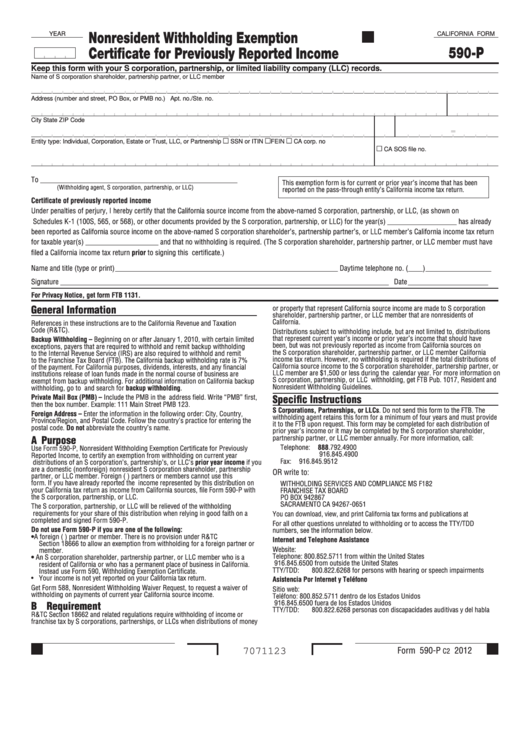

Nonresident Withholding Exemption

YEAR

CALIFORNIA FORM

590-P

Certificate for Previously Reported Income

Keep this form with your S corporation, partnership, or limited liability company (LLC) records.

Name of S corporation shareholder, partnership partner, or LLC member

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

-

m

m

m

Entity type: Individual, Corporation, Estate or Trust, LLC, or Partnership

SSN or ITIN

FEIN

CA corp. no

m

CA SOS file no.

To ______________________________________________________

This exemption form is for current or prior year’s income that has been

(Withholding agent, S corporation, partnership, or LLC)

reported on the pass-through entity’s California income tax return.

Certificate of previously reported income

Under penalties of perjury, I hereby certify that the California source income from the above-named S corporation, partnership, or LLC, (as shown on

Schedules K-1 (100S, 565, or 568), or other documents provided by the S corporation, partnership, or LLC) for the year(s) ___________________ has already

been reported as California source income on the above-named S corporation shareholder’s, partnership partner’s, or LLC member’s California income tax return

for taxable year(s) ____________________ and that no withholding is required. (The S corporation shareholder, partnership partner, or LLC member must have

filed a California income tax return prior to signing this certificate.)

Name and title (type or print) _____________________________________________________________ Daytime telephone no. (____) __________________

Signature __________________________________________________________________________________________

Date ______________________

For Privacy Notice, get form FTB 1131.

General Information

or property that represent California source income are made to S corporation

shareholder, partnership partner, or LLC member that are nonresidents of

California.

References in these instructions are to the California Revenue and Taxation

Code (R&TC).

Distributions subject to withholding include, but are not limited to, distributions

that represent current year’s income or prior year’s income that should have

Backup Withholding – Beginning on or after January 1, 2010, with certain limited

been, but was not previously reported as income from California sources on

exceptions, payers that are required to withhold and remit backup withholding

the S corporation shareholder, partnership partner, or LLC member California

to the Internal Revenue Service (IRS) are also required to withhold and remit

income tax return. However, no withholding is required if the total distributions of

to the Franchise Tax Board (FTB). The California backup withholding rate is 7%

California source income to the S corporation shareholder, partnership partner, or

of the payment. For California purposes, dividends, interests, and any financial

LLC member are $1,500 or less during the calendar year. For more information on

institutions release of loan funds made in the normal course of business are

S corporation, partnership, or LLC withholding, get FTB Pub. 1017, Resident and

exempt from backup withholding. For additional information on California backup

Nonresident Withholding Guidelines.

withholding, go to ftb.ca.gov and search for backup withholding.

Specific Instructions

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first,

then the box number. Example: 111 Main Street PMB 123.

S Corporations, Partnerships, or LLCs. Do not send this form to the FTB. The

Foreign Address – Enter the information in the following order: City, Country,

withholding agent retains this form for a minimum of four years and must provide

Province/Region, and Postal Code. Follow the country’s practice for entering the

it to the FTB upon request. This form may be completed for each distribution of

postal code. Do not abbreviate the country’s name.

prior year’s income or it may be completed by the S corporation shareholder,

partnership partner, or LLC member annually. For more information, call:

A Purpose

Telephone:

888.792.4900

Use Form 590-P, Nonresident Withholding Exemption Certificate for Previously

916.845.4900

Reported Income, to certify an exemption from withholding on current year

Fax:

916.845.9512

distributions of an S corporation’s, partnership’s, or LLC’s prior year income if you

are a domestic (nonforeign) nonresident S corporation shareholder, partnership

OR write to:

partner, or LLC member. Foreign (non-U.S.) partners or members cannot use this

form. If you have already reported the income represented by this distribution on

WITHHOLDING SERVICES AND COMPLIANCE MS F182

your California tax return as income from California sources, file Form 590-P with

FRANCHISE TAX BOARD

the S corporation, partnership, or LLC.

PO BOX 942867

SACRAMENTO CA 94267-0651

The S corporation, partnership, or LLC will be relieved of the withholding

requirements for your share of this distribution when relying in good faith on a

You can download, view, and print California tax forms and publications at ftb.ca.gov.

completed and signed Form 590-P.

For all other questions unrelated to withholding or to access the TTY/TDD

Do not use Form 590-P if you are one of the following:

numbers, see the information below.

• A foreign (non-U.S.) partner or member. There is no provision under R&TC

Internet and Telephone Assistance

Section 18666 to allow an exemption from withholding for a foreign partner or

Website:

ftb.ca.gov

member.

Telephone:

800.852.5711 from within the United States

• An S corporation shareholder, partnership partner, or LLC member who is a

916.845.6500 from outside the United States

resident of California or who has a permanent place of business in California.

TTY/TDD:

800.822.6268 for persons with hearing or speech impairments

Instead use Form 590, Withholding Exemption Certificate.

• Your income is not yet reported on your California tax return.

Asistencia Por Internet y Teléfono

Get Form 588, Nonresident Withholding Waiver Request, to request a waiver of

Sitio web:

ftb.ca.gov

withholding on payments of current year California source income.

Teléfono:

800.852.5711 dentro de los Estados Unidos

916.845.6500 fuera de los Estados Unidos

B Requirement

TTY/TDD:

800.822.6268 personas con discapacidades auditivas y del habla

R&TC Section 18662 and related regulations require withholding of income or

franchise tax by S corporations, partnerships, or LLCs when distributions of money

Form 590-P

2012

C2

7071123

1

1