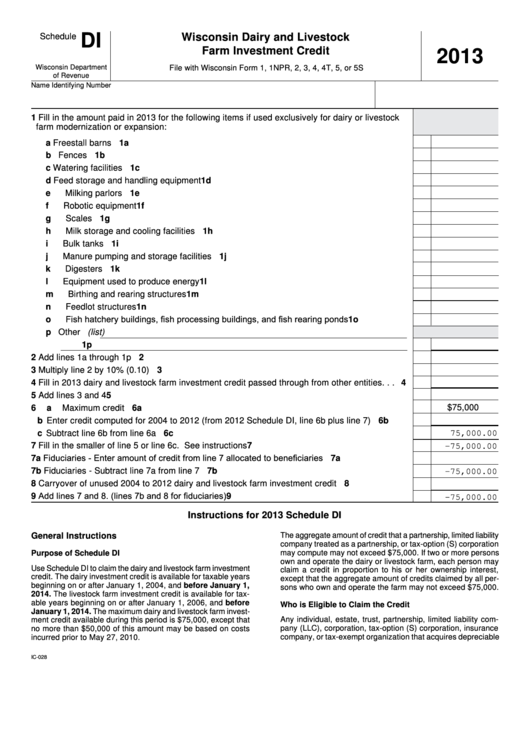

DI

Wisconsin Dairy and Livestock

Schedule

Farm Investment Credit

2013

Wisconsin Department

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5, or 5S

of Revenue

Name

Identifying Number

1

Fill in the amount paid in 2013 for the following items if used exclusively for dairy or livestock

farm modernization or expansion:

a Freestall barns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

b Fences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

c Watering facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

d Feed storage and handling equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1d

e Milking parlors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1e

f

Robotic equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1f

g Scales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1g

h Milk storage and cooling facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1h

i

Bulk tanks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1i

j

Manure pumping and storage facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1j

k Digesters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1k

l

Equipment used to produce energy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1l

m Birthing and rearing structures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1m

n Feedlot structures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1n

o Fish hatchery buildings, fish processing buildings, and fish rearing ponds . . . . . . . . . . . .

1o

p Other (list)

1p

2

Add lines 1a through 1p . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Multiply line 2 by 10% (0.10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Fill in 2013 dairy and livestock farm investment credit passed through from other entities . . .

4

5

Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

$75,000

6

a Maximum credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

b Enter credit computed for 2004 to 2012 (from 2012 Schedule DI, line 6b plus line 7) . . . .

6b

c Subtract line 6b from line 6a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6c

75,000.00

7

Fill in the smaller of line 5 or line 6c. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

-75,000.00

7a Fiduciaries - Enter amount of credit from line 7 allocated to beneficiaries . . . . . . . . . . . . . . .

7a

7b Fiduciaries - Subtract line 7a from line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

-75,000.00

8

Carryover of unused 2004 to 2012 dairy and livestock farm investment credit . . . . . . . . . . . .

8

Add lines 7 and 8. (lines 7b and 8 for fiduciaries) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

-75,000.00

Instructions for 2013 Schedule DI

General Instructions

The aggregate amount of credit that a partnership, limited liability

company treated as a partnership, or tax-option (S) corporation

may compute may not exceed $75,000. If two or more persons

Purpose of Schedule DI

own and operate the dairy or livestock farm, each person may

Use Schedule DI to claim the dairy and livestock farm investment

claim a credit in proportion to his or her ownership interest,

credit. The dairy investment credit is available for taxable years

except that the aggregate amount of credits claimed by all per-

beginning on or after January 1, 2004, and before January 1,

sons who own and operate the farm may not exceed $75,000.

2014. The livestock farm investment credit is available for tax-

able years beginning on or after January 1, 2006, and before

Who is Eligible to Claim the Credit

January 1, 2014. The maximum dairy and livestock farm invest-

Any individual, estate, trust, partnership, limited liability com-

ment credit available during this period is $75,000, except that

pany (LLC), corporation, tax-option (S) corporation, insurance

no more than $50,000 of this amount may be based on costs

company, or tax-exempt organization that acquires depreciable

incurred prior to May 27, 2010.

IC-028

1

1 2

2