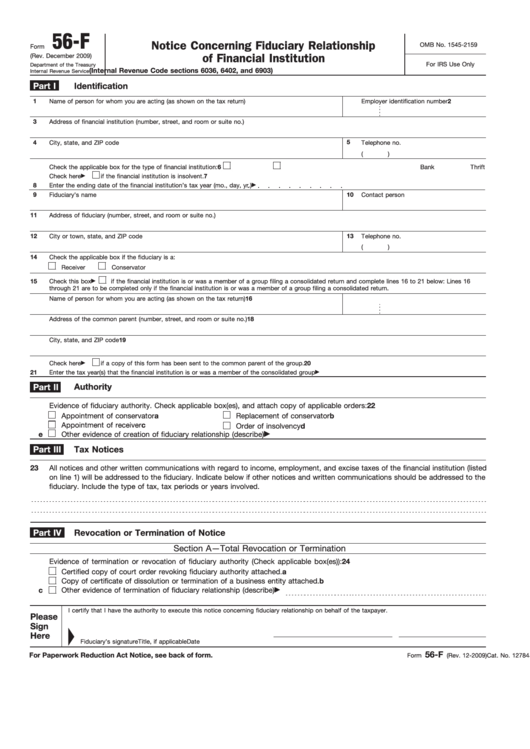

56-F

Notice Concerning Fiduciary Relationship

OMB No. 1545-2159

Form

(Rev. December 2009)

of Financial Institution

For IRS Use Only

Department of the Treasury

(Internal Revenue Code sections 6036, 6402, and 6903)

Internal Revenue Service

Part I

Identification

1

Name of person for whom you are acting (as shown on the tax return)

2

Employer identification number

3

Address of financial institution (number, street, and room or suite no.)

5

4

City, state, and ZIP code

Telephone no.

(

)

6

Check the applicable box for the type of financial institution:

Bank

Thrift

7

Check here

if the financial institution is insolvent.

8

Enter the ending date of the financial institution’s tax year (mo., day, yr.)

9

Fiduciary’s name

10

Contact person

11

Address of fiduciary (number, street, and room or suite no.)

12

City or town, state, and ZIP code

13

Telephone no.

(

)

14

Check the applicable box if the fiduciary is a:

Receiver

Conservator

15

Check this box

if the financial institution is or was a member of a group filing a consolidated return and complete lines 16 to 21 below: Lines 16

through 21 are to be completed only if the financial institution is or was a member of a group filing a consolidated return.

16

Name of person for whom you are acting (as shown on the tax return)

17

Employer identification number

18

Address of the common parent (number, street, and room or suite no.)

19

City, state, and ZIP code

20

Check here

if a copy of this form has been sent to the common parent of the group.

21

Enter the tax year(s) that the financial institution is or was a member of the consolidated group

Authority

Part II

22

Evidence of fiduciary authority. Check applicable box(es), and attach copy of applicable orders:

a

Appointment of conservator

b

Replacement of conservator

c

Appointment of receiver

d

Order of insolvency

e

Other evidence of creation of fiduciary relationship (describe)

Part III

Tax Notices

23

All notices and other written communications with regard to income, employment, and excise taxes of the financial institution (listed

on line 1) will be addressed to the fiduciary. Indicate below if other notices and written communications should be addressed to the

fiduciary. Include the type of tax, tax periods or years involved.

Part IV

Revocation or Termination of Notice

Section A—Total Revocation or Termination

24

Evidence of termination or revocation of fiduciary authority (Check applicable box(es)):

a

Certified copy of court order revoking fiduciary authority attached.

b

Copy of certificate of dissolution or termination of a business entity attached.

c

Other evidence of termination of fiduciary relationship (describe)

I certify that I have the authority to execute this notice concerning fiduciary relationship on behalf of the taxpayer.

Please

Sign

Here

Fiduciary’s signature

Title, if applicable

Date

56-F

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 12784J

Form

(Rev. 12-2009)

1

1 2

2