PRINT FORM

RESET

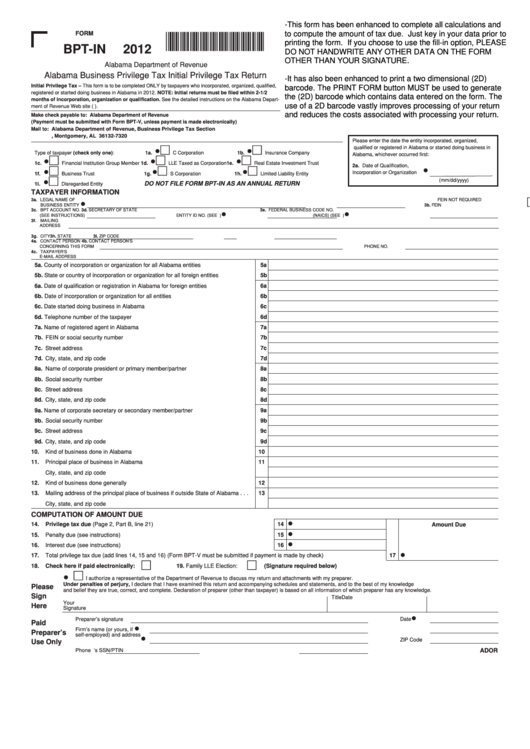

-This form has been enhanced to complete all calculations and

to compute the amount of tax due. Just key in your data prior to

FORM

121101BN

printing the form. If you choose to use the fill-in option, PLEASE

BPT-IN

2012

DO NOT HANDWRITE ANY OTHER DATA ON THE FORM

OTHER THAN YOUR SIGNATURE.

Alabama Department of Revenue

Alabama Business Privilege Tax Initial Privilege Tax Return

-It has also been enhanced to print a two dimensional (2D)

Initial Privilege Tax – This form is to be completed ONLY by taxpayers who incorporated, organized, qualified,

barcode. The PRINT FORM button MUST be used to generate

registered or started doing business in Alabama in 2012. NOTE: Initial returns must be filed within 2-1/2

the (2D) barcode which contains data entered on the form. The

months of incorporation, organization or qualification. See the detailed instructions on the Alabama Depart-

use of a 2D barcode vastly improves processing of your return

ment of Revenue Web site ( ).

and reduces the costs associated with processing your return.

Make check payable to: Alabama Department of Revenue

(Payment must be submitted with Form BPT-V, unless payment is made electronically)

Mail to: Alabama Department of Revenue, Business Privilege Tax Section

P.O. Box 327320, Montgomery, AL 36132-7320

Please enter the date the entity incorporated, organized,

qualified or registered in Alabama or started doing business in

•

•

Type of taxpayer (check only one):

1a.

C Corporation

1b.

Insurance Company

Alabama, whichever occurred first:

•

•

•

1c.

Financial Institution Group Member

1d.

LLE Taxed as Corporation

1e.

Real Estate Investment Trust

2a. Date of Qualification,

•

•

•

•

Incorporation or Organization

1f.

Business Trust

1g.

S Corporation

1h.

Limited Liability Entity

•

(mm/dd/yyyy)

1i.

Disregarded Entity

DO NOT FILE FORM BPT-IN AS AN ANNUAL RETURN

TAXPAYER INFORMATION

Find NAICS Code

Find Sec of State File #

3a. LEGAL NAME OF

FEIN NOT REQUIRED

•

BUSINESS ENTITY

3b. FEIN

(SEE INSTRUCTIONS)

3c. BPT ACCOUNT NO.

3d. SECRETARY OF STATE

3e. FEDERAL BUSINESS CODE NO.

•

•

(SEE INSTRUCTIONS)

ENTITY ID NO. (SEE SOS.ALABAMA.GOV)

(NAICS) (SEE )

3f. MAILING

ADDRESS

3g. CITY

3h. STATE

3i. ZIP CODE

4a. CONTACT PERSON

4b. CONTACT PERSON’S

CONCERNING THIS FORM

PHONE NO.

4c. TAXPAYER’S

E-MAIL ADDRESS

5a. County of incorporation or organization for all Alabama entities . . . . . . . . . . . . . .

5a

5b. State or country of incorporation or organization for all foreign entities . . . . . . . . .

5b

6a. Date of qualification or registration in Alabama for foreign entities . . . . . . . . . . . .

6a

6b. Date of incorporation or organization for all entities . . . . . . . . . . . . . . . . . . . . . . .

6b

6c. Date started doing business in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6c

6d. Telephone number of the taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6d

7a. Name of registered agent in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

7b. FEIN or social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

7c. Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7c

7d. City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7d

8a. Name of corporate president or primary member/partner. . . . . . . . . . . . . . . . . . .

8a

8b. Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8b

8c. Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8c

8d. City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8d

9a. Name of corporate secretary or secondary member/partner . . . . . . . . . . . . . . . .

9a

9b. Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

9c. Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9c

9d. City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9d

10. Kind of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Principal place of business in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Kind of business done generally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. Mailing address of the principal place of business if outside State of Alabama . . .

13

City, state, and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

COMPUTATION OF AMOUNT DUE

•

Go to Page 2 of BPT-IN

14. Privilege tax due (Page 2, Part B, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

Amount Due

•

15. Penalty due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

•

16. Interest due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

17. Total privilege tax due (add lines 14, 15 and 16) (Form BPT-V must be submitted if payment is made by check). . . . . . . . . . . . . . . . . .

17

18. Check here if paid electronically:

19. Family LLE Election:

(Signature required below)

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

Please

and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Title

Date

Your

Here

Signature

•

Preparer’s signature

Date

Paid

•

Firm’s name (or yours, if

E.I. No.

Preparer’s

self-employed) and address

•

ZIP Code

Use Only

Phone No.

Preparer’s SSN/PTIN

ADOR

1

1 2

2