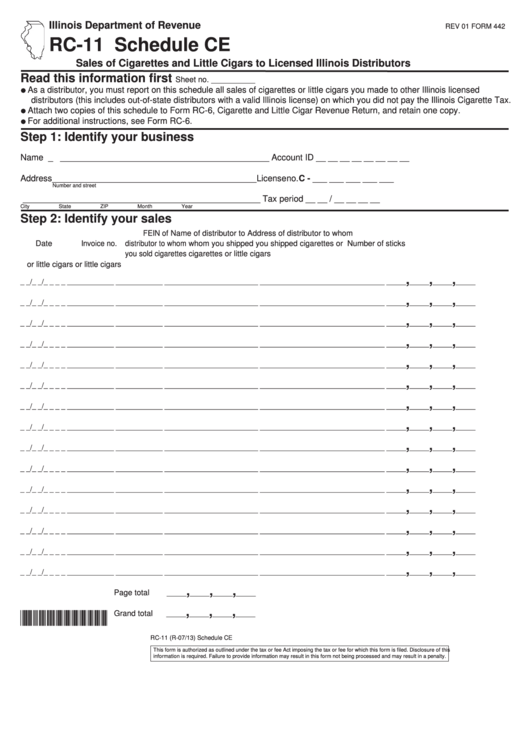

Illinois Department of Revenue

REV 01 FORM 442

RC-11

Schedule CE

Sales of Cigarettes and Little Cigars to Licensed Illinois Distributors

Read this information first

Sheet no. __________

As a distributor, you must report on this schedule all sales of cigarettes or little cigars you made to other Illinois licensed

distributors (this includes out-of-state distributors with a valid Illinois license) on which you did not pay the Illinois Cigarette Tax.

Attach two copies of this schedule to Form RC-6, Cigarette and Little Cigar Revenue Return, and retain one copy.

For additional instructions, see Form RC-6.

Step 1: Identify your business

Name _ ____________________________________________

Account ID __ __ __ __ __ __ __ __

Address ___________________________________________

License no. C - ___ ___ ___ ___ ___

Number and street

__________________________________________________ Tax period __ __ / __ __ __ __

City

State

ZIP

Month

Year

Step 2: Identify your sales

FEIN of

Name of distributor to

Address of distributor to whom

Date

Invoice no.

distributor to whom

whom you shipped

you shipped cigarettes or

Number of sticks

you sold cigarettes

cigarettes or

little cigars

or little cigars

or little cigars

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

____________

____________

________________________

________________________________

_____

_____

_____

_____

,

,

,

Page total

_____

_____

_____

_____

,

,

,

*344211110*

Grand total

_____

_____

_____

_____

RC-11 (R-07/13) Schedule CE

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

1

1