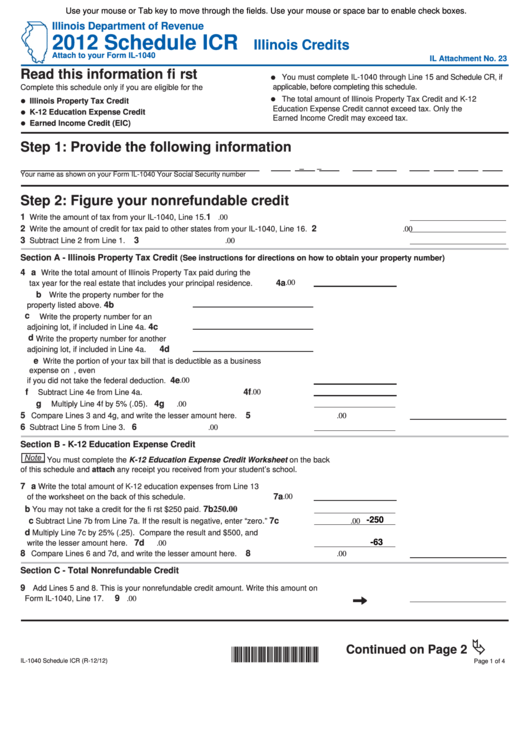

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2012 Schedule ICR

Illinois Credits

Attach to your Form IL-1040

IL Attachment No. 23

Read this information fi rst

You must complete IL-1040 through Line 15 and Schedule CR, if

applicable, before completing this schedule.

Complete this schedule only if you are eligible for the

The total amount of Illinois Property Tax Credit and K-12

Illinois Property Tax Credit

Education Expense Credit cannot exceed tax. Only the

K-12 Education Expense Credit

Earned Income Credit may exceed tax.

Earned Income Credit (EIC)

Step 1: Provide the following information

–

–

Your name as shown on your Form IL-1040

Your Social Security number

Step 2: Figure your nonrefundable credit

1

1

Write the amount of tax from your IL-1040, Line 15.

.00

2

2

Write the amount of credit for tax paid to other states from your IL-1040, Line 16.

.00

3

3

Subtract Line 2 from Line 1.

.00

Section A - Illinois Property Tax Credit

(See instructions for directions on how to obtain your property number)

4 a

Write the total amount of Illinois Property Tax paid during the

4a

.00

tax year for the real estate that includes your principal residence.

b

Write the property number for the

4b

property listed above.

c

Write the property number for an

4c

adjoining lot, if included in Line 4a.

d

Write the property number for another

4d

adjoining lot, if included in Line 4a.

e

Write the portion of your tax bill that is deductible as a business

expense on U.S. income tax forms or schedules, even

4e

.00

if you did not take the federal deduction.

f

4f

.00

Subtract Line 4e from Line 4a.

g

4g

Multiply Line 4f by 5% (.05).

.00

5

5

Compare Lines 3 and 4g, and write the lesser amount here.

.00

6

6

Subtract Line 5 from Line 3.

.00

Section B - K-12 Education Expense Credit

You must complete the K-12 Education Expense Credit Worksheet on the back

of this schedule and attach any receipt you received from your student’s school.

7 a

Write the total amount of K-12 education expenses from Line 13

7a

.00

of the worksheet on the back of this schedule.

b

7b

250.00

You may not take a credit for the fi rst $250 paid.

-250

c

7c

Subtract Line 7b from Line 7a. If the result is negative, enter “zero.”

.00

d

Multiply Line 7c by 25% (.25). Compare the result and $500, and

-63

7d

write the lesser amount here.

.00

8

8

Compare Lines 6 and 7d, and write the lesser amount here.

.00

Section C - Total Nonrefundable Credit

9

Add Lines 5 and 8. This is your nonrefundable credit amount. Write this amount on

9

Form IL-1040, Line 17.

.00

Continued on Page 2

*260501110*

IL-1040 Schedule ICR (R-12/12)

Page 1 of 4

1

1 2

2 3

3 4

4