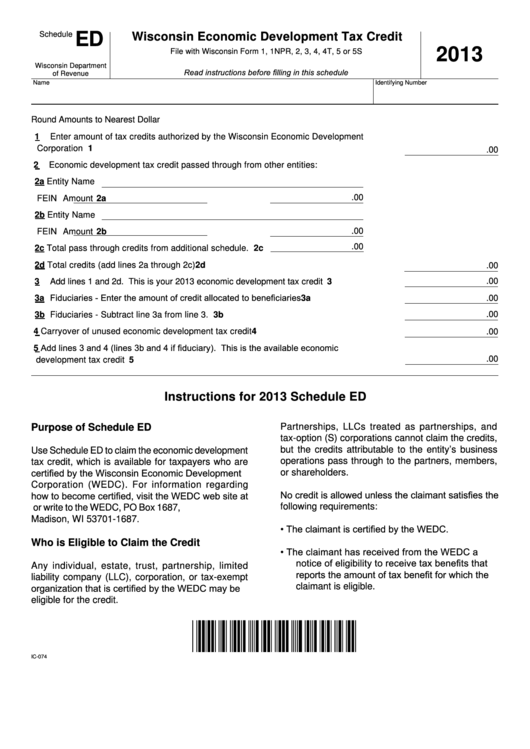

Schedule

ED

Wisconsin Economic Development Tax Credit

2013

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Round Amounts to Nearest Dollar

1

Enter amount of tax credits authorized by the Wisconsin Economic Development

Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2

Economic development tax credit passed through from other entities:

2a Entity Name

.00

FEIN

Amount 2a

2b Entity Name

.00

FEIN

Amount 2b

.00

2c Total pass through credits from additional schedule . 2c

2d Total credits (add lines 2a through 2c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

.00

3

Add lines 1 and 2d . This is your 2013 economic development tax credit . . . . . . . . . . . . 3

.00

3a Fiduciaries - Enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . 3a

.00

3b Fiduciaries - Subtract line 3a from line 3 .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b

.00

4

Carryover of unused economic development tax credit . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

Add lines 3 and 4 (lines 3b and 4 if fiduciary). This is the available economic

5

.00

development tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Instructions for 2013 Schedule ED

Partnerships, LLCs treated as partnerships, and

Purpose of Schedule ED

tax-option (S) corporations cannot claim the credits,

but the credits attributable to the entity’s business

Use Schedule ED to claim the economic development

operations pass through to the partners, members,

tax credit, which is available for taxpayers who are

certified by the Wisconsin Economic Development

or shareholders .

Corporation (WEDC) . For information regarding

No credit is allowed unless the claimant satisfies the

how to become certified, visit the WEDC web site at

following requirements:

inwisconsin .com or write to the WEDC, PO Box 1687,

Madison, WI 53701-1687 .

•

The claimant is certified by the WEDC.

Who is Eligible to Claim the Credit

•

The claimant has received from the WEDC a

notice of eligibility to receive tax benefits that

Any individual, estate, trust, partnership, limited

reports the amount of tax benefit for which the

liability company (LLC), corporation, or tax-exempt

organization that is certified by the WEDC may be

claimant is eligible .

eligible for the credit .

IC-074

1

1 2

2