Vermont Corporate Income Tax Return (Co-411) Instructions

ADVERTISEMENT

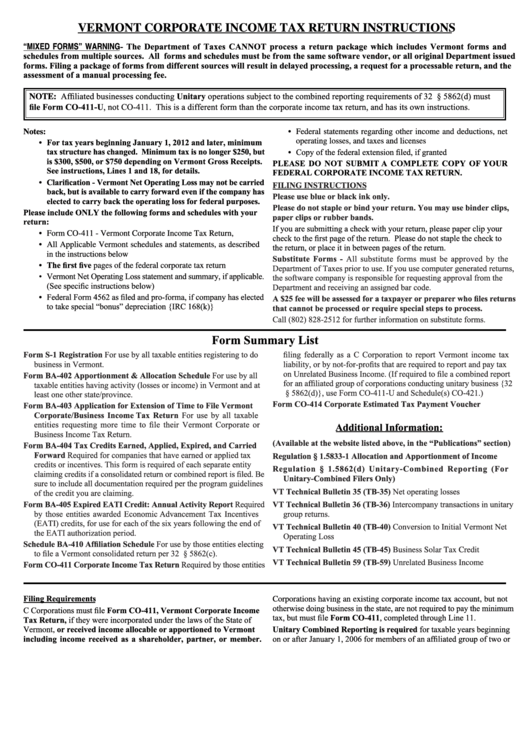

VERMONT CORPORATE INCOME TAX RETURN INSTRUCTIONS

“MIXED FORMS” WARNING - The Department of Taxes CANNOT process a return package which includes Vermont forms and

schedules from multiple sources. All forms and schedules must be from the same software vendor, or all original Department issued

forms. Filing a package of forms from different sources will result in delayed processing, a request for a processable return, and the

assessment of a manual processing fee.

NOTE: Affiliated businesses conducting Unitary operations subject to the combined reporting requirements of 32 V.S.A. § 5862(d) must

file Form CO-411-U, not CO-411. This is a different form than the corporate income tax return, and has its own instructions.

• Federal statements regarding other income and deductions, net

Notes:

• For tax years beginning January 1, 2012 and later, minimum

operating losses, and taxes and licenses

tax structure has changed. Minimum tax is no longer $250, but

• Copy of the federal extension filed, if granted

is $300, $500, or $750 depending on Vermont Gross Receipts.

PLEASE DO NOT SUBMIT A COMPLETE COPY OF YOUR

See instructions, Lines 1 and 18, for details.

FEDERAL CORPORATE INCOME TAX RETURN.

• Clarification - Vermont Net Operating Loss may not be carried

FILING INSTRUCTIONS

back, but is available to carry forward even if the company has

Please use blue or black ink only.

elected to carry back the operating loss for federal purposes.

Please do not staple or bind your return. You may use binder clips,

Please include ONLY the following forms and schedules with your

paper clips or rubber bands.

return:

If you are submitting a check with your return, please paper clip your

• Form CO-411 - Vermont Corporate Income Tax Return,

check to the first page of the return. Please do not staple the check to

• All Applicable Vermont schedules and statements, as described

the return, or place it in between pages of the return.

in the instructions below

Substitute Forms - All substitute forms must be approved by the

• The first five pages of the federal corporate tax return

Department of Taxes prior to use. If you use computer generated returns,

• Vermont Net Operating Loss statement and summary, if applicable.

the software company is responsible for requesting approval from the

(See specific instructions below)

Department and receiving an assigned bar code.

• Federal Form 4562 as filed and pro-forma, if company has elected

A $25 fee will be assessed for a taxpayer or preparer who files returns

to take special “bonus” depreciation {IRC 168(k)}

that cannot be processed or require special steps to process.

Call (802) 828-2512 for further information on substitute forms.

Form Summary List

Form S-1 Registration For use by all taxable entities registering to do

filing federally as a C Corporation to report Vermont income tax

business in Vermont.

liability, or by not-for-profits that are required to report and pay tax

on Unrelated Business Income. (If required to file a combined report

Form BA-402 Apportionment & Allocation Schedule For use by all

for an affiliated group of corporations conducting unitary business {32

taxable entities having activity (losses or income) in Vermont and at

V.S.A. § 5862(d)}, use Form CO-411-U and Schedule(s) CO-421.)

least one other state/province.

Form CO-414 Corporate Estimated Tax Payment Voucher

Form BA-403 Application for Extension of Time to File Vermont

Corporate/Business Income Tax Return For use by all taxable

entities requesting more time to file their Vermont Corporate or

Additional Information:

Business Income Tax Return.

(Available at the website listed above, in the “Publications” section)

Form BA-404 Tax Credits Earned, Applied, Expired, and Carried

Forward Required for companies that have earned or applied tax

Regulation § 1.5833-1 Allocation and Apportionment of Income

credits or incentives. This form is required of each separate entity

Regulation § 1.5862(d) Unitary-Combined Reporting (For

claiming credits if a consolidated return or combined report is filed. Be

Unitary-Combined Filers Only)

sure to include all documentation required per the program guidelines

VT Technical Bulletin 35 (TB-35) Net operating losses

of the credit you are claiming.

Form BA-405 Expired EATI Credit: Annual Activity Report Required

VT Technical Bulletin 36 (TB-36) Intercompany transactions in unitary

by those entities awarded Economic Advancement Tax Incentives

group returns.

(EATI) credits, for use for each of the six years following the end of

VT Technical Bulletin 40 (TB-40) Conversion to Initial Vermont Net

the EATI authorization period.

Operating Loss

Schedule BA-410 Affiliation Schedule For use by those entities electing

VT Technical Bulletin 45 (TB-45) Business Solar Tax Credit

to file a Vermont consolidated return per 32 V.S.A. § 5862(c).

VT Technical Bulletin 59 (TB-59) Unrelated Business Income

Form CO-411 Corporate Income Tax Return Required by those entities

Filing Requirements

Corporations having an existing corporate income tax account, but not

otherwise doing business in the state, are not required to pay the minimum

C Corporations must file Form CO-411, Vermont Corporate Income

tax, but must file Form CO-411, completed through Line 11.

Tax Return, if they were incorporated under the laws of the State of

Vermont, or received income allocable or apportioned to Vermont

Unitary Combined Reporting is required for taxable years beginning

including income received as a shareholder, partner, or member.

on or after January 1, 2006 for members of an affiliated group of two or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5