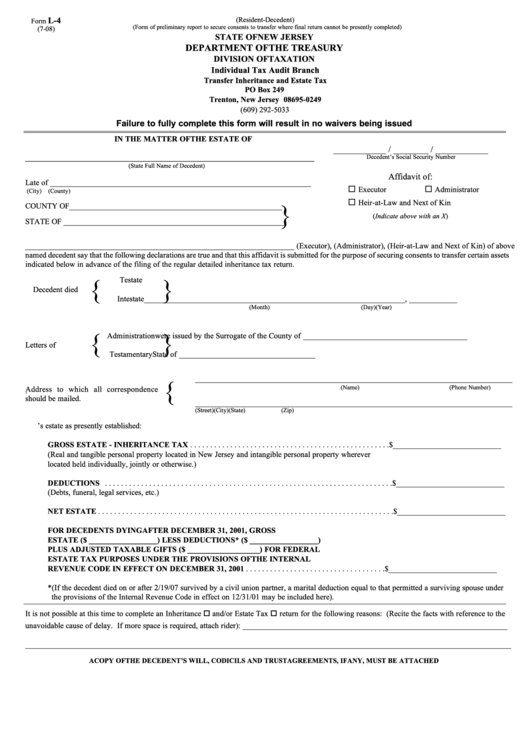

L-4

(Resident-Decedent)

Form

(Form of preliminary report to secure consents to transfer where final return cannot be presently completed)

(7-08)

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

DIVISION OF TAXATION

Individual Tax Audit Branch

Transfer Inheritance and Estate Tax

PO Box 249

Trenton, New Jersey 08695-0249

(609) 292-5033

Failure to fully complete this form will result in no waivers being issued

IN THE MATTER OF THE ESTATE OF

____________ / ________ / ____________

Decedent’s Social Security Number

________________________________________________________________________

(State Full Name of Decedent)

Affidavit of:

Late of _________________________________________________________________

Executor

Administrator

(City)

(County)

Heir-at-Law and Next of Kin

COUNTY OF_____________________________________________________

}

(Indicate above with an X)

S.S.

STATE OF _______________________________________________________

___________________________________________________________________ (Executor), (Administrator), (Heir-at-Law and Next of Kin) of above

named decedent say that the following declarations are true and that this affidavit is submitted for the purpose of securing consents to transfer certain assets

indicated below in advance of the filing of the regular detailed inheritance tax return.

Testate

}

}

Decedent died

Intestate

_________________________________________________________________, ____________

(Month)

(Day)

(Year)

Administration

were issued by the Surrogate of the County of _________________________________________

}

}

Letters of

Testamentary

State of __________________________________

_______________________________________________________________________________

}

(Name)

(Phone Number)

Address to which all correspondence

.

should be mailed.

_______________________________________________________________________________

(Street)

(City)

(State)

(Zip)

1. Following is the status of decedent’s estate as presently established:

GROSS ESTATE - INHERITANCE TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

(Real and tangible personal property located in New Jersey and intangible personal property wherever

located held individually, jointly or otherwise.)

DEDUCTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

(Debts, funeral, legal services, etc.)

NET ESTATE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

FOR DECEDENTS DYING AFTER DECEMBER 31, 2001, GROSS

ESTATE ($ _________________) LESS DEDUCTIONS* ($ _________________)

PLUS ADJUSTED TAXABLE GIFTS ($ __________________) FOR FEDERAL

ESTATE TAX PURPOSES UNDER THE PROVISIONS OF THE INTERNAL

REVENUE CODE IN EFFECT ON DECEMBER 31, 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

*(If the decedent died on or after 2/19/07 survived by a civil union partner, a marital deduction equal to that permitted a surviving spouse under

the provisions of the Internal Revenue Code in effect on 12/31/01 may be included here).

It is not possible at this time to complete an Inheritance

and/or Estate Tax

return for the following reasons: (Recite the facts with reference to the

unavoidable cause of delay. If more space is required, attach rider): __________________________________________________________________

_________________________________________________________________________________________________________________________

A COPY OF THE DECEDENT’S WILL, CODICILS AND TRUST AGREEMENTS, IF ANY, MUST BE ATTACHED

1

1 2

2 3

3 4

4