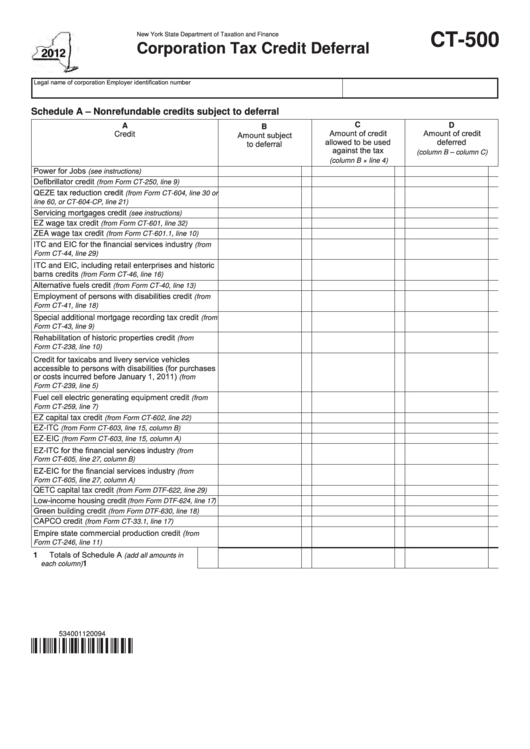

Form Ct-500 - Corporation Tax Credit Deferral - 2012

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-500

Corporation Tax Credit Deferral

Legal name of corporation

Employer identification number

Schedule A – Nonrefundable credits subject to deferral

C

D

A

B

Amount of credit

Amount of credit

Credit

Amount subject

allowed to be used

deferred

to deferral

against the tax

(column B – column C)

(column B × line 4)

Power for Jobs

..................................

(see instructions)

Defibrillator credit

.................

(from Form CT-250, line 9)

QEZE tax reduction credit

(from Form CT-604, line 30 or

.........................................

line 60, or CT-604-CP, line 21)

Servicing mortgages credit

...............

(see instructions)

EZ wage tax credit

.............

(from Form CT-601, line 32)

ZEA wage tax credit

........

(from Form CT-601.1, line 10)

ITC and EIC for the financial services industry

(from

......................................................

Form CT-44, line 29)

ITC and EIC, including retail enterprises and historic

barns credits

........................

(from Form CT-46, line 16)

Alternative fuels credit

.........

(from Form CT-40, line 13)

Employment of persons with disabilities credit

(from

......................................................

Form CT-41, line 18)

Special additional mortgage recording tax credit

(from

........................................................

Form CT-43, line 9)

Rehabilitation of historic properties credit

(from

....................................................

Form CT-238, line 10)

Credit for taxicabs and livery service vehicles

accessible to persons with disabilities (for purchases

or costs incurred before January 1, 2011)

(from

......................................................

Form CT-239, line 5)

Fuel cell electric generating equipment credit

(from

......................................................

Form CT-259, line 7)

EZ capital tax credit

...........

(from Form CT-602, line 22)

EZ-ITC

................

(from Form CT-603, line 15, column B)

EZ-EIC

................

(from Form CT-603, line 15, column A)

EZ-ITC for the financial services industry

(from

.....................................

Form CT-605, line 27, column B)

EZ-EIC for the financial services industry

(from

.....................................

Form CT-605, line 27, column A)

QETC capital tax credit

....

(from Form DTF-622, line 29)

Low-income housing credit

(from Form DTF-624, line 17)

Green building credit

........

(from Form DTF-630, line 18)

CAPCO credit

...................

(from Form CT-33.1, line 17)

Empire state commercial production credit (

from

.....................................................

Form CT-246, line 11)

1 Totals of Schedule A

(add all amounts in

............................................

1

each column)

534001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6