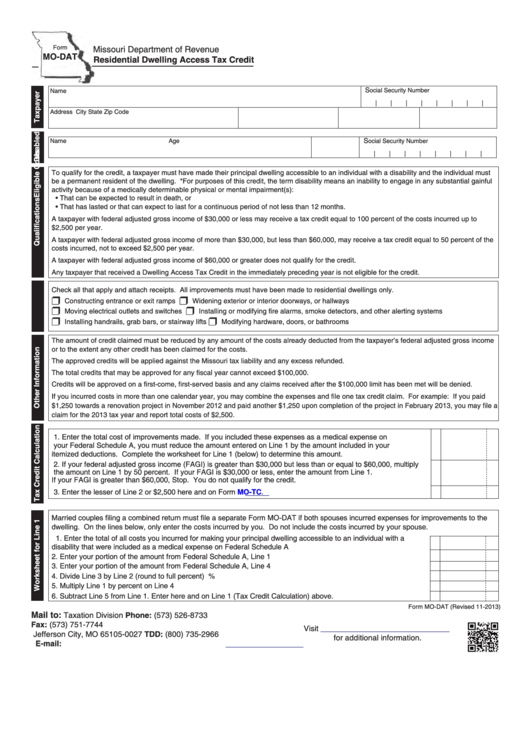

Form

Missouri Department of Revenue

MO-DAT

Residential Dwelling Access Tax Credit

S

ocial Security Number

Name

|

|

|

|

|

|

|

|

Address

City

State

Zip Code

S

Name

Age

ocial Security Number

|

|

|

|

|

|

|

|

To qualify for the credit, a taxpayer must have made their principal dwelling accessible to an individual with a disability and the individual must

be a permanent resident of the dwelling. *For purposes of this credit, the term disability means an inability to engage in any substantial gainful

activity because of a medically determinable physical or mental impairment(s):

• That can be expected to result in death, or

• That has lasted or that can expect to last for a continuous period of not less than 12 months.

A taxpayer with federal adjusted gross income of $30,000 or less may receive a tax credit equal to 100 percent of the costs incurred up to

$2,500 per year.

A taxpayer with federal adjusted gross income of more than $30,000, but less than $60,000, may receive a tax credit equal to 50 percent of the

costs incurred, not to exceed $2,500 per year.

A taxpayer with federal adjusted gross income of $60,000 or greater does not qualify for the credit.

Any taxpayer that received a Dwelling Access Tax Credit in the immediately preceding year is not eligible for the credit.

Check all that apply and attach receipts. All improvements must have been made to residential dwellings only.

r

r

Constructing entrance or exit ramps

Widening exterior or interior doorways, or hallways

r

r

Moving electrical outlets and switches

Installing or modifying fire alarms, smoke detectors, and other alerting systems

r

r

Installing handrails, grab bars, or stairway lifts

Modifying hardware, doors, or bathrooms

The amount of credit claimed must be reduced by any amount of the costs already deducted from the taxpayer’s federal adjusted gross income

or to the extent any other credit has been claimed for the costs.

The approved credits will be applied against the Missouri tax liability and any excess refunded.

The total credits that may be approved for any fiscal year cannot exceed $100,000.

Credits will be approved on a first-come, first-served basis and any claims received after the $100,000 limit has been met will be denied.

If you incurred costs in more than one calendar year, you may combine the expenses and file one tax credit claim. For example: If you paid

$1,250 towards a renovation project in November 2012 and paid another $1,250 upon completion of the project in February 2013, you may file a

claim for the 2013 tax year and report total costs of $2,500.

1. Enter the total cost of improvements made. If you included these expenses as a medical expense on

your Federal Schedule A, you must reduce the amount entered on Line 1 by the amount included in your

itemized deductions. Complete the worksheet for Line 1 (below) to determine this amount. ............................... 1

00

2. If your federal adjusted gross income (FAGI) is greater than $30,000 but less than or equal to $60,000, multiply

the amount on Line 1 by 50 percent. If your FAGI is $30,000 or less, enter the amount from Line 1.

If your FAGI is greater than $60,000, Stop. You do not qualify for the credit. ...................................................... 2

00

3. Enter the lesser of Line 2 or $2,500 here and on Form MO-TC. ............................................................................ 3

00

Married couples filing a combined return must file a separate Form MO-DAT if both spouses incurred expenses for improvements to the

dwelling. On the lines below, only enter the costs incurred by you. Do not include the costs incurred by your spouse.

1. Enter the total of all costs you incurred for making your principal dwelling accessible to an individual with a

disability that were included as a medical expense on Federal Schedule A ......................................................... 1

00

2. Enter your portion of the amount from Federal Schedule A, Line 1 ....................................................................... 2

00

3. Enter your portion of the amount from Federal Schedule A, Line 4 ....................................................................... 3

00

4. Divide Line 3 by Line 2 (round to full percent) ....................................................................................................... 4

%

5. Multiply Line 1 by percent on Line 4 ..................................................................................................................... 5

00

6. Subtract Line 5 from Line 1. Enter here and on Line 1 (Tax Credit Calculation) above. ...................................... 6

00

Form MO-DAT (Revised 11-2013)

Mail to:

Phone: (573) 526-8733

Taxation Division

Fax: (573) 751-7744

P.O. Box 27

Visit

TDD: (800) 735-2966

Jefferson City, MO 65105-0027

for additional information.

E-mail:

income@dor.mo.gov

1

1