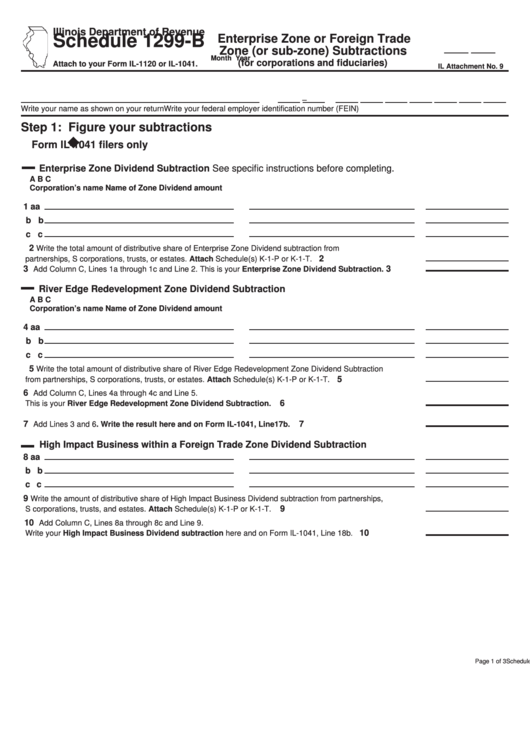

Schedule 1299-B - Attach To Your Form Il-1120 Or Il-1041 - Enterprise Zone Or Foreign Trade Zone (Or Sub-Zone) Subtractions

ADVERTISEMENT

Illinois Department of Revenue

Enterprise Zone or Foreign Trade

Schedule 1299-B

Zone (or sub-zone) Subtractions

Month

Year

(for corporations and fiduciaries)

Attach to your Form IL-1120 or IL-1041.

IL Attachment No. 9

–

Write your name as shown on your return

Write your federal employer identification number (FEIN)

Step 1: Figure your subtractions

Form IL-1041 filers only

Enterprise Zone Dividend Subtraction See specific instructions before completing.

A

B

C

Corporation’s name

Name of Zone

Dividend amount

1 a

a

b

b

c

c

2

Write the total amount of distributive share of Enterprise Zone Dividend subtraction from

2

partnerships, S corporations, trusts, or estates. Attach Schedule(s) K-1-P or K-1-T.

3

3

Add Column C, Lines 1a through 1c and Line 2. This is your Enterprise Zone Dividend Subtraction.

River Edge Redevelopment Zone Dividend Subtraction

A

B

C

Corporation’s name

Name of Zone

Dividend amount

4 a

a

b

b

c

c

5

Write the total amount of distributive share of River Edge Redevelopment Zone Dividend Subtraction

5

from partnerships, S corporations, trusts, or estates. Attach Schedule(s) K-1-P or K-1-T.

6

Add Column C, Lines 4a through 4c and Line 5.

6

This is your River Edge Redevelopment Zone Dividend Subtraction.

7

7

Add Lines 3 and 6. Write the result here and on Form IL-1041, Line17b.

High Impact Business within a Foreign Trade Zone Dividend Subtraction

8 a

a

b

b

c

c

9

Write the amount of distributive share of High Impact Business Dividend subtraction from partnerships,

9

S corporations, trusts, and estates. Attach Schedule(s) K-1-P or K-1-T.

10

Add Column C, Lines 8a through 8c and Line 9.

10

Write your High Impact Business Dividend subtraction here and on Form IL-1041, Line 18b.

Schedule 1299-B (R-12/12)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3