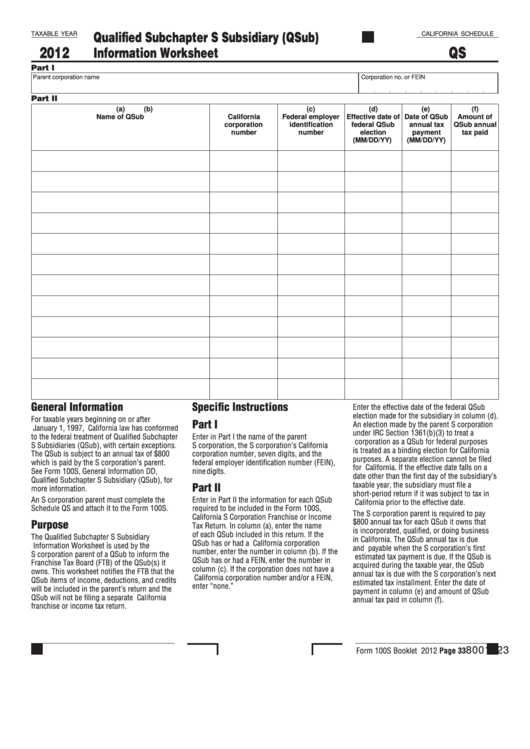

Qualified Subchapter S Subsidiary (QSub)

TAXABLE YEAR

CALIFORNIA SCHEDULE

2012

QS

Information Worksheet

Part I

Parent corporation name

Corporation no. or FEIN

Part II

(a)

(b)

(c)

(d)

(e)

(f)

Name of QSub

California

Federal employer

Effective date of

Date of QSub

Amount of

corporation

identification

federal QSub

annual tax

QSub annual

number

number

election

payment

tax paid

(MM/DD/YY)

(MM/DD/YY)

General Information

Specific Instructions

Enter the effective date of the federal QSub

election made for the subsidiary in column (d).

For taxable years beginning on or after

Part I

An election made by the parent S corporation

January 1, 1997, California law has conformed

under IRC Section 1361(b)(3) to treat a

to the federal treatment of Qualified Subchapter

Enter in Part I the name of the parent

corporation as a QSub for federal purposes

S Subsidiaries (QSub), with certain exceptions.

S corporation, the S corporation’s California

is treated as a binding election for California

The QSub is subject to an annual tax of $800

corporation number, seven digits, and the

purposes. A separate election cannot be filed

which is paid by the S corporation’s parent.

federal employer identification number (FEIN),

for California. If the effective date falls on a

See Form 100S, General Information DD,

nine digits.

date other than the first day of the subsidiary’s

Qualified Subchapter S Subsidiary (QSub), for

Part II

taxable year, the subsidiary must file a

more information.

short-period return if it was subject to tax in

An S corporation parent must complete the

Enter in Part II the information for each QSub

California prior to the effective date.

Schedule QS and attach it to the Form 100S.

required to be included in the Form 100S,

The S corporation parent is required to pay

California S Corporation Franchise or Income

$800 annual tax for each QSub it owns that

Purpose

Tax Return. In column (a), enter the name

is incorporated, qualified, or doing business

of each QSub included in this return. If the

The Qualified Subchapter S Subsidiary

in California. The QSub annual tax is due

QSub has or had a California corporation

Information Worksheet is used by the

and payable when the S corporation’s first

number, enter the number in column (b). If the

S corporation parent of a QSub to inform the

estimated tax payment is due. If the QSub is

QSub has or had a FEIN, enter the number in

Franchise Tax Board (FTB) of the QSub(s) it

acquired during the taxable year, the QSub

column (c). If the corporation does not have a

owns. This worksheet notifies the FTB that the

annual tax is due with the S corporation’s next

California corporation number and/or a FEIN,

QSub items of income, deductions, and credits

estimated tax installment. Enter the date of

enter “none.”

will be included in the parent’s return and the

payment in column (e) and amount of QSub

QSub will not be filing a separate California

annual tax paid in column (f).

franchise or income tax return.

8001123

Form 100S Booklet 2012 Page 33

1

1