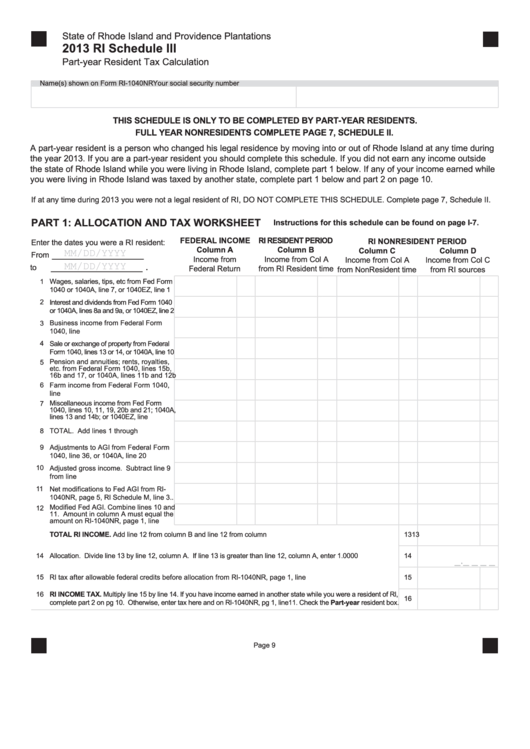

State of Rhode Island and Providence Plantations

2013 RI Schedule III

Part-year Resident Tax Calculation

Name(s) shown on Form RI-1040NR

Your social security number

THIS SCHEDULE IS ONLY TO BE COMPLETED BY PART-YEAR RESIDENTS.

FULL YEAR NONRESIDENTS COMPLETE PAGE 7, SCHEDULE II.

A part-year resident is a person who changed his legal residence by moving into or out of Rhode Island at any time during

the year 2013. If you are a part-year resident you should complete this schedule. If you did not earn any income outside

the state of Rhode Island while you were living in Rhode Island, complete part 1 below. If any of your income earned while

you were living in Rhode Island was taxed by another state, complete part 1 below and part 2 on page 10.

If at any time during 2013 you were not a legal resident of RI, DO NOT COMPLETE THIS SCHEDULE. Complete page 7, Schedule II.

PART 1: ALLOCATION AND TAX WORKSHEET

Instructions for this schedule can be found on page I-7.

FEDERAL INCOME

RI RESIDENT PERIOD

RI NONRESIDENT PERIOD

Enter the dates you were a RI resident:

MM/DD/YYYY

Column A

Column B

Column C

Column D

________________

From

Income from

Income from Col A

Income from Col A

Income from Col C

MM/DD/YYYY

________________ .

to

Federal Return

from RI Resident time

from NonResident time

from RI sources

Wages, salaries, tips, etc from Fed Form

1

1040 or 1040A, line 7, or 1040EZ, line 1

2

Interest and dividends from Fed Form 1040

or 1040A, lines 8a and 9a, or 1040EZ, line 2

Business income from Federal Form

3

1040, line 12............................................

4

Sale or exchange of property from Federal

Form 1040, lines 13 or 14, or 1040A, line 10

Pension and annuities; rents, royalties,

5

etc. from Federal Form 1040, lines 15b,

16b and 17, or 1040A, lines 11b and 12b

6

Farm income from Federal Form 1040,

line 18......................................................

Miscellaneous income from Fed Form

7

1040, lines 10, 11, 19, 20b and 21; 1040A,

lines 13 and 14b; or 1040EZ, line 3............

TOTAL. Add lines 1 through 7 ................

8

9

Adjustments to AGI from Federal Form

1040, line 36, or 1040A, line 20 ..............

10

Adjusted gross income. Subtract line 9

from line 8...............................................

11

Net modifications to Fed AGI from RI-

1040NR, page 5, RI Schedule M, line 3 ..

Modified Fed AGI. Combine lines 10 and

12

11. Amount in column A must equal the

amount on RI-1040NR, page 1, line 3.....

13

TOTAL RI INCOME. Add line 12 from column B and line 12 from column D..................................................................... 13

14

Allocation. Divide line 13 by line 12, column A. If line 13 is greater than line 12, column A, enter 1.0000 ....................... 14

_._ _ _ _

15

RI tax after allowable federal credits before allocation from RI-1040NR, page 1, line 10...........................................

15

RI INCOME TAX. Multiply line 15 by line 14. If you have income earned in another state while you were a resident of RI,

16

16

complete part 2 on pg 10. Otherwise, enter tax here and on RI-1040NR, pg 1, line11. Check the Part-year resident box.

Page 9

1

1 2

2