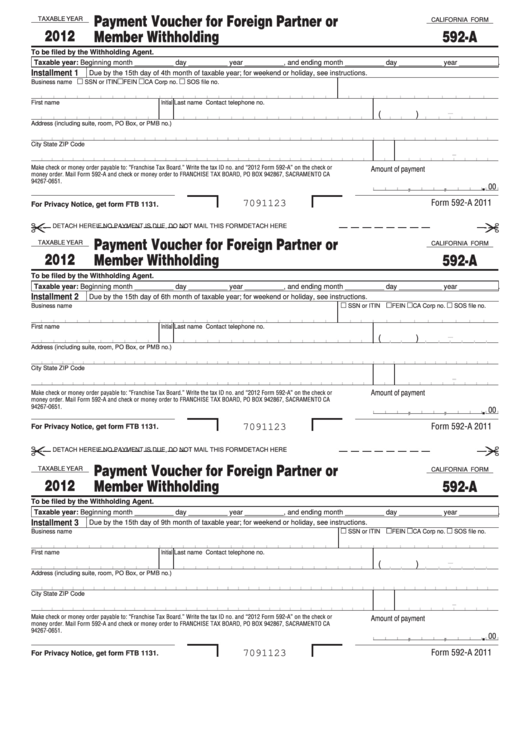

Payment Voucher for Foreign Partner or

TAXABLE YEAR

CALIFORNIA FORM

2012

Member Withholding

592-A

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 1

Due by the 15th day of 4th month of taxable year; for weekend or holiday, see instructions.

FEIN

CA Corp no.

Business name

SSN or ITIN

SOS file no.

First name

Initial Last name

Contact telephone no.

(

)

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Make check or money order payable to: “Franchise Tax Board.” Write the tax ID no. and “2012 Form 592-A” on the check or

Amount of payment

money order. Mail Form 592-A and check or money order to FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA

94267-0651.

.

00

,

,

Form 592-A 2011

7091123

For Privacy Notice, get form FTB 1131.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

Payment Voucher for Foreign Partner or

TAXABLE YEAR

CALIFORNIA FORM

2012

Member Withholding

592-A

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 2

Due by the 15th day of 6th month of taxable year; for weekend or holiday, see instructions.

FEIN

CA Corp no.

Business name

SSN or ITIN

SOS file no.

First name

Initial Last name

Contact telephone no.

(

)

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Make check or money order payable to: “Franchise Tax Board.” Write the tax ID no. and “2012 Form 592-A” on the check or

Amount of payment

money order. Mail Form 592-A and check or money order to FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA

94267-0651.

.

00

,

,

Form 592-A 2011

7091123

For Privacy Notice, get form FTB 1131.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

Payment Voucher for Foreign Partner or

TAXABLE YEAR

CALIFORNIA FORM

2012

Member Withholding

592-A

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 3

Due by the 15th day of 9th month of taxable year; for weekend or holiday, see instructions.

FEIN

CA Corp no.

Business name

SSN or ITIN

SOS file no.

First name

Initial Last name

Contact telephone no.

(

)

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Make check or money order payable to: “Franchise Tax Board.” Write the tax ID no. and “2012 Form 592-A” on the check or

Amount of payment

money order. Mail Form 592-A and check or money order to FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA

94267-0651.

.

00

,

,

Form 592-A 2011

7091123

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4