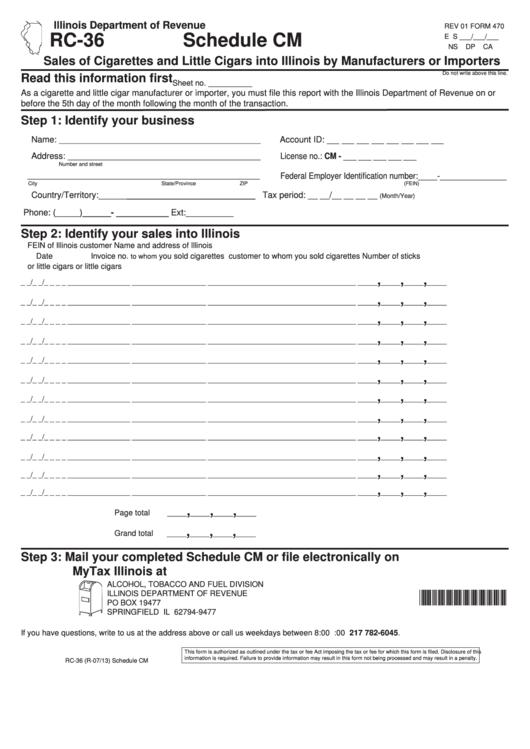

Illinois Department of Revenue

REV 01 FORM 470

RC-36

Schedule CM

E S ___/___/___

NS

DP

CA

Sales of Cigarettes and Little Cigars into Illinois by Manufacturers or Importers

Do not write above this line.

Read this information first

Sheet no. __________

As a cigarette and little cigar manufacturer or importer, you must file this report with the Illinois Department of Revenue on or

before the 5th day of the month following the month of the transaction.

Step 1: Identify your business

Name:

Account ID: __ __ __ __ __ __ __ __

______________________________________________

Address:

License no.: CM - ___ ___ ___ ___ ___

____________________________________________

Number and street

Federal Employer Identification number:____-______________

_____________________________________________________

City

State/Province

ZIP

(FEIN)

Country/Territory:_________________________________

Tax period: __ __/__ __ __ __

(Month/Year)

Phone: (_____)______- ___________ Ext:__________

_________

Step 2: Identify your sales into Illinois

FEIN of Illinois customer

Name and address of Illinois

Date

Invoice no.

you sold cigarettes

customer to whom you sold cigarettes

Number of sticks

to whom

or little cigars

or little cigars

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

Page total

_____

_____

_____

_____

,

,

,

Grand total

_____

_____

_____

_____

Step 3: Mail your completed Schedule CM or file electronically on

MyTax Illinois at tax.illinois.gov

ALCOHOL, TOBACCO AND FUEL DIVISION

*347011110*

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19477

SPRINGFIELD IL 62794-9477

If you have questions, write to us at the address above or call us weekdays between 8:00 a.m. and 4:00 p.m. at 217 782-6045.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

RC-36 (R-07/13) Schedule CM

1

1