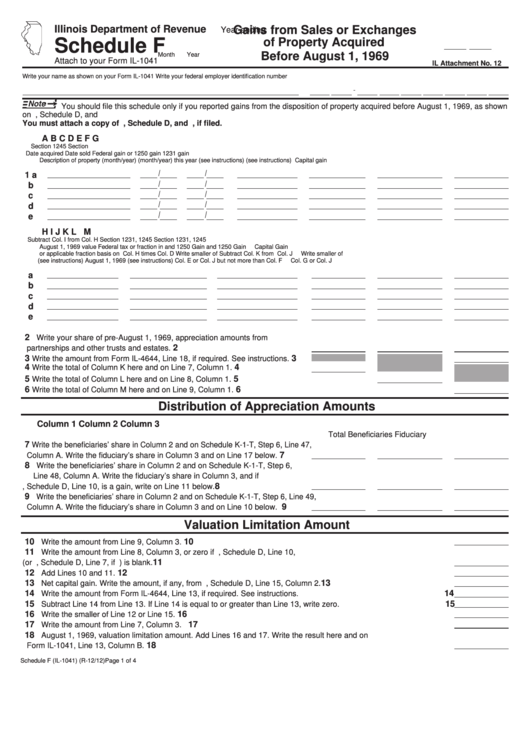

Schedule F - Attach To Your Form Il-1041 - Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969

ADVERTISEMENT

Illinois Department of Revenue

Gains from Sales or Exchanges

Year ending

Schedule F

of Property Acquired

Before August 1, 1969

Month

Year

Attach to your Form IL-1041

IL Attachment No. 12

Write your name as shown on your Form IL-1041

Write your federal employer identification number

You should file this schedule only if you reported gains from the disposition of property acquired before August 1, 1969, as shown

on U.S. Form 1041, Schedule D, and U.S. Form 4797 or U.S. Form 6252. See instructions.

You must attach a copy of U.S. Form 1041, Schedule D, and U.S. Form 4797 or 6252, if filed.

A

B

C

D

E

F

G

Section 1245

Section

Date acquired

Date sold

Federal gain

or 1250 gain

1231 gain

Description of property

(month/year)

(month/year)

this year

(see instructions)

(see instructions)

Capital gain

1 a

b

c

d

e

H

I

J

K

L

M

Subtract Col. I from Col. H

Section 1231, 1245

Section 1231, 1245

August 1, 1969 value

Federal tax

or fraction in

and 1250 Gain

and 1250 Gain

Capital Gain

or applicable fraction

basis on

Col. H times Col. D

Write smaller of

Subtract Col. K from Col. J

Write smaller of

(see instructions)

August 1, 1969

(see instructions)

Col. E or Col. J

but not more than Col. F

Col. G or Col. J

a

b

c

d

e

2

Write your share of pre-August 1, 1969, appreciation amounts from

2

partnerships and other trusts and estates.

3

3

Write the amount from Form IL-4644, Line 18, if required. See instructions.

4

4

Write the total of Column K here and on Line 7, Column 1.

5

5

Write the total of Column L here and on Line 8, Column 1.

6

6

Write the total of Column M here and on Line 9, Column 1.

Distribution of Appreciation Amounts

Column 1

Column 2

Column 3

Total

Beneficiaries

Fiduciary

7

Write the beneficiaries’ share in Column 2 and on Schedule K-1-T, Step 6, Line 47,

7

Column A. Write the fiduciary’s share in Column 3 and on Line 17 below.

8

Write the beneficiaries’ share in Column 2 and on Schedule K-1-T, Step 6,

Line 48, Column A. Write the fiduciary’s share in Column 3, and if

8

U.S. Form 1041, Schedule D, Line 10, is a gain, write on Line 11 below.

9

Write the beneficiaries’ share in Column 2 and on Schedule K-1-T, Step 6, Line 49,

9

Column A. Write the fiduciary’s share in Column 3 and on Line 10 below.

Valuation Limitation Amount

10

10

Write the amount from Line 9, Column 3.

11

Write the amount from Line 8, Column 3, or zero if U.S. Form 1041, Schedule D, Line 10,

11

(or U.S. Form 1041, Schedule D, Line 7, if U.S. Form 6252 is used) is blank.

12

12

Add Lines 10 and 11.

13

13

Net capital gain. Write the amount, if any, from U.S. Form 1041, Schedule D, Line 15, Column 2.

14

14

Write the amount from Form IL-4644, Line 13, if required. See instructions.

15

15

Subtract Line 14 from Line 13. If Line 14 is equal to or greater than Line 13, write zero.

16

16

Write the smaller of Line 12 or Line 15.

17

17

Write the amount from Line 7, Column 3.

18

August 1, 1969, valuation limitation amount. Add Lines 16 and 17. Write the result here and on

18

Form IL-1041, Line 13, Column B.

Schedule F (IL-1041) (R-12/12)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4