Schedule Bpt-E - Family Limited Liability Entity Election Form - 2012

ADVERTISEMENT

SCHEDULE

XX0006BE

BUSINESS PRIVILEGE

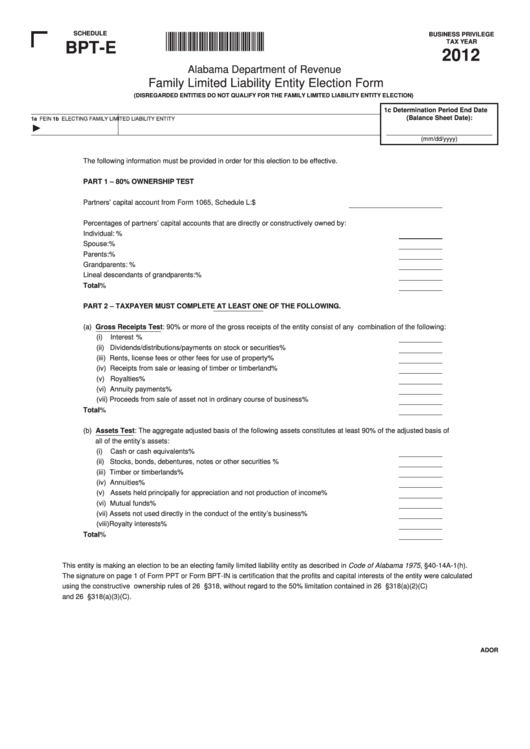

BPT-E

TAX YEAR

2012

Alabama Department of Revenue

Family Limited Liability Entity Election Form

(DISREGARDED ENTITIES DO NOT QUALIFY FOR THE FAMILY LIMITED LIABILITY ENTITY ELECTION)

1c Determination Period End Date

(Balance Sheet Date):

1a FEIN

1b ELECTING FAMILY LIMITED LIABILITY ENTITY

(mm/dd/yyyy)

The following information must be provided in order for this election to be effective.

PART 1 – 80% OWNERSHIP TEST

Partners’ capital account from Form 1065, Schedule L: . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Percentages of partners’ capital accounts that are directly or constructively owned by:

Individual: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Spouse:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Parents:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Grandparents: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Lineal descendants of grandparents:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

PART 2 – TAXPAYER MUST COMPLETE AT LEAST ONE OF THE FOLLOWING.

(a) Gross Receipts Test: 90% or more of the gross receipts of the entity consist of any combination of the following:

(i)

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(ii) Dividends/distributions/payments on stock or securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(iii) Rents, license fees or other fees for use of property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(iv) Receipts from sale or leasing of timber or timberland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(v) Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(vi) Annuity payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(vii) Proceeds from sale of asset not in ordinary course of business . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(b) Assets Test: The aggregate adjusted basis of the following assets constitutes at least 90% of the adjusted basis of

all of the entity’s assets:

(i)

Cash or cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(ii) Stocks, bonds, debentures, notes or other securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(iii) Timber or timberlands . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(iv) Annuities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(v) Assets held principally for appreciation and not production of income . . . . . . . . . . . . . . . . . . . . . . .

%

(vi) Mutual funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(vii) Assets not used directly in the conduct of the entity’s business . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(viii) Royalty interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

This entity is making an election to be an electing family limited liability entity as described in Code of Alabama 1975, §40-14A-1(h).

The signature on page 1 of Form PPT or Form BPT-IN is certification that the profits and capital interests of the entity were calculated

using the constructive ownership rules of 26 U.S.C. §318, without regard to the 50% limitation contained in 26 U.S.C. §318(a)(2)(C)

and 26 U.S.C. §318(a)(3)(C).

ADOR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1