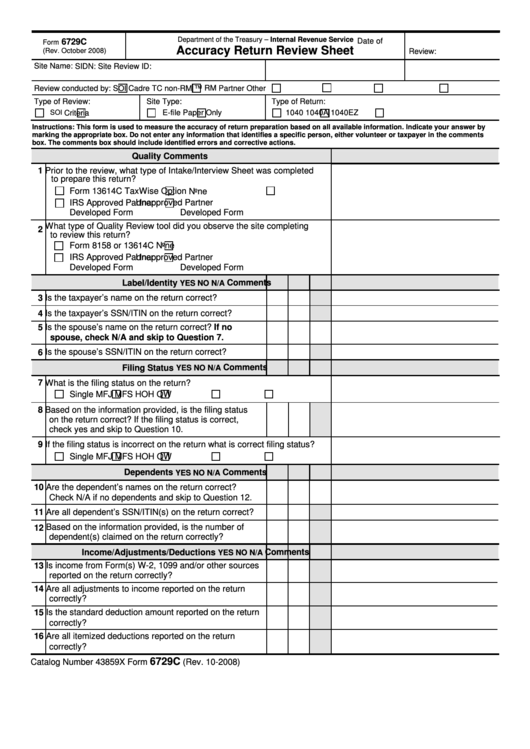

Department of the Treasury – Internal Revenue Service

Date of

6729C

Form

Accuracy Return Review Sheet

(Rev. October 2008)

Review:

Site Name:

SIDN:

Site Review ID:

Review conducted by:

SOI Cadre

TC non-RM

TM

RM

Partner

Other

Type of Review:

Site Type:

Type of Return:

SOI

E-fiIe

Paper Only

1040

1040A

1040EZ

Criteria

Instructions: This form is used to measure the accuracy of return preparation based on all available information. Indicate your answer by

marking the appropriate box. Do not enter any information that identifies a specific person, either volunteer or taxpayer in the comments

box. The comments box should include identified errors and corrective actions.

Quality

Comments

1 Prior to the review, what type of Intake/Interview Sheet was completed

to prepare this return?

Form 13614C

TaxWise Option

None

IRS Approved Partner

Unapproved Partner

Developed Form

Developed Form

2 What type of Quality Review tool did you observe the site completing

to review this return?

Form 8158 or 13614C

None

IRS Approved Partner

Unapproved Partner

Developed Form

Developed Form

Label/Identity

Comments

YES

NO

N/A

3 Is the taxpayer’s name on the return correct?

4 Is the taxpayer’s SSN/ITIN on the return correct?

5 Is the spouse’s name on the return correct? If no

spouse, check N/A and skip to Question 7.

6 Is the spouse’s SSN/ITIN on the return correct?

Comments

Filing Status

YES

NO

N/A

7 What is the filing status on the return?

Single

MFJ

MFS

HOH

QW

8 Based on the information provided, is the filing status

on the return correct? If the filing status is correct,

check yes and skip to Question 10.

9 If the filing status is incorrect on the return what is correct filing status?

Single

MFJ

MFS

HOH

QW

Dependents

Comments

YES

NO

N/A

10 Are the dependent’s names on the return correct?

Check N/A if no dependents and skip to Question 12.

11 Are all dependent’s SSN/ITIN(s) on the return correct?

12 Based on the information provided, is the number of

dependent(s) claimed on the return correctly?

Income/Adjustments/Deductions

Comments

YES

NO

N/A

13 Is income from Form(s) W-2, 1099 and/or other sources

reported on the return correctly?

14 Are all adjustments to income reported on the return

correctly?

15 Is the standard deduction amount reported on the return

correctly?

16 Are all itemized deductions reported on the return

correctly?

6729C

Catalog Number 43859X

Form

(Rev. 10-2008)

1

1 2

2