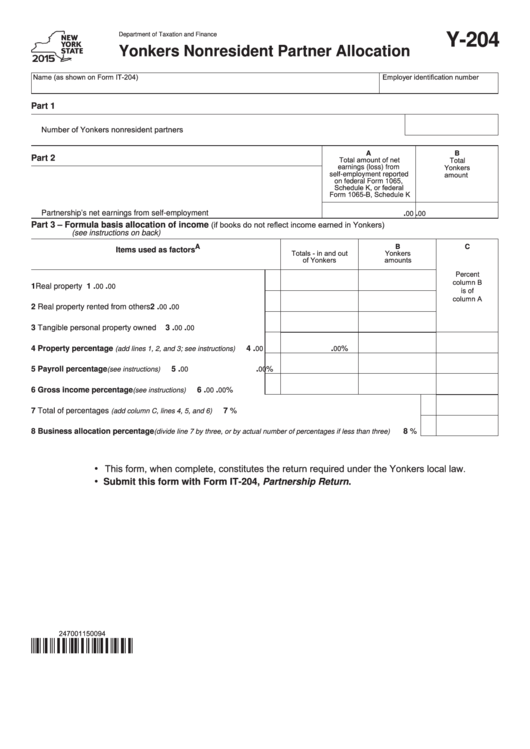

Department of Taxation and Finance

Y-204

Yonkers Nonresident Partner Allocation

Name (as shown on Form IT-204)

Employer identification number

Part 1

Number of Yonkers nonresident partners .....................................................................................................

A

B

Part 2

Total amount of net

Total

Yonkers

earnings (loss) from

amount

self-employment reported

on federal Form 1065,

Schedule K, or federal

Form 1065-B, Schedule K

Partnership’s net earnings from self-employment ..................................................

.

.

00

00

(if books do not reflect income earned in Yonkers)

Part 3 – Formula basis allocation of income

(see instructions on back)

A

B

C

Items used as factors

Totals - in and out

Yonkers

of Yonkers

amounts

Percent

column B

.

.

1 Real property owned....................................................................

1

00

00

is of

column A

.

.

2 Real property rented from others .................................................

2

00

00

3 Tangible personal property owned ...............................................

.

.

3

00

00

.

.

4 Property percentage

.........

4

%

(add lines 1, 2, and 3; see instructions)

00

00

.

.

5 Payroll percentage

...........................................

5

%

(see instructions)

00

00

.

.

6 Gross income percentage

...............................

6

%

(see instructions)

00

00

7 Total of percentages

.............................................................................................

7

%

(add column C, lines 4, 5, and 6)

8 Business allocation percentage

.........

8

%

(divide line 7 by three, or by actual number of percentages if less than three)

This form, when complete, constitutes the return required under the Yonkers local law.

•

•

Submit this form with Form IT-204, Partnership Return.

247001150094

1

1 2

2