6478

Alcohol and Cellulosic Biofuel Fuels Credit

OMB No. 1545-0231

2011

Form

Attachment

Department of the Treasury

83

Attach to your tax return.

Sequence No.

Internal Revenue Service

▶

Identifying number

Name(s) shown on return

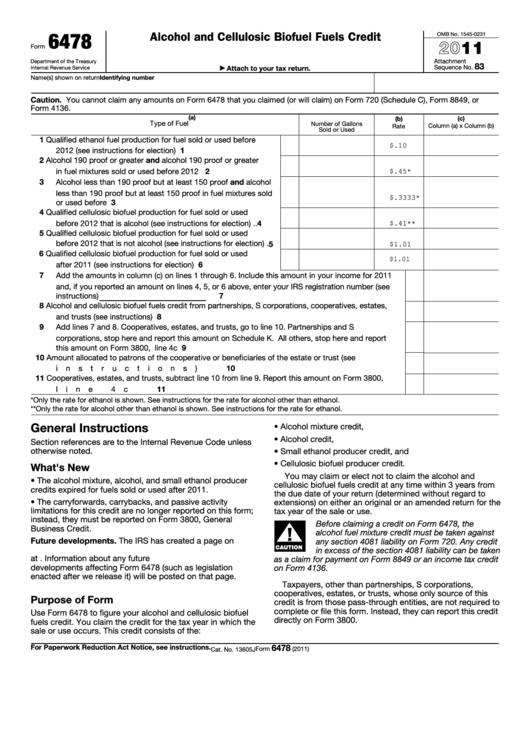

Caution. You cannot claim any amounts on Form 6478 that you claimed (or will claim) on Form 720 (Schedule C), Form 8849, or

Form 4136.

(a)

(b)

(c)

Type of Fuel

Number of Gallons

Column (a) x Column (b)

Rate

Sold or Used

1

Qualified ethanol fuel production for fuel sold or used before

$.10

1

2012 (see instructions for election)

.

.

.

.

.

.

.

.

.

2

Alcohol 190 proof or greater and alcohol 190 proof or greater

in fuel mixtures sold or used before 2012

.

.

.

.

.

.

.

2

$.45*

3

Alcohol less than 190 proof but at least 150 proof and alcohol

less than 190 proof but at least 150 proof in fuel mixtures sold

$.3333*

or used before 2012

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Qualified cellulosic biofuel production for fuel sold or used

4

before 2012 that is alcohol (see instructions for election)

.

.

$.41**

5

Qualified cellulosic biofuel production for fuel sold or used

before 2012 that is not alcohol (see instructions for election) .

5

$1.01

6

Qualified cellulosic biofuel production for fuel sold or used

$1.01

after 2011 (see instructions for election) .

.

.

.

.

.

.

.

6

7

Add the amounts in column (c) on lines 1 through 6. Include this amount in your income for 2011

and, if you reported an amount on lines 4, 5, or 6 above, enter your IRS registration number (see

7

instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Alcohol and cellulosic biofuel fuels credit from partnerships, S corporations, cooperatives, estates,

and trusts (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Add lines 7 and 8. Cooperatives, estates, and trusts, go to line 10. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, stop here and report

this amount on Form 3800, line 4c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Cooperatives, estates, and trusts, subtract line 10 from line 9. Report this amount on Form 3800,

11

line 4c .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

*Only the rate for ethanol is shown. See instructions for the rate for alcohol other than ethanol.

**Only the rate for alcohol other than ethanol is shown. See instructions for the rate for ethanol.

General Instructions

• Alcohol mixture credit,

• Alcohol credit,

Section references are to the Internal Revenue Code unless

otherwise noted.

• Small ethanol producer credit, and

• Cellulosic biofuel producer credit.

What's New

You may claim or elect not to claim the alcohol and

• The alcohol mixture, alcohol, and small ethanol producer

cellulosic biofuel fuels credit at any time within 3 years from

credits expired for fuels sold or used after 2011.

the due date of your return (determined without regard to

• The carryforwards, carrybacks, and passive activity

extensions) on either an original or an amended return for the

limitations for this credit are no longer reported on this form;

tax year of the sale or use.

instead, they must be reported on Form 3800, General

Before claiming a credit on Form 6478, the

▲

Business Credit.

!

alcohol fuel mixture credit must be taken against

Future developments. The IRS has created a page on

any section 4081 liability on Form 720. Any credit

CAUTION

IRS.gov for information about Form 6478 and its instructions

in excess of the section 4081 liability can be taken

at Information about any future

as a claim for payment on Form 8849 or an income tax credit

developments affecting Form 6478 (such as legislation

on Form 4136.

enacted after we release it) will be posted on that page.

Taxpayers, other than partnerships, S corporations,

cooperatives, estates, or trusts, whose only source of this

Purpose of Form

credit is from those pass-through entities, are not required to

complete or file this form. Instead, they can report this credit

Use Form 6478 to figure your alcohol and cellulosic biofuel

directly on Form 3800.

fuels credit. You claim the credit for the tax year in which the

sale or use occurs. This credit consists of the:

6478

For Paperwork Reduction Act Notice, see instructions.

Form

(2011)

Cat. No. 13605J

1

1 2

2 3

3 4

4