Vermont Nonprofit Income Tax Return Instructions

ADVERTISEMENT

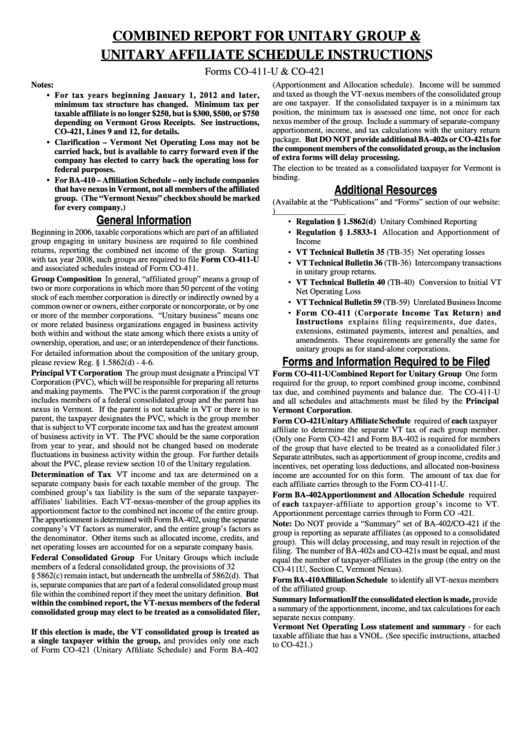

Combined RepoRt foR UnitaRy GRoUp &

UnitaRy affiliate SChedUle inStRUCtionS

Forms CO-411-U & CO-421

notes:

(Apportionment and Allocation schedule). Income will be summed

• for tax years beginning January 1, 2012 and later,

and taxed as though the VT-nexus members of the consolidated group

are one taxpayer. If the consolidated taxpayer is in a minimum tax

minimum tax structure has changed. minimum tax per

position, the minimum tax is assessed one time, not once for each

taxable affiliate is no longer $250, but is $300, $500, or $750

nexus member of the group. Include a summary of separate-company

depending on Vermont Gross Receipts. See instructions,

apportionment, income, and tax calculations with the unitary return

Co-421, lines 9 and 12, for details.

package. but do not provide additional ba-402s or Co-421s for

• Clarification – Vermont net operating loss may not be

the component members of the consolidated group, as the inclusion

carried back, but is available to carry forward even if the

of extra forms will delay processing.

company has elected to carry back the operating loss for

The election to be treated as a consolidated taxpayer for Vermont is

federal purposes.

• for ba-410 – affiliation Schedule – only include companies

binding.

Additional Resources

that have nexus in Vermont, not all members of the affiliated

group. (the “Vermont nexus” checkbox should be marked

(Available at the “Publications” and “Forms” section of our website:

for every company.)

)

General Information

• Regulation § 1.5862(d) Unitary Combined Reporting

• Regulation § 1.5833-1 Allocation and Apportionment of

Beginning in 2006, taxable corporations which are part of an affiliated

group engaging in unitary business are required to file combined

Income

• Vt technical bulletin 35 (TB-35) Net operating losses

returns, reporting the combined net income of the group. Starting

with tax year 2008, such groups are required to file form Co-411-U

• Vt technical bulletin 36 (TB-36) Intercompany transactions

and associated schedules instead of Form CO-411.

in unitary group returns.

Group Composition In general, “affiliated group” means a group of

• Vt technical bulletin 40 (TB-40) Conversion to Initial VT

two or more corporations in which more than 50 percent of the voting

Net Operating Loss

stock of each member corporation is directly or indirectly owned by a

• Vt technical bulletin 59 (TB-59) Unrelated Business Income

common owner or owners, either corporate or noncorporate, or by one

• form Co-411 (Corporate income tax Return) and

or more of the member corporations. “Unitary business” means one

instructions explains filing requirements, due dates,

or more related business organizations engaged in business activity

extensions, estimated payments, interest and penalties, and

both within and without the state among which there exists a unity of

amendments. These requirements are generally the same for

ownership, operation, and use; or an interdependence of their functions.

unitary groups as for stand-alone corporations.

For detailed information about the composition of the unitary group,

Forms and Information Required to be Filed

please review Reg. § 1.5862(d) - 4-6.

principal Vt Corporation The group must designate a Principal VT

form Co-411-U Combined Report for Unitary Group One form

Corporation (PVC), which will be responsible for preparing all returns

required for the group, to report combined group income, combined

and making payments. The PVC is the parent corporation if the group

tax due, and combined payments and balance due. The CO-411-U

includes members of a federal consolidated group and the parent has

and all schedules and attachments must be filed by the principal

nexus in Vermont. If the parent is not taxable in VT or there is no

Vermont Corporation.

parent, the taxpayer designates the PVC, which is the group member

form Co-421 Unitary affiliate Schedule required of each taxpayer

that is subject to VT corporate income tax and has the greatest amount

affiliate to determine the separate VT tax of each group member.

of business activity in VT. The PVC should be the same corporation

(Only one Form CO-421 and Form BA-402 is required for members

from year to year, and should not be changed based on moderate

of the group that have elected to be treated as a consolidated filer.)

fluctuations in business activity within the group. For further details

Separate attributes, such as apportionment of group income, credits and

about the PVC, please review section 10 of the Unitary regulation.

incentives, net operating loss deductions, and allocated non-business

determination of tax VT income and tax are determined on a

income are accounted for on this form. The amount of tax due for

separate company basis for each taxable member of the group. The

each affiliate carries through to the Form CO-411-U.

combined group’s tax liability is the sum of the separate taxpayer-

form ba-402 apportionment and allocation Schedule required

affiliates’ liabilities. Each VT-nexus-member of the group applies its

of each taxpayer-affiliate to apportion group’s income to VT.

apportionment factor to the combined net income of the entire group.

Apportionment percentage carries through to Form CO -421.

The apportionment is determined with Form BA-402, using the separate

note: Do NOT provide a “Summary” set of BA-402/CO-421 if the

company’s VT factors as numerator, and the entire group’s factors as

group is reporting as separate affiliates (as opposed to a consolidated

the denominator. Other items such as allocated income, credits, and

group). This will delay processing, and may result in rejection of the

net operating losses are accounted for on a separate company basis.

filing. The number of BA-402s and CO-421s must be equal, and must

federal Consolidated Group For Unitary Groups which include

equal the number of taxpayer-affiliates in the group (the entry on the

members of a federal consolidated group, the provisions of 32 V.S.A.

CO-411U, Section C, Vermont Nexus).

§ 5862(c) remain intact, but underneath the umbrella of 5862(d). That

form ba-410 affiliation Schedule to identify all VT-nexus members

is, separate companies that are part of a federal consolidated group must

of the affiliated group.

file within the combined report if they meet the unitary definition. but

Summary information if the consolidated election is made, provide

within the combined report, the Vt-nexus members of the federal

a summary of the apportionment, income, and tax calculations for each

consolidated group may elect to be treated as a consolidated filer,

separate nexus company.

i.e. a single taxpayer.

Vermont net operating loss statement and summary - for each

if this election is made, the Vt consolidated group is treated as

taxable affiliate that has a VNOL. (See specific instructions, attached

a single taxpayer within the group, and provides only one each

to CO-421.)

of Form CO-421 (Unitary Affiliate Schedule) and Form BA-402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5