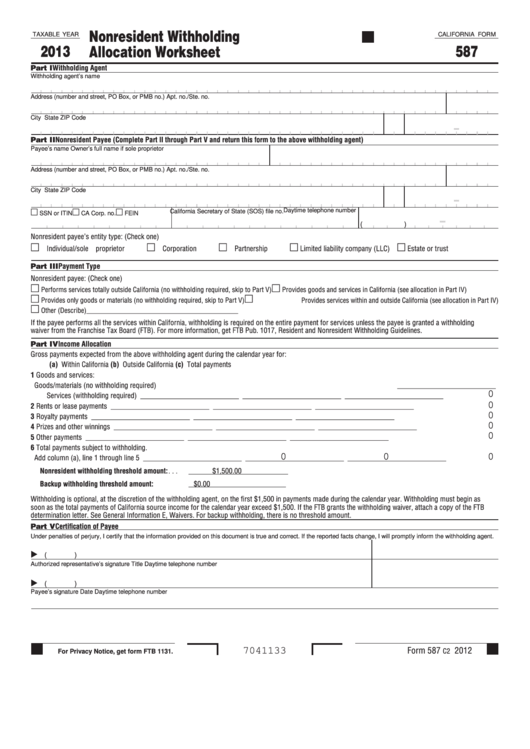

Nonresident Withholding

TAXABLE YEAR

CALIFORNIA FORM

2013

587

Allocation Worksheet

Part I

Withholding Agent

Withholding agent’s name

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

Part II

Nonresident Payee (Complete Part II through Part V and return this form to the above withholding agent)

Payee’s name

Owner’s full name if sole proprietor

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

Daytime telephone number

California Secretary of State (SOS) file no.

SSN or ITIN

CA Corp. no.

FEIN

(

)

Nonresident payee’s entity type: (Check one)

Individual/sole proprietor

Corporation

Partnership

Limited liability company (LLC)

Estate or trust

Part III

Payment Type

Nonresident payee: (Check one)

Performs services totally outside California (no withholding required, skip to Part V)

Provides goods and services in California (see allocation in Part IV)

Provides only goods or materials (no withholding required, skip to Part V)

Provides services within and outside California (see allocation in Part IV)

Other (Describe)___________________________________________

If the payee performs all the services within California, withholding is required on the entire payment for services unless the payee is granted a withholding

waiver from the Franchise Tax Board (FTB) . For more information, get FTB Pub . 1017, Resident and Nonresident Withholding Guidelines .

Part IV

Income Allocation

Gross payments expected from the above withholding agent during the calendar year for:

(a) Within California

(b) Outside California

(c) Total payments

1 Goods and services:

Goods/materials (no withholding required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ___________________________

0

Services (withholding required) . . . . . . . . . . . . ___________________________ ___________________________ ___________________________

2 Rents or lease payments . . . . . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________

0

3 Royalty payments . . . . . . . . . . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________

0

4 Prizes and other winnings . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________

0

0

5 Other payments . . . . . . . . . . . . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________

6 Total payments subject to withholding .

Add column (a), line 1 through line 5 . . . . . . . ___________________________ ___________________________ ___________________________

0

0

0

Nonresident withholding threshold amount: . . .

$1,500 .00

Backup withholding threshold amount: . . . . . . .

$0 .00

Withholding is optional, at the discretion of the withholding agent, on the first $1,500 in payments made during the calendar year . Withholding must begin as

soon as the total payments of California source income for the calendar year exceed $1,500 . If the FTB grants the withholding waiver, attach a copy of the FTB

determination letter . See General Information E, Waivers . For backup withholding, there is no threshold amount .

Part V

Certification of Payee

Under penalties of perjury, I certify that the information provided on this document is true and correct. If the reported facts change, I will promptly inform the withholding agent.

(

)

Authorized representative’s signature

Title

Daytime telephone number

(

)

Payee’s signature

Date

Daytime telephone number

Form 587

2012

7041133

C2

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3