Reset Form

Print Form

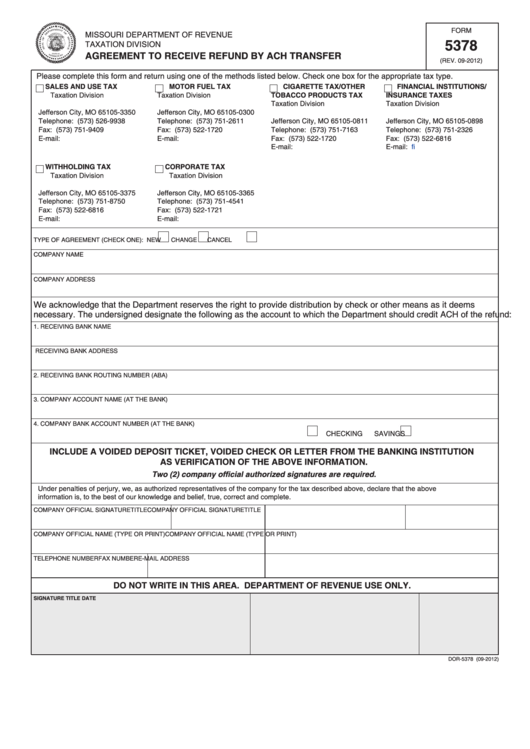

FORM

MISSOURI DEPARTMENT OF REVENUE

5378

TAXATION DIVISION

AGREEMENT TO RECEIVE REFUND BY ACH TRANSFER

(REV. 09-2012)

Please complete this form and return using one of the methods listed below. Check one box for the appropriate tax type.

SALES AND USE TAX

MOTOR FUEL TAX

CIGARETTE TAX/OTHER

FINANCIAL INSTITUTIONS/

Taxation Division

Taxation Division

TOBACCO PRODUCTS TAX

INSURANCE TAXES

P.O. Box 3350

P.O. Box 300

Taxation Division

Taxation Division

Jefferson City, MO 65105-3350

Jefferson City, MO 65105-0300

P.O. Box 811

P.O. Box 898

Telephone: (573) 526-9938

Telephone: (573) 751-2611

Jefferson City, MO 65105-0811

Jefferson City, MO 65105-0898

Fax: (573) 751-9409

Fax: (573) 522-1720

Telephone: (573) 751-7163

Telephone: (573) 751-2326

E-mail:

salesrefund@dor.mo.gov

E-mail:

excise@dor.mo.gov

Fax: (573) 522-1720

Fax: (573) 522-6816

E-mail:

excise@dor.mo.gov

E-mail:

fit@dor.mo.gov

WITHHOLDING TAX

CORPORATE TAX

Taxation Division

Taxation Division

P.O. Box 3375

P.O. Box 3365

Jefferson City, MO 65105-3375

Jefferson City, MO 65105-3365

Telephone: (573) 751-8750

Telephone: (573) 751-4541

Fax: (573) 522-6816

Fax: (573) 522-1721

E-mail:

withholding@dor.mo.gov

E-mail:

corporate@dor.mo.gov

TYPE OF AGREEMENT (CHECK ONE):

NEW

CHANGE

CANCEL

COMPANY NAME

COMPANY ADDRESS

We acknowledge that the Department reserves the right to provide distribution by check or other means as it deems

necessary. The undersigned designate the following as the account to which the Department should credit ACH of the refund:

1.

RECEIVING BANK NAME

RECEIVING BANK ADDRESS

2.

RECEIVING BANK ROUTING NUMBER (ABA)

3.

COMPANY ACCOUNT NAME (AT THE BANK)

4. COMPANY BANK ACCOUNT NUMBER (AT THE BANK)

CHECKING

SAVINGS

INCLUDE A VOIDED DEPOSIT TICKET, VOIDED CHECK OR LETTER FROM THE BANKING INSTITUTION

AS VERIFICATION OF THE ABOVE INFORMATION.

Two (2) company official authorized signatures are required.

Under penalties of perjury, we, as authorized representatives of the company for the tax described above, declare that the above

information is, to the best of our knowledge and belief, true, correct and complete.

COMPANY OFFICIAL SIGNATURE

TITLE

COMPANY OFFICIAL SIGNATURE

TITLE

COMPANY OFFICIAL NAME (TYPE OR PRINT)

COMPANY OFFICIAL NAME (TYPE OR PRINT)

TELEPHONE NUMBER

FAX NUMBER

E-MAIL ADDRESS

DO NOT WRITE IN THIS AREA. DEPARTMENT OF REVENUE USE ONLY.

SIGNATURE

TITLE

DATE

DOR-5378 (09-2012)

1

1 2

2